Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Interest-Free Banking

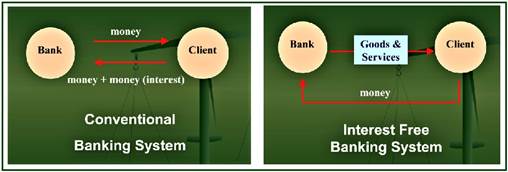

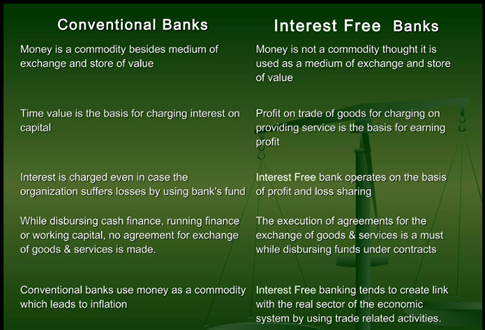

Basis of the Interest-Free Banking Theory

How can a bank work without levying interest?

Instruments to generate money

Various instruments are available for those who want to take credit from a Sharia-compliant bank.

Interest-free banking in India

Final Thought

© 2024 iasgyan. All right reserved