Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

What is Inflation?

|

Purchasing power Purchase power is a measure of how many goods or services we can buy with a unit of currency. All else being equal, inflation decreases the number of goods or services we would be able to purchase with the same unit.

If one's monetary income stays the same, but the price level increases, the purchasing power of that income falls.

Note: Inflation does not always imply falling purchasing power of one's money income since income may rise faster than the price level. A higher real income means a higher purchasing power since real income refers to the income adjusted for inflation. |

Measures of Inflation in India

Retail inflation tracked by the Consumer Price Index (CPI) measures the changes in prices from a retail buyer's perspective.

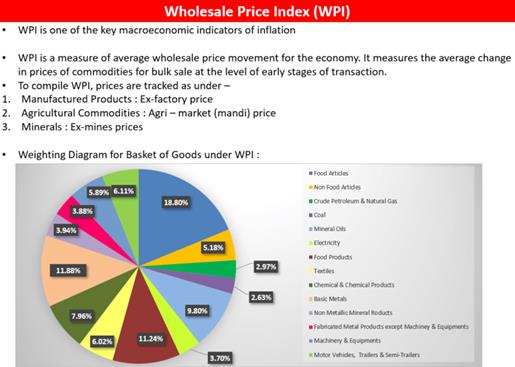

Wholesale inflation on the other hand is tracked by the Wholesale Price Index (WPI), which measures inflation at the level of producers.

Consumer Price Index

Who maintains Consumer Price Index in India?

WPI

Who publishes WPI in India and what does it show?

GDP Deflator

Read Comprehensive Articles here: https://www.iasgyan.in/daily-current-affairs/inflation-29

https://www.iasgyan.in/rstv/perspective-managing-inflation

© 2024 iasgyan. All right reserved