Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: slideserve.com

Context: The term “Loanable funds theory” is in the news.

Details

Key Highlights

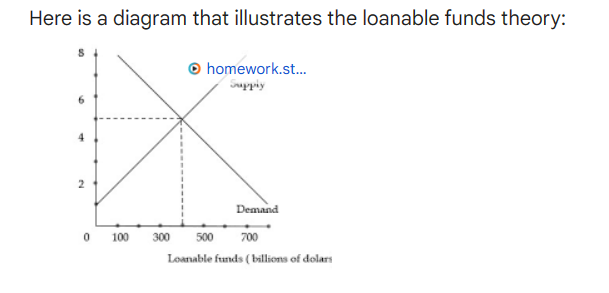

As given in the graph, the interest rate is determined by the intersection of the supply and demand curves for loanable funds. When the supply of loanable funds is greater than the demand for loanable funds, the interest rate will fall. When the demand for loanable funds is greater than the supply of loanable funds, the interest rate will rise.

Conclusion

|

PRACTICE QUESTION Q. According to the loanable funds theory, the interest rate is determined by: A) The demand for and supply of money B) The demand for and supply of loanable funds C) The marginal productivity of capital D) The marginal propensity to save Answer: B Explanation: The loanable funds theory is a theory of the market interest rate that considers all forms of credit, such as loans, bonds, or savings deposits, as loanable funds. The interest rate is determined by the equilibrium between the demand for and supply of loanable funds from various sources and for various purposes. |

© 2024 iasgyan. All right reserved