Copyright infringement not intended

Picture Courtesy: www.gobankingrates.com

Context: In August, India's retail inflation saw a reduction, primarily due to a moderation in food prices, but it remained above the upper limit of the central bank's target range for the second consecutive month. The annual retail inflation rate for August stood at 6.83%, a decrease from July's 7.44%, which was a 15-month high.

Key Highlights

- Food inflation, which constitutes nearly half of the overall consumer price basket, increased by 9.94% in August, down from the 11.51% recorded in July. Economists noted that this slight relief in consumer price inflation was primarily due to lower vegetable prices and some moderation in clothing and footwear, housing, and miscellaneous items.

- Food prices have been a significant concern for policymakers due to erratic weather conditions affecting the production of vegetables, milk, and cereals. Inflation has exceeded the central bank's target band of 2%-6% for seven months out of the past 12.

- In an attempt to control domestic inflation, the Indian government imposed various restrictions, including banning exports of non-basmati white rice, imposing a 20% duty on parboiled rice exports, and implementing a 40% tax on onion exports. Wheat exports have been banned since the previous year.

- Crude oil prices have also been on the rise, with Brent crude surpassing $90 per barrel for the first time in 10 months. Additionally, India has reduced the prices of cooking gas cylinders for 330 million households and is considering extending its free food program beyond December.

- Core inflation, which excludes volatile food and energy prices, was estimated to range between 4.6% and 4.9%, according to three economists, though the Indian government does not officially release core inflation figures.

