Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Details

Need of the lightweight payment system

Features of LPSS

Significance

Trivia

|

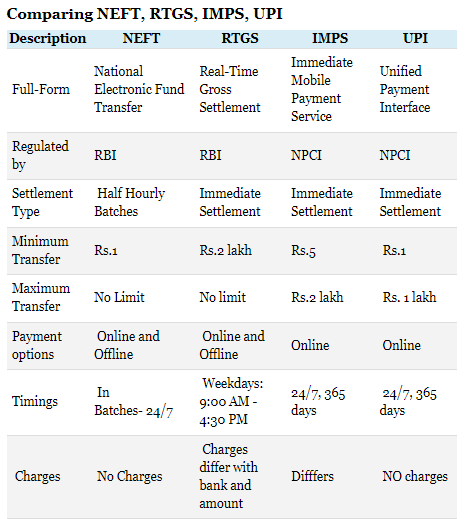

Parameters |

UPI |

NEFT |

|

Platform |

A mobile app-based system that brings you multiple bank accounts on one platform for a unique effortless funds transfer experience |

A process that is possible through mobile banking, internet banking and on-ground NEFT transactions |

|

Transfer Time |

Works on Immediate Payment Service; available 24×7 |

Can take up to 12 hours for fund transfer |

|

Transfer cost |

Currently free of cost; some banks may charge Rs.0.5 on every transaction |

Currently free of cost via online platforms |

|

Transfer initiation |

Can be initiated from any bank’s UPI app |

Must be initiated from the Sender/Remitter bank’s app |

|

Transfer Type |

Both payment and collection transactions are possible |

Only payment transactions are possible |

|

Per Transaction Limit |

Daily limit: Rs. 1 Lakh |

No upper or lower limits |

|

Beneficiary Details |

Requires only Virtual ID |

Requires bank account no., IFSC code, etc. |

|

Bank Account Requirement |

UPI payment or collection of money is possible even if you do not have a bank account |

NEFT is possible only if you have a bank account |

|

Adding a beneficiary |

No need of pre-addition/approval of beneficiary; transfer made to beneficiary’s virtual ID |

Pre-addition and bank’s approval of beneficiary required before transfer |

|

PRACTICE QUESTION Q. Consider the following statements: 1. The Minimum transfer value in National Electronic Fund Transfer is Rs 5 lakhs. 2. In the case of Real Time Gross Settlement depending on the bank and the location, the operating hours vary. 3. UPI payment or collection of money is possible even if you do not have a bank account. How many of the above statements are correct? a. Only one b. Only two c. Only three d. None. Answer: b.Only two |

© 2024 iasgyan. All right reserved