Copyright infringement not intended

Picture Courtesy: www.moneycontrol.com

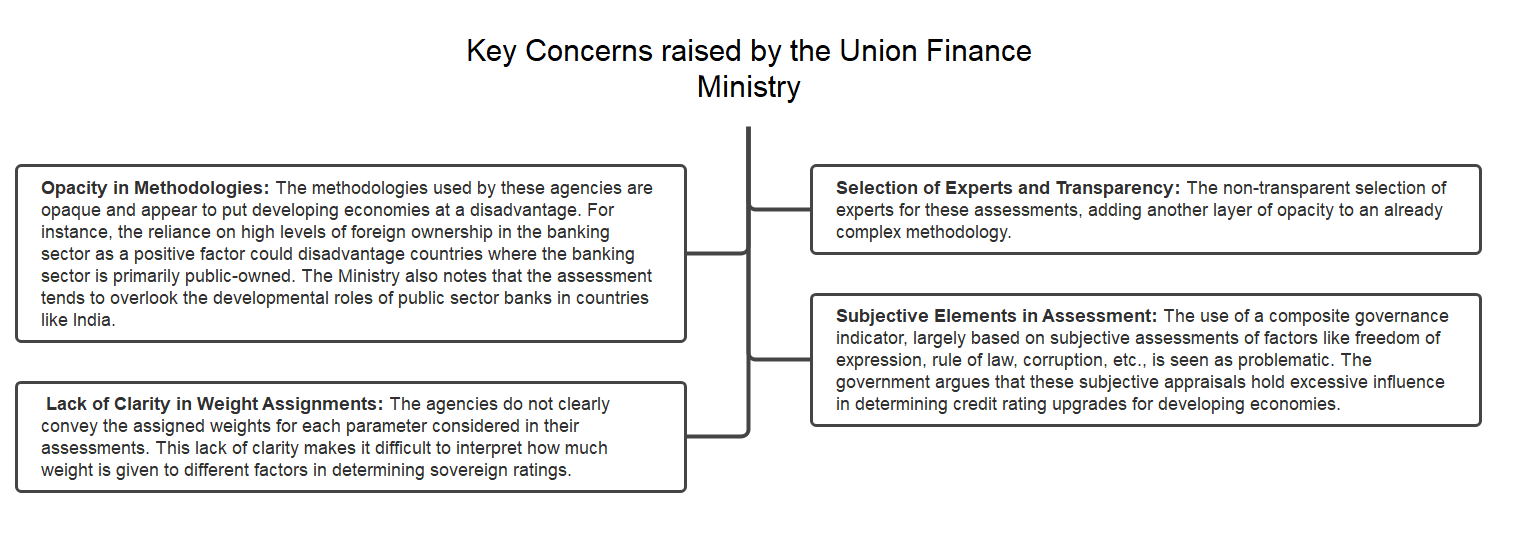

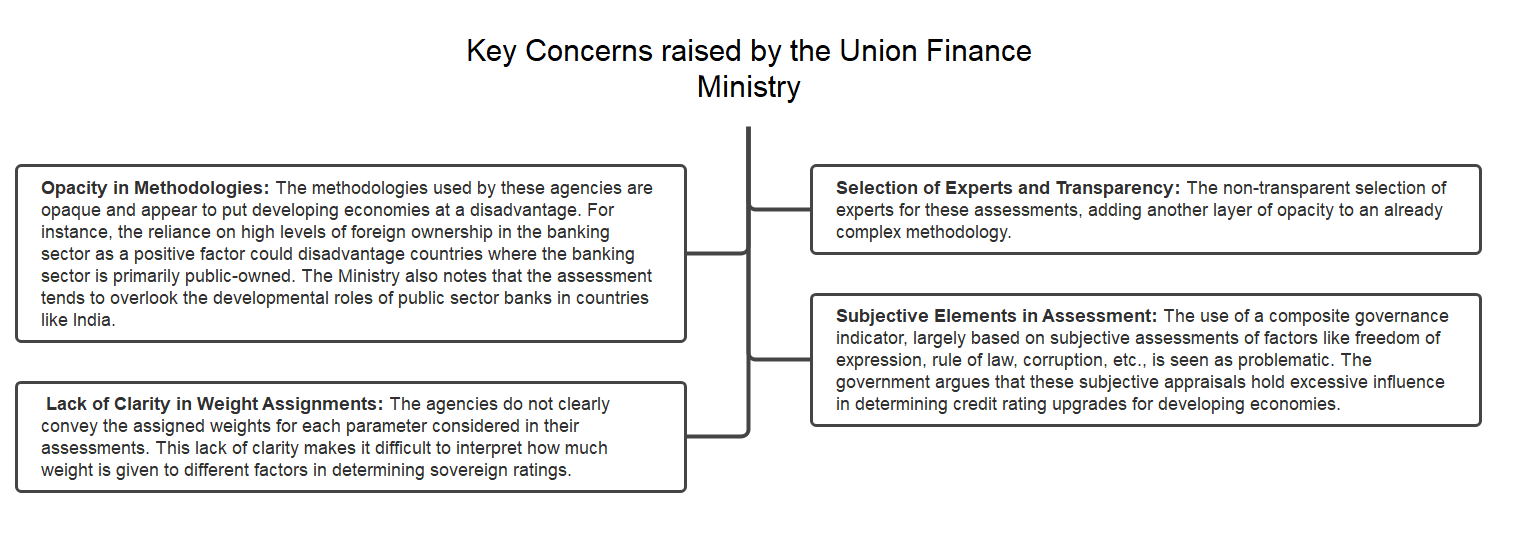

Context: The Union Finance Ministry is raising concerns about the methodologies employed by credit rating agencies, particularly Moody’s, Standard & Poor’s, and Fitch. They argue that these methodologies might be disadvantageous to developing economies like India.

Details

- CRAs are private firms that assign ratings to the debt obligations of sovereigns, corporations and other entities based on their ability and willingness to repay. These ratings range from AAA (highest) to D (default) and influence the borrowing costs and investment flows for the rated entities.

- The three major CRAs - Standard & Poor's (S&P), Moody's and Fitch - collectively account for about 95% of the global market share and wield enormous power in the financial landscape.

- The Finance Ministry suggests that these methodologies heavily emphasize subjective perceptions and governance indicators, which could potentially hinder developing economies from receiving fair credit rating upgrades. They contend that these agencies place too much emphasis on subjective indicators, which might not accurately represent the economic fundamentals of developing countries like India.

The low sovereign rating has adverse implications for its economic development and financial stability:

- It increases the borrowing costs for the government as well as the private sector, as lenders demand higher interest rates to compensate for the perceived risk.

- It discourages foreign portfolio investors (FPIs) and foreign direct investors (FDIs) from investing in India, as they rely on the ratings as a signal of creditworthiness. This reduces the availability of capital for productive activities and hampers growth and employment generation.

