Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

In News

MSME

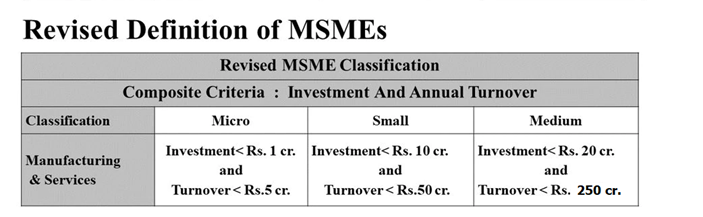

Types of MSME

Importance

As per International Council for Small Business, formal and informal MSMEs male up to 90% of total firms, 70% of employment and 50% of world GDP.

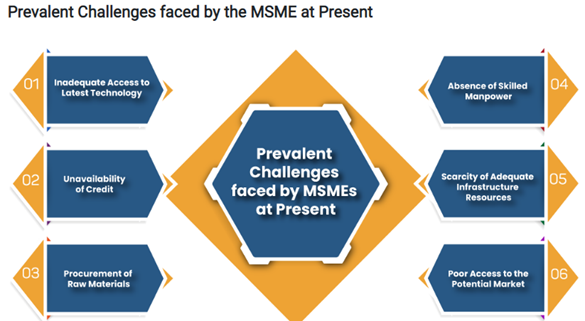

Challenges faced by MSMEs

Impact due to COVID

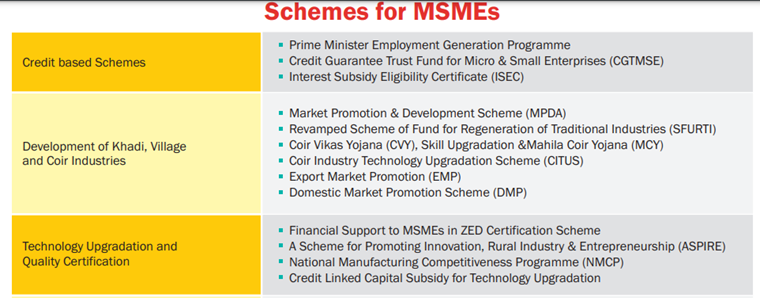

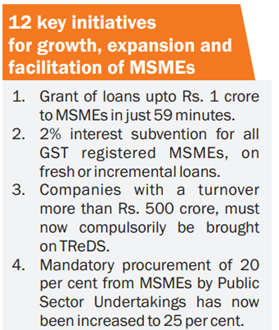

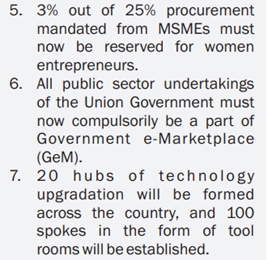

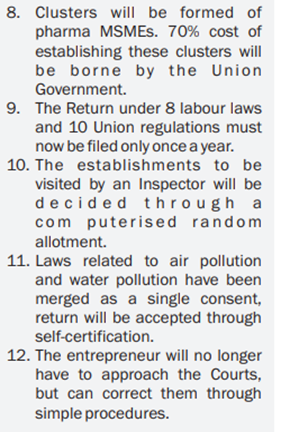

Measures taken to revive the sector

Could the measures revive the sector?

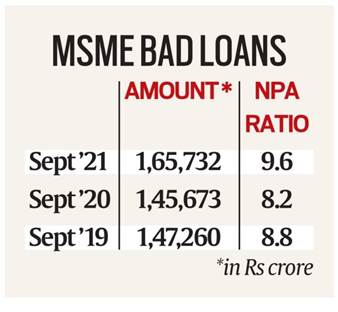

Findings

|

Most MSMEs are unable to avail the measures of loan disbursal owing to the amount of paperwork, documentation, non-existing credit history, and non-availability of adequate collateral, especially for a first-time borrower. The cost of compliance, covering all licenses, and complex taxation take a huge toll on the enterprises. The challenges of running a business amidst pandemic and slump in demand add further complications to the stressed sector. |

Way Ahead

|

The government is already encouraging MSMEs to on-board TReDS platform, as it offers them an option to discount invoices and raise short-term credit from banks to support their delayed payment issue temporarily. |

Final Thought

© 2024 iasgyan. All right reserved