Inflation

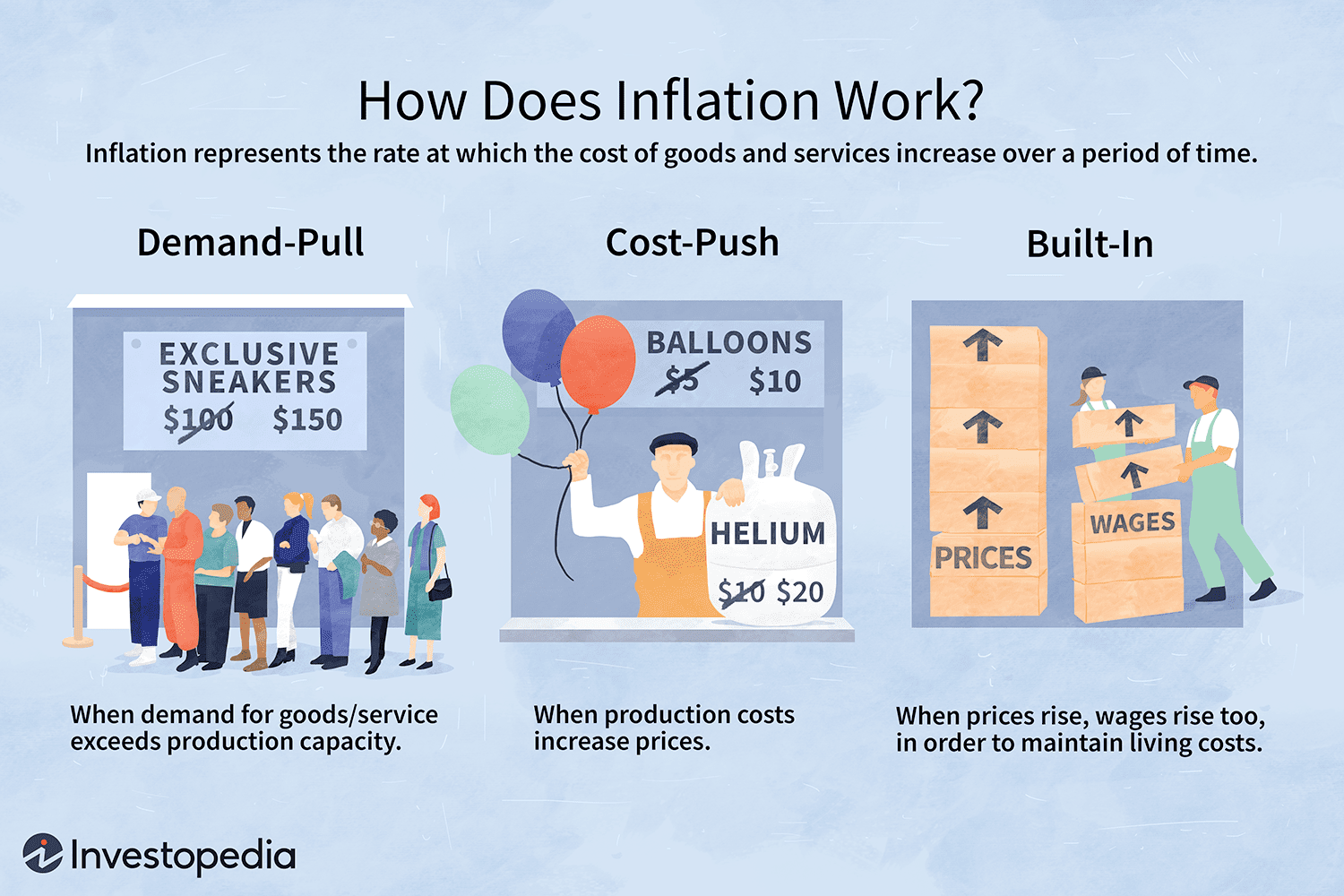

Meaning and Types of Inflation

- Inflation is the rate at which the general price level of goods and services rises, leading to a decrease in the purchasing power of a country's currency. In India, as in most countries, inflation is measured using the Consumer Price Index (CPI) and the Wholesale Price Index (WPI).

Demand-Pull Inflation

- Cause: This type of inflation is driven by increased demand for goods and services within an economy. When demand rises rapidly and exceeds the available supply, it leads to upward pressure on prices.

- Example: During a period of economic growth, consumers may have more disposable income, leading to higher spending. If businesses cannot quickly expand production to meet this increased demand, they may raise prices.

- Effect: Demand-pull inflation is typically associated with economic expansion and can be a sign of a healthy economy. However, if it becomes too rapid, it can erode purchasing power and create uncertainty.

Cost-Push Inflation

- Cause: Cost-push inflation occurs when production costs rise, compelling producers to increase prices. This can be due to various factors, including higher labour wages, increased costs of raw materials, or supply chain disruptions.

- Example: An increase in the minimum wage can lead to higher labour costs for businesses. They may respond by raising prices on their products to maintain profit margins.

- Effect: Cost-push inflation can be challenging for consumers and businesses. It can reduce real incomes and profitability, potentially leading to reduced economic growth.

Structural Inflation

- Cause: Structural inflation is a long-term phenomenon rooted in structural issues within an economy. These issues may include labour market inefficiencies, inadequate infrastructure, or regulatory constraints that hinder the efficient functioning of markets.

- Example: In an economy with rigid labour laws that make it difficult to hire and fire workers, there may be persistently high labour costs, leading to higher prices for goods and services.

- Effect: Structural inflation is more challenging to address as it requires fundamental changes to an economy's structure. It can lead to reduced competitiveness and hinder economic growth.

Built-In Inflation (Wage-Price Inflation)

- Cause: Built-in inflation is a self-reinforcing cycle where inflation expectations become embedded in the behaviour of both businesses and workers. Workers demand higher wages to keep up with expected price increases, and businesses raise prices to cover increased labour costs.

- Example: If workers anticipate annual inflation of 5%, they may negotiate for a 5% wage increase. In response, businesses raise prices by 5% to cover the higher labour costs, creating a cycle of inflation.

- Effect: Built-in inflation can be difficult to break because it becomes a self-fulfilling prophecy. It can lead to a persistent and high inflationary environment if not addressed.

Picture Courtesy: Investopedia

Factors contribute to inflation in India

Food Price Volatility

- India's economy is heavily dependent on agriculture, and fluctuations in agricultural production can directly impact food prices. Factors like monsoon variability, droughts, floods, and crop diseases can lead to supply shocks, causing food prices to rise.

- Inefficiencies in the supply chain, such as waste during transportation and storage, also contribute to food price volatility.