- The low rating affects India's global reputation and bargaining power in international forums.

- It undermines India's aspirations to become a major economic power and a leader in multilateral institutions such as the IMF, World Bank and G20.

- It exposes India to external shocks and vulnerabilities that could trigger capital outflows, currency depreciation and financial instability.

Steps taken by India Government

- Engaging with CRAs: The government has been regularly communicating with CRAs to present its case for a rating upgrade and to highlight its achievements and reforms. It has also sought greater transparency and accountability from CRAs in their rating processes and methodologies.

- Pursuing fiscal consolidation: The government has adhered to a prudent fiscal policy and reduced its fiscal deficit from 4.5% of GDP in 2013-14 to 3.5% in 2019-20 (before the pandemic). It has also enacted the Fiscal Responsibility and Budget Management Act (FRBM Act) to institutionalize fiscal discipline.

- Boosting growth: The government has implemented various measures to revive growth after the pandemic-induced slowdown. These include providing fiscal stimulus, enhancing public investment, facilitating credit flow, promoting manufacturing, digitalization and innovation, reforming labour laws, agriculture markets and public sector enterprises.

- Strengthening external sector: The government has improved its external sector position by increasing its foreign exchange reserves to a record high of US$598.89 billion as of October 26, 2023. It has also diversified its export basket, enhanced its trade competitiveness, attracted record FDI inflows and participated in regional trade agreements.

