Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: globalgreenews.com

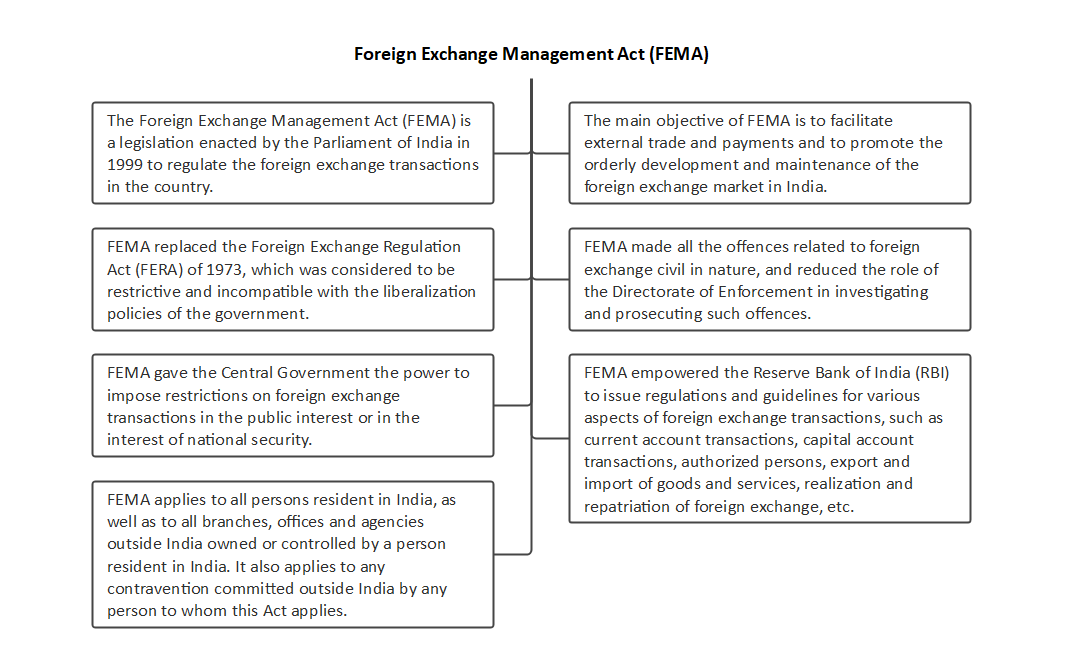

Context: The Reserve Bank of India (RBI) published a proposed 'Licensing Framework for Authorised Persons (APs)' under the Foreign Exchange Management Act (FEMA), 1999. The draft framework aimed to streamline the licensing process and eligibility criteria for entities authorized to deal in foreign exchange transactions.

Draft Licensing Framework Overview

Forex Correspondent Scheme

Perpetual Authorisation

Facilitating Trade-Related Transactions

Conclusion

Must Read Articles:

FEMA: https://www.iasgyan.in/daily-current-affairs/fema

|

PRACTICE QUESTION Q. What is the crucial role played by the Reserve Bank of India (RBI) in the country's economic landscape, and how does its monetary policy impact key aspects such as inflation, interest rates, and overall economic stability? |

© 2024 iasgyan. All right reserved