Disclaimer: Copyright infringement not intended.

Context

- India’s Inflation, has stayed above the Reserve Bank of India (RBI)’s upper tolerance limit of 6% for three months running.

What is Inflation?

- Inflation is a general rise in the price level of most goods and services in an economy over a period of time, resulting in a sustained drop in the purchasing power of currency.

MUST READ:

TO READ A COMPREHENSIVE ARTICLE ON “INFLATION”, VISIT: https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

TO READ A COMPREHENSIVE ARTICLE ON “MONETARY POLICY” VISIT: https://www.iasgyan.in/daily-current-affairs/monetary-policy#:~:text=Monetary%20policy%20is%20a%20set,its%20consumers%2C%20and%20its%20businesses.

Monetary Policy and Inflation

- In 2016, the government constituted the Monetary Policy Committee with a mandate to contain inflation.

- It chose the CPI as the target discarding the Wholesale Price Index. WPI was junked since manufacturing items did not touch the common man much.

Inflation Targets

- Targeted consumer price index (CPI) inflation rate is= 4%

- Upper tolerance limit of inflation is = Target inflation rate + 2% = (4% + 2%) =6%

- Lower tolerance limit of inflation is = Target inflation rate – 2% = (4% – 2%) =2%

- Targeted consumer price index (CPI) inflation rate period from = April 1, 2021

- Targeted consumer price index (CPI) inflation rate period up to =March 31, 2026

- If the MPC fails to keep price rise in this band for three consecutive quarters, the governor would be obligated to write to Parliament as to why it failed and how it could achieve the target.

Inflation-Present Scenario

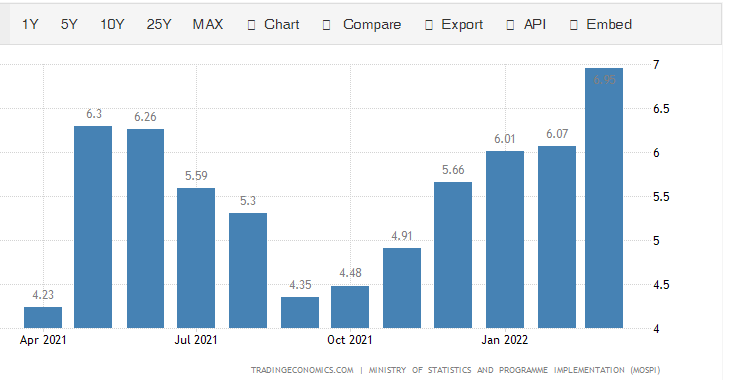

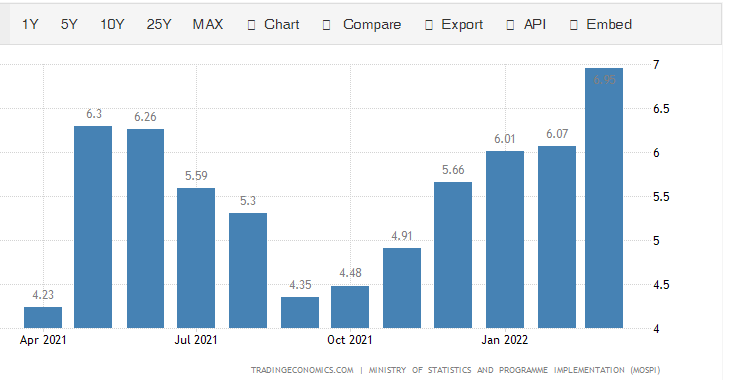

- Inflation, which is measured by the Consumer Price Index (CPI), has stayed above the Reserve Bank of India (RBI)’s upper tolerance limit of 6% for three months running.

- Annual inflation rate in India increased to 6.95% in March of 2022, the highest since October of 2020.

- Food inflation accelerated for a 6th straight month to 7.68%, a new high since November of 2020, with cost of oils and fats (18.79%), vegetables (11.64%) and meat and fish (9.63%) recording again the biggest rises.

- Other upward pressure came from prices of clothing and footwear (9.4%), fuel and light (7.52%), miscellaneous (7.02%), housing (3.38%).

Inflation Rate Trend

Is Monetary Policy enough to control inflation?

Supply Side Shocks

- In India, inflation is not strictly a monetary phenomenon. There are many supply-side shocks.

- So, Credit/liquidity infusion through economic stimulus packages — does not work very well. If there is no corresponding growth in the economy, then this credit infusion can lead to mounting Non Performing Assets.

Example: Current geopolitical uncertainty. The war in Ukraine led to supply-chain disruptions. Consignments are getting delayed. So, it’s a supply-side shock. Maneuvering with repo rate adjustments to contain inflation may not work.

Complex Monetary Policy

- Monetary policy is extremely complex. All the macro variables— inflation, growth, jobs, external balance, financial stability — are interrelated. Targeting one without touching the other is not possible.