- Improving governance: The government has improved its governance and institutional quality by curbing corruption, enhancing transparency, strengthening the rule of law, ensuring policy stability and fostering social inclusion.

Challenges in achieving a rating upgrade and sustaining its economic growth

- High public debt: India's public debt-to-GDP ratio increased from 72% in 2019-20 to 90% in 2020-21 due to the pandemic-related fiscal expansion. This poses a risk to fiscal sustainability and debt servicing capacity in the medium to long term.

- Low tax revenue: India's tax-to-GDP ratio is one of the lowest among emerging economies at around 17%. This limits the fiscal space for public spending on infrastructure, health, education and social welfare.

- Structural bottlenecks: India faces structural bottlenecks such as low productivity, skill gaps, infrastructural deficits, regulatory hurdles, environmental degradation and social inequalities that constrain its growth potential and competitiveness.

- Global uncertainties: India is exposed to global uncertainties such as rising protectionism, trade tensions, geopolitical conflicts, climate change and health emergencies that could affect its external demand, capital flows and financial stability.

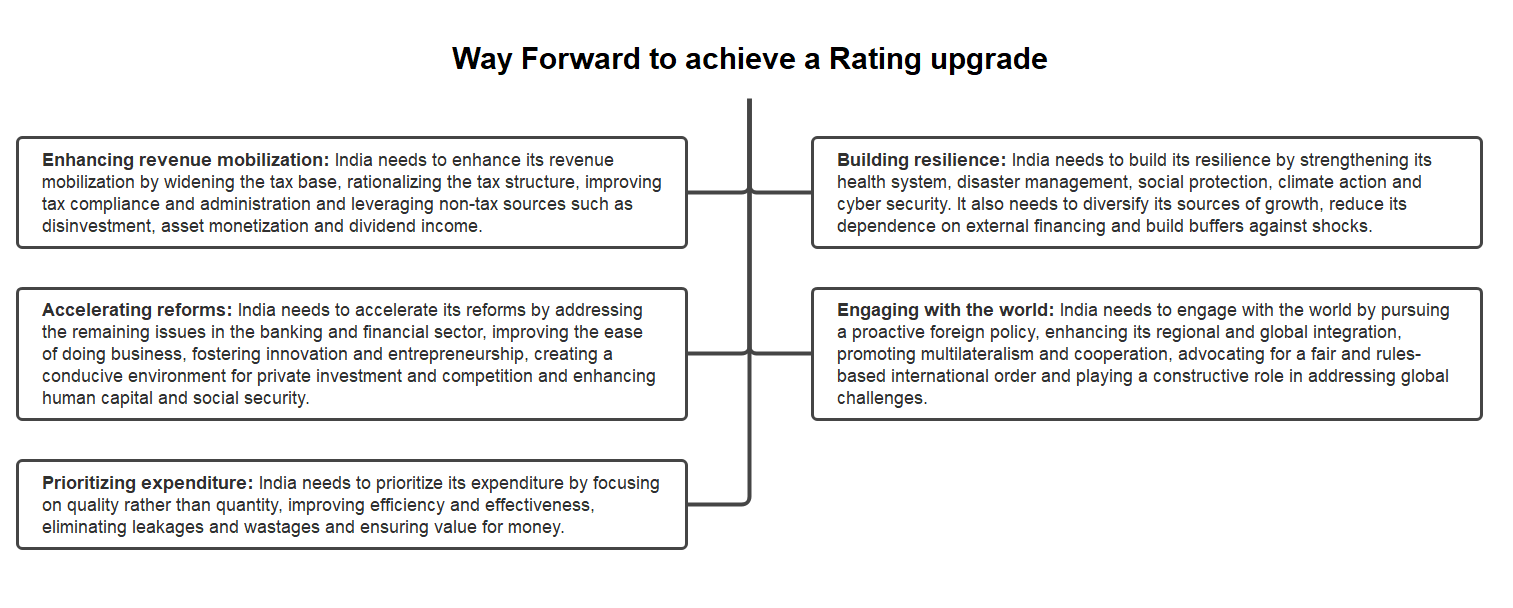

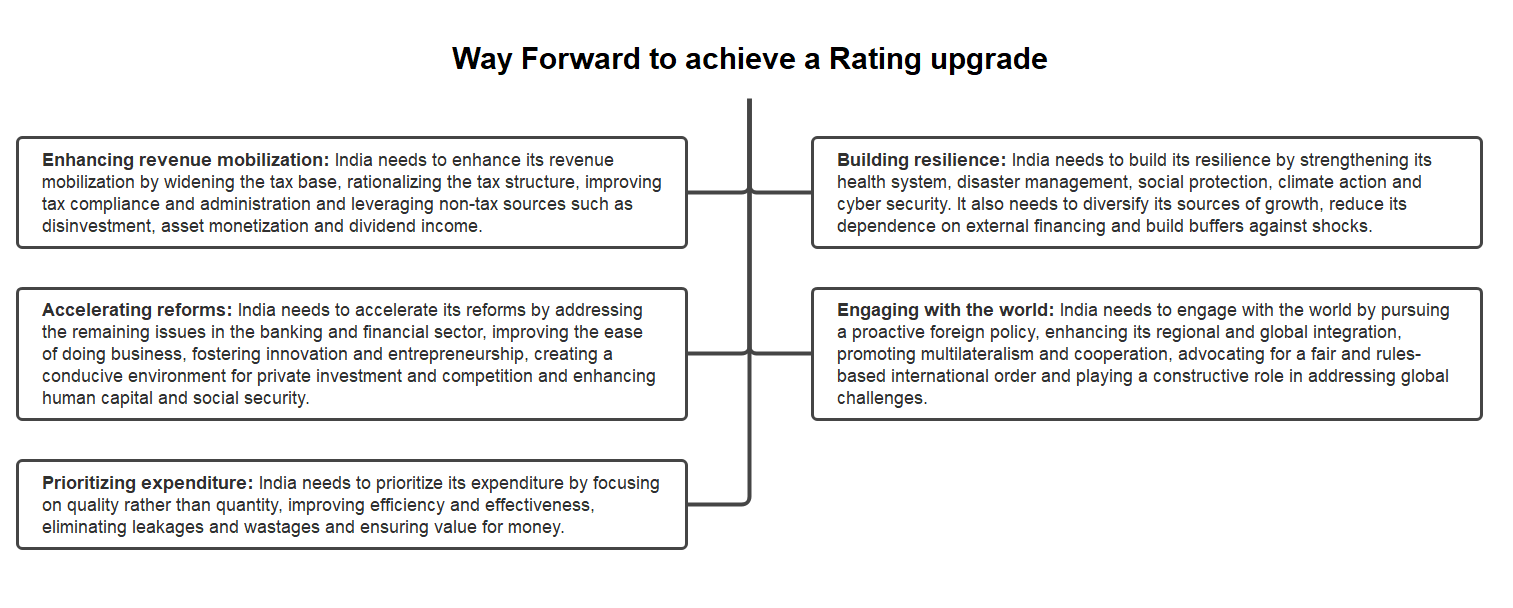

To overcome these challenges and achieve a rating upgrade, India needs to pursue a balanced and holistic approach that combines macroeconomic stability, structural reforms, social development and global cooperation.

Conclusion

- India's sovereign rating by global CRAs misrepresents its economic fundamentals, impacting borrowing costs, investment, and global standing. The government aims to enhance economic performance but faces hurdles in securing an upgrade. To achieve this, a comprehensive strategy balancing stability, reforms, social progress, and global collaboration is crucial for acknowledging India's economic prowess fairly.

Must Read Articles:

World Bank’s Governance Indicators: https://www.iasgyan.in/daily-current-affairs/world-banks-governance-indicators

Global Credit Ratings: https://www.iasgyan.in/daily-current-affairs/global-credit-ratings

|

PRACTICE QUESTION

Q. What comprehensive strategies is the Indian government considering to address the misrepresentation of its economic fundamentals by global credit rating agencies and to achieve a fair acknowledgement of its economic strength?

|