Disclaimer: Copyright infringement not intended.

Context

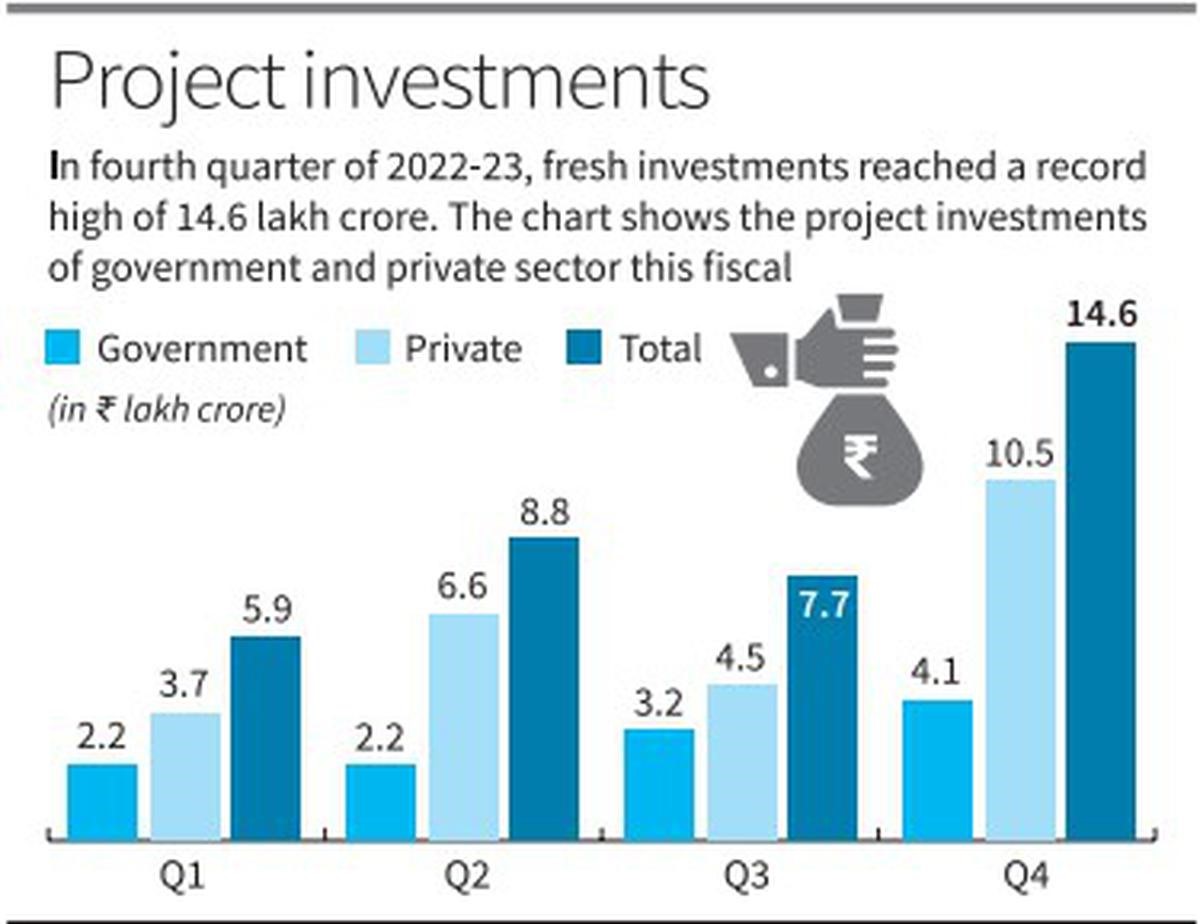

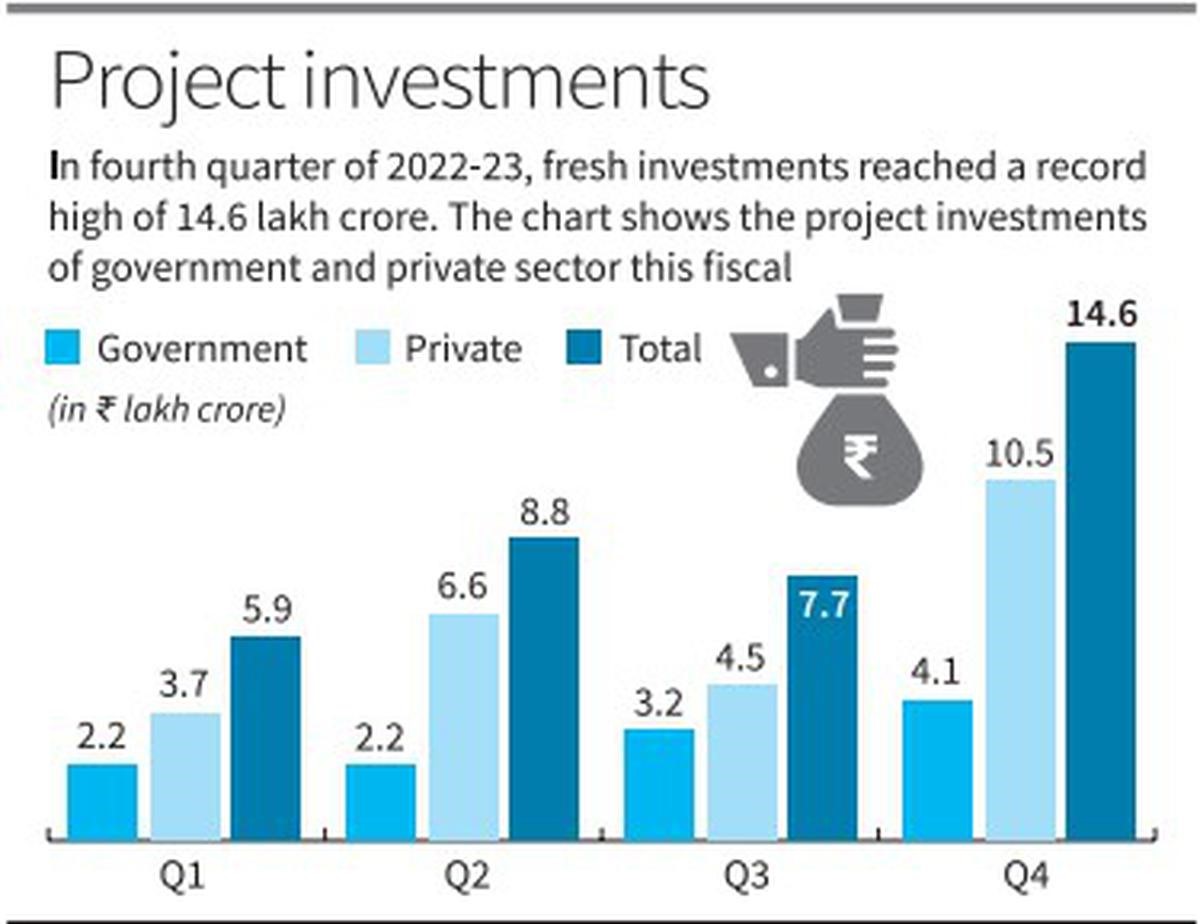

- January-to-March quarter recorded the highest-ever total fresh investments of ₹14.6 lakh crore, led by private sector outlays that also hit an all-time high of ₹10.5 lakh crore.

Sector-wise Investment Trends

Manufacturing Sector

- The manufacturing sector has emerged as the dominant sector in terms of investment, with its share in total fresh investment increasing from 41.93% in 2021-22 to 53.66% in 2022-23.

Private Sector Investments

- Private sector investments, jumped 90.7% to ₹25.32 lakh crore in 2022-23 from ₹13.27 lakh crore a year earlier.

Foreign investments

- Foreign investments grew at a faster clip, albeit on a smaller base, to touch ₹4.73 lakh crore compared to ₹2.17 lakh crore in 2021-22.

Investments in irrigation projects

- Investments in irrigation projects also recorded an almost five-fold increase in 2022-23 to hit nearly ₹62,000 crore.

Infrastructure

- Infrastructure projects saw a 32.4% uptick to cross ₹11.76 lakh crore from ₹8.88 lakh crore in 2021-22.

Electricity sector

- Electricity sector investments surged 175% to ₹4.11 lakh crore from less than ₹1.5 lakh crore in 2021-22.

Mining Sector

- Mining was the only sector to record a contraction in investment plans last year, slipping 4.2% to ₹65,252 crore.

Overview of Investment in India

- Over the years, India has emerged as one of the fastest-growing economies in the world, and it now offers a growing and thriving environment for investments, both domestic and foreign.

- With the largest youth population in the world, it provides prospective investors with a highly skilled workforce and a strong work ethic.

- India's huge domestic consumption, led by the private sector, has played a major role in the country's growth.

- India has an estimated middle class of 400 million people who are the main drivers of consumption expenditure. This emerging middle class and increasing disposable incomes are the largest factors behind the increasing domestic consumption in India.

- It is estimated that the private consumer market in India will increase four times by 2025. The present government is also focusing on rural areas and farmers, as rural India is also emerging as an upcoming market for all types of consumer goods.

- A host of government initiatives has also enabled India's investment growth, which includes developing India's financial system, improving the infrastructure and relaxing FDI norms.

- The Government has propagated an investor-friendly FDI policy, in which most sectors are open for 100% FDI under the automatic route. India's FDI policy is also reviewed on an ongoing basis to ensure that India remains an attractive and investor-friendly destination.

Government Initiatives

- The steps taken by the Government during the last few years to attract investments have borne fruit, as is evident from the record volume of FDI inflow that was received in the country in FY22.

