Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Details

Significance

PM KISAN

Who is eligible for PM Kisan scheme?

Who is not eligible for PM Kisan scheme?

Soil Health Card

About PMFBY

PMFBY 2.0

APMC and Karnataka Model

Features of APMC

Note: However, not all states have passed the bill. Some states have passed but neither framed rules nor notified it. Thus, inter-state barriers continue.

Shortcomings in APMC system

Karnataka Model

Recent Reforms at National Level

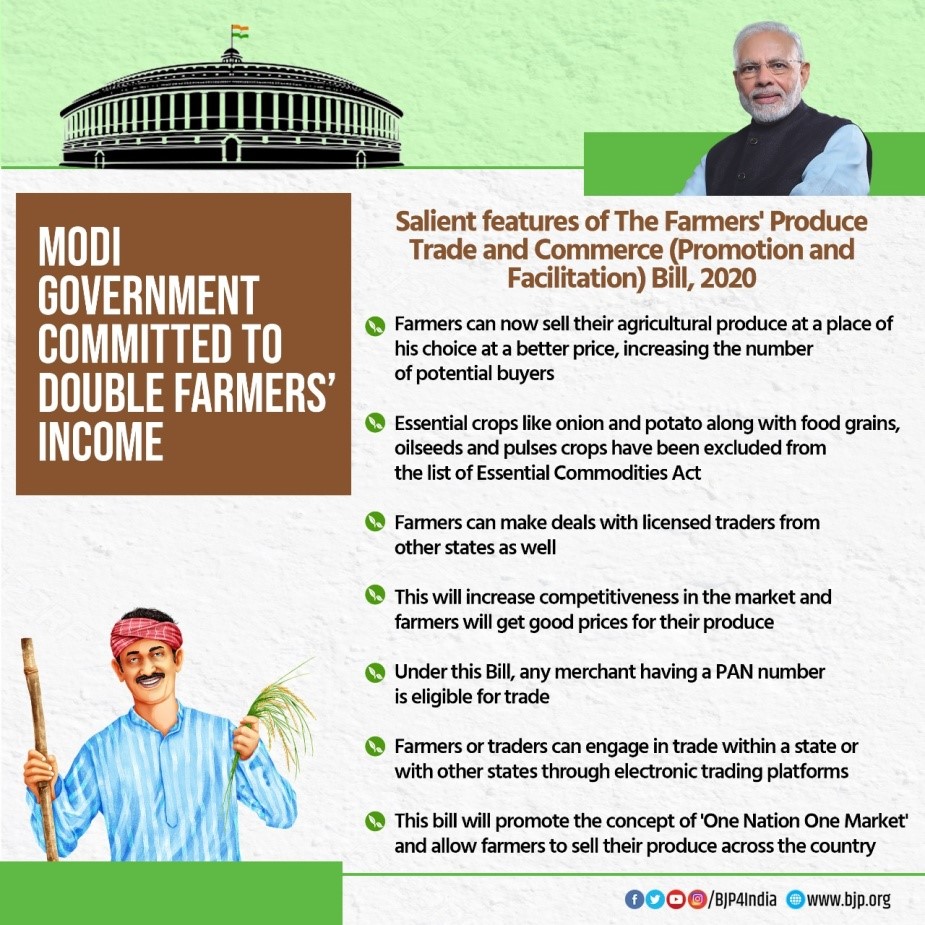

