Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Details

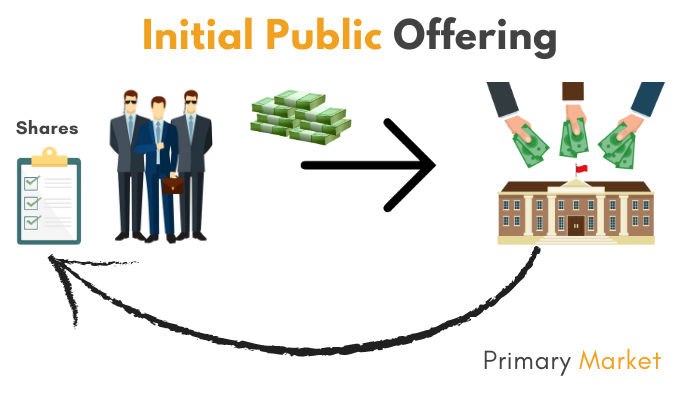

IPO

|

While coming with an IPO, the company has to file its offer document with the market regulator Securities and Exchange Board of India (SEBi). The offer document contains all relevant information about the company, its promoters, its projects, financial details, the object of raising the money, terms of the issue, etc. |

IPO-Source of Fund for a Company

Types of IPOS

Fixed Price Offering

Book Building Offering

In Book Building securities are offered at prices above or equal to the floor prices, whereas securities are offered at a fixed price in case of a public issue. In case of Book Building, the demand can be known everyday as the book is built. But in case of the public issue the demand is known at the close of the issue.

Importance

Which companies can come out with an IPO?

Where do the proceeds of the IPO go?

Who fixes the price of securities in an issue?

What are the advantages of listing a company?

Who can invest in an IPO?

© 2024 iasgyan. All right reserved