Supply Chain Disruptions

- Events like the COVID-19 pandemic highlighted the vulnerabilities in India's supply chain. Lockdowns and disruptions in transportation and logistics disrupted the flow of goods, leading to shortages and price spikes. Addressing supply chain inefficiencies is crucial to stabilizing prices.

Global Commodity Prices

- India is a net importer of commodities like crude oil, metals, and edible oils. Changes in global prices of these commodities, influenced by factors like geopolitical tensions and international demand, can affect India's inflation rate.

- A rise in global commodity prices often translates into higher costs for Indian consumers.

Monetary Policy

- The Reserve Bank of India (RBI) plays a significant role in controlling inflation through its monetary policy tools.

- When the RBI adopts an expansionary monetary policy, like reducing interest rates or increasing money supply, it can stimulate aggregate demand in the economy. While this can spur economic growth, it may also lead to demand-pull inflation if production capacity cannot keep pace with increased demand.

Fiscal Policy

- When the government engages in excessive spending, particularly if it's financed by borrowing, it can lead to an increase in the money supply. This excess money in circulation can drive up demand for goods and services, potentially causing demand-pull inflation.

- Maintaining prudent fiscal policies is crucial to avoid inflationary pressures stemming from government expenditure.

Exchange Rates

- Fluctuations in the exchange rate can significantly impact inflation in India, especially for a country that relies on imports for critical commodities like oil.

- A depreciation of the Indian rupee can make imported goods more expensive, contributing to imported inflation. This effect can be mitigated through effective management of exchange rates and foreign exchange reserves.

Wage Price Spiral

- When wages in certain sectors of the economy increase rapidly, it can lead to higher production costs. These increased costs are often passed on to consumers in the form of higher prices for goods and services. This wage-price spiral can contribute to inflation, particularly if it becomes a self-reinforcing cycle.

Inflation Expectations

- People's expectations about future inflation can indeed influence their economic behaviour. If individuals and businesses anticipate that prices will rise significantly in the future, they may demand higher wages and increase prices of goods and services in anticipation. These actions can become self-fulfilling and contribute to inflationary pressures.

- Managing inflation expectations is a key aspect of central bank communication and policy.

Inflation has several implications for an economy

Reduced Purchasing Power

- Inflation reduces the purchasing power of a currency, which means that consumers can buy fewer goods and services with the same amount of money. This can lead to a decrease in the standard of living for individuals on fixed incomes or with limited wage growth.

- It also affects consumers' ability to afford essential items, which can impact their overall well-being.

Uncertainty

- High and unpredictable inflation can create uncertainty in financial markets and investment decisions. When inflation is volatile or significantly higher than expected, it becomes challenging for businesses and investors to make long-term plans.

- This uncertainty can hinder economic growth as it may lead to delayed investments and decreased consumer spending.

Income Redistribution

- Inflation can lead to a redistribution of income within an economy. Borrowers tend to benefit from inflation because the real value of their debt decreases over time.

- On the other hand, lenders, especially those holding fixed-interest loans, can lose purchasing power as the real value of the money they are repaid diminishes. This can affect financial stability and wealth distribution within the society.

Impact on Savings and Investments

- Inflation erodes the real returns on savings and investments. When the nominal interest rate on savings or investments is lower than the inflation rate, the real (inflation-adjusted) returns become negative. This discourages people from saving and investing, which can have long-term economic consequences.

- It's especially problematic for retirees and individuals saving for retirement, as their savings may not keep up with the rising cost of living.

Steps Taken to Address Inflation

Monetary Policy

- The Reserve Bank of India (RBI) plays a central role in controlling inflation through its monetary policy tools. It uses mechanisms such as interest rates, reserve requirements, and open market operations to influence the money supply and interest rates in the economy. By adjusting these tools, the RBI aims to strike a balance between controlling inflation and promoting economic growth.

- If inflation is rising, the RBI may raise interest rates to curb excessive demand and reduce inflationary pressures.

Food Price Controls

- Given the significant impact of food prices on overall inflation in India, the government often intervenes in food markets to stabilize prices. This intervention can take the form of price controls, subsidies on essential food items, and maintaining buffer stocks of food grains.