- And each of these is impacted by multiple policy tools, such as interest rates (long term, short term), banking liquidity, fiscal balance, exchange rates, macro-prudential regulations, RBI interventions

- But we currently have a simplistic monetary framework amid economic complexity. The assumption that CPI inflation can be controlled by the repo rate almost linearly is incorrect. The assumption that CPI inflation can be kept between 2% and 6% at all times by changing the repo rate is incorrect.

Employment - Ultimate way to control Inflation

- High Inflation and unemployment are related economic problems. In India, we have legislated to keep inflation in control. But there is no policy that considers some level of unemployment or employment as a policy target.

- India is not among the worst performing countries in terms of inflation, but it has among the worst labour participation rates and also the worst employment rates in the world. It is odd because ultimately all economic policy must result in improving livelihoods.

- Nurturing the real economy, not just tweaking the repo rate, is the need of the hour.

- The ultimate way to control inflation for India is for us to create jobs and output. The real economy is the only way to improve all our macro variables including- Inflation.

- Monetary policy cannot do much for either growth, jobs, or for inflation control. Eventually, it’s the real economy, where the government comes into the picture.

- On the fiscal policy side, the government has to act as an employer of last resort through ‘participation income’ (not ‘basic income’) in the hands of people, by providing guaranteed jobs.

- There can be a very strong policy to tackle inflation rather than the government providing cash transfers, a huge fiscal stimulus, into the hands of people.

|

The Urjit Patel Report in 2014 stated that- The US, in 2014 announced an explicit unemployment target – to keep interest rates low till unemployment falls below 6.5%. This is consistent with what monetary policy can do, i.e. to bring actual unemployment closer to the natural unemployment level or actual growth closer to the potential growth level.

|

- India adopted inflation targeting five years ago. During this period, average inflation over the years was reasonably stable around acceptable 4%. But, during this period, the employment rate fell from 42.7% in 2016-17 to 39.4% in 2019-20.

- Employment Rate in India averaged 44.36 percent from 2012 until 2021.

- According to ILO-modelled rates, world average employment rate is 57%. India is placed by ILO at 47%. Pakistan and Sri Lanka are at 50% and 51% respectively and Bangladesh is at 57%. India needs a fix for low employment more than for its inflation problems.

- A contained fiscal deficit and a contained inflation rate are pointless if they cannot help stem the fall in the employment rate even over a five year term.

Suggestions

Increasing Public Sector Workforce

- First, India must increase employment in the government. According to ILO Data, India is the worst performing country in terms of share of public sector workers as a per cent of total workforce. Only 3.8% of India’s total workforce is employed in the public sector. USA and UK are 15.8% and 21.5%; Germany and France are 12.9% and 24.9%; South Korea and Japan are 10.3% and 10.5%. Singapore and China are 32% and 50% and Bangladesh is 8%.

Physical and Social Infrastructure

- The government must lead the way in building physical and social infrastructure. This is an area where India suffers a substantial deficit.

- The immediate impact of building physical and social infrastructure would be an increase in employment in the construction industry. This is the best first step in moving labour out of farms. During 2004-05 through 2011-12 absolute number of workers fell in agriculture for the first time in India’s history primarily for this reason. Further, investment into social infrastructure is necessary to enable an increase in government jobs.

Development of Industrial and Manufacturing Clusters

- Infrastructure development should concentrate on development of industrial clusters for labour intensive industries.

- Food processing, leather and footwear, wood manufacture/furniture, textiles and garments are industries that qualify easily. But, the effort should extend to creating manufacturing clusters to exploit the local advantage in every district or set of neighboring districts.

Correct Inverted Duty Structure

- The Centre should correct the inverted duty structure (IDS) prevailing against Indian manufacturers. IDS constitute negative protection for India’s manufactures.

- A 2017 study showed IDS exists in paper and paper products, chemical and chemical products, pharmaceuticals, computers, electronic and optical products, machinery and transport equipment.

- Another study showed IDS in electronic products like refrigerators, ACs, washing machines, microwave ovens.

- Performance-linked incentives (awarded by GOI in various sectors in AtmaNirbhar Bharat 3.0) alone will not generate domestic manufacturing capacity.

|

The term ‘Inverted Tax Structure’ refers to a situation where the rate of tax on inputs purchased (i.e GST rate paid on inputs received) is more than the rate of tax on outward supplies (i.e. GST rate payable on sales).

|

Penalty for failing Employment Targets

- Devising a mechanism to declare a project as a non-performing asset if it fails to provide the employment it promised to provide when it sought any benefit from the government.

- Promoters of such projects may be required to contribute to a jobs-creating fund in lieu of their default.

Coordination between Fiscal and Monetary Policy

- Nobel Laureate Abhijit Banerjee have highlighted that there is a need for the re-emergence of monetisation of fiscal deficit through better coordination of fiscal and monetary policy.

Read: https://www.iasgyan.in/ig-uploads/pdf/RSTV_-_Making_India_a_Manufacturing_Hub_Reviewed.pdf

https://www.iasgyan.in/daily-current-affairs/indias-manufacturing-sector-and-pmi

https://www.thehindu.com/opinion/op-ed/is-the-reserve-bank-doing-enough-to-rein-in-inflation/article65321502.ece?homepage=true