Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

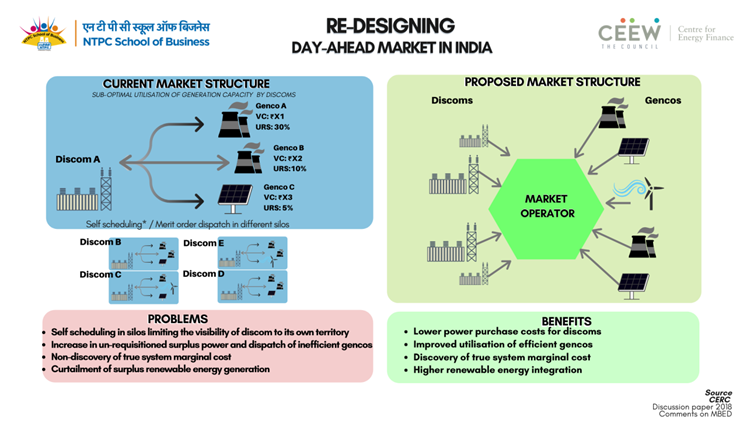

Context

Background

MBED

Relevance and impact

The proposed market design is expected to have the following impact on the power sector:

Reduced power purchase costs

Greater renewable energy integration

Concerns

|

India has a diversified electricity market ranging from long-term power purchase agreements (PPAs), cross border PPAs, short and medium term bilaterals, day-ahead power exchange, and a real-time online market. A major percentage of the installed power capacity –over 87 per cent – is tied up under long term PPAs of around 25 years. The remaining 13 per cent is transacted in the power markets, with nearly half of this over the power exchanges and the remaining through short-term and medium-term bilateral deals. At present, each control area or state follows merit-order dispatch (cheapest power dispatched first) from the basket of intra-state and inter-state resources and buys or sells on the day-ahead power exchange. |

Way Ahead

© 2024 iasgyan. All right reserved