- The government has launched policies that significantly simplify the ease of doing business, as evidenced by India's jump from rank 142 in 2015 to rank 63 in 2020 in the Doing Business Reports of the World Bank. Some of these policies are:

Business Reforms Action Plan

- The Department for Promotion of Industry and Internal Trade (DPIIT) has introduced a dynamic reform exercise called the Business Reforms Action Plan, which ranks all the states and UTs in the country based on the implementation of designated reform parameters. The reforms have focused on streamlining the current rules and procedures and getting rid of unnecessary requirements and steps. The Action Plan covers multiple reform areas such as:

- Investment Enablers

- Online Single Window System

- Land administration and Transfer of Land and Property

- Construction Permits Enabler

- Labour Regulation Enablers

- Environment Registration Enablers

- Inspection Enablers

- Paying Taxes

- Obtaining Utility Permits

Investor-Friendly Strategy

- The government has implemented an investor-friendly strategy to encourage FDI, and the majority of sectors are accessible to 100% FDI under the automatic route. In order to keep India a desirable and welcoming place for investors, the FDI policy is also revised frequently.

- Any changes to the policy are made after extensive consultations with stakeholders, including apex industry chambers, associations, representatives of industries/groups, and other organisations.

National Monetization Pipeline (NMP)

- The National Monetization Pipeline (NMP) was launched in 2021 to provide a comprehensive view to investors and developers of the available investment avenues in Infrastructure. Over a four-year period, the total indicative value of NMP for the Central Government's core assets has been assessed at Rs. 6 lakh crore (US$ 75.18 billion).

Empowered Group of Secretaries (EGoS) and Project Development Cells (PDCs)

- The Union Cabinet set up Empowered Group of Secretaries (EGoS) and Project Development Cells (PDCs) in Ministries/Departments of the Government of India to expedite investments in conjunction with state governments, hence expanding India's pipeline of investable projects and attracting more FDI and domestic investments.

Four Labour Codes

- The Ministry of Labour and Employment has taken a number of steps to streamline labour laws to make conducting business easier.

- By condensing, combining, and rationalising the pertinent provisions of 29 Central Labour Laws, the Government has notified four labour codes: the Code on Wages, 2019, the Industrial Relations Code, 2020, the Code on Social Security, 2020, and the Code on Occupational Safety, Health, and Working Conditions, 2020.

Concessional Tax Rate

- In order to incentivise new domestic companies to set up their manufacturing units in India, the government has extended the concessional tax rate of 15% to March 31, 2024.

India Industrial Land Bank

- The government introduced the India Industrial Land Bank (IILB), which is a GIS-based portal - a one-stop repository of all industrial infrastructure-related information - connectivity, infrastructure, natural resources, terrain, plot-level information on vacant plots, line of activity, and contact details.

Phased Manufacturing Programme (PMP)

- In February 2022, The Ministry of Heavy Industries notified a Phased Manufacturing Programme (PMP) to promote domestic manufacturing of electric vehicles, their assemblies/sub-assemblies and parts/sub-parts/inputs of the sub-assemblies.

National Single Window System (NSWS)

- In September 2021, Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles, launched the National Single Window System (NSWS).

- The single window portal would become a one-stop shop for investors for approvals and clearances, which would bring transparency, accountability and responsiveness to the ecosystem.

Central Bank Digital Currency

- The Reserve Bank of India (RBI), in order to boost India's digital economy, launched the Central Bank Digital Currency (CBDC) as India's official digital rupee in FY23.

- The digital rupee will play a crucial role in improving the speed of transactions and reducing the cost of cash.

PLI Scheme

- Increased government investment is expected to attract private investments, both domestic and foreign.

- The government's key production-linked incentive (PLI) schemes in multiple sectors will provide significant support to the manufacturing sector.

- The PLI schemes in 14 different sectors can lead to additional production of Rs. 30 lakh crore (US$ 401 billion) over the next five years, as well as create employment for 60 lakh people.

Closing Thoughts

- Gradual opening up of the economy by relaxing FDI norms, record vaccinations to combat the pandemic, increase in consumer demand and income, improving financial infrastructure of the country, and continued policy support towards industries by the government in the form of the Atmanirbhar Bharat Abhiyan and various PLI schemes have led to an upturn in the performance of the investment sector in India, which is set to scale new heights in the coming years.

- In India, mega projects are delayed due to several issues including the availability of land and environmental clearances in time. A quicker grounding of mega projects would instil confidence in the private promoters to commit more fresh investment.

|

PRACTICE QUESTION

Q. Over the years, India has emerged as one of the fastest-growing economies in the world, and it now offers a growing and thriving environment for investments, both domestic and foreign. Delineate the steps taken by the GOI to boost domestic and foreign investments in India.

|

https://www.thehindu.com/business/Economy/record-q4-investments-lift-2022-23-outlays-to-all-time-high-of-37-lakh-crore/article66748605.ece