- Price controls can prevent sudden spikes in food prices, which can be particularly beneficial for low-income households.

Supply-Side Reforms

- Improving the agricultural sector and addressing supply chain inefficiencies are essential for controlling inflation in India. The government has initiated structural reforms aimed at modernizing agriculture, reducing post-harvest losses, and enhancing supply chain efficiency.

- These reforms can help ensure a consistent and stable supply of essential goods, reducing the volatility in prices caused by supply disruptions.

Challenges in managing inflation

Supply Chain Disruptions

- Supply chain disruptions, such as those experienced during the COVID-19 pandemic, can have a substantial impact on inflation. When the flow of goods and services is disrupted, it can lead to shortages and price spikes.

- India's vast and complex supply chains can be vulnerable to various disruptions, including natural disasters, transportation bottlenecks, and logistical challenges. Addressing these vulnerabilities is crucial to maintaining price stability.

Structural Issues

- India grapples with long-term structural issues in various sectors, including agriculture, labour markets, and infrastructure. These issues can contribute to supply-side constraints and inefficiencies, making it difficult to meet rising demand for goods and services without causing inflationary pressures.

- Implementing and sustaining policy reforms in these areas is essential to address the root causes of inflation.

Global Factors

- India's reliance on imports for critical commodities like oil makes it vulnerable to global price fluctuations. Geopolitical tensions, changes in international demand, and supply disruptions in global markets can lead to significant price volatility.

- Developing strategies to mitigate the impact of global factors on domestic inflation is a challenge for Indian policymakers.

Balancing Act

- Balancing the objectives of controlling inflation and supporting economic growth is a perennial challenge for policymakers. Tightening monetary policy to curb inflation can slow down economic growth, while overly expansionary policies can fuel inflation. Achieving the right balance requires careful consideration of both short-term and long-term economic goals.

Way Forward for managing inflation

Structural Reforms

- Accelerating structural reforms, especially in agriculture, labour markets, and logistics, is essential to enhance supply-side efficiency. Reforms in agriculture can improve productivity, reduce post-harvest losses, and stabilize food prices.

- Labour market reforms can boost productivity and increase employment opportunities, contributing to overall economic stability.

Monetary Policy Coordination

- Coordinated efforts between fiscal and monetary policies are crucial for maintaining price stability while supporting economic growth. Ensuring that fiscal policies are consistent with the inflation targets set by the central bank (RBI) helps avoid conflicting policy objectives.

Investment in Infrastructure

- Infrastructure development, particularly in agriculture and transportation, is vital for reducing supply chain disruptions and inefficiencies. Enhanced infrastructure can help streamline the movement of goods and reduce wastage, ultimately contributing to price stability.

Diversification of Imports

- Reducing dependence on volatile global commodity markets by diversifying sources of essential imports can help mitigate the impact of external factors on domestic inflation. This involves identifying alternative suppliers and building strategic reserves when necessary.

Inflation Targeting

- India's adoption of an inflation-targeting framework by the RBI is a positive step. This approach provides transparency and predictability in monetary policy, helping anchor inflation expectations and guide policy decisions.

Financial Inclusion

- Promoting financial inclusion and literacy is important for households to better manage the impact of inflation on their finances. Access to financial services, including savings and investment options, can empower individuals to protect their wealth from erosion due to inflation.

Must Read Articles:

INDIA’S RETAIL INFLATION: https://www.iasgyan.in/daily-current-affairs/indias-retail-inflation

Inflation: https://www.iasgyan.in/daily-current-affairs/inflation-19#:~:text=Inflation%20measures%20the%20average%20price,items%20is%20called%20%27deflation%27.

|

PRACTICE QUESTION

Q. What are the primary factors driving inflation in India, and what are the economic and social impacts of this inflation? What challenges does India face in managing inflation, and what strategies or actions should be considered for the way forward in addressing this issue?

|

https://www.livemint.com/economy/indias-retail-inflation-eases-to-6-83-in-august-from-15-month-high-peak-in-july-remains-above-rbis-tolerance-band-11694518897329.html

https://t.me/+hJqMV1O0se03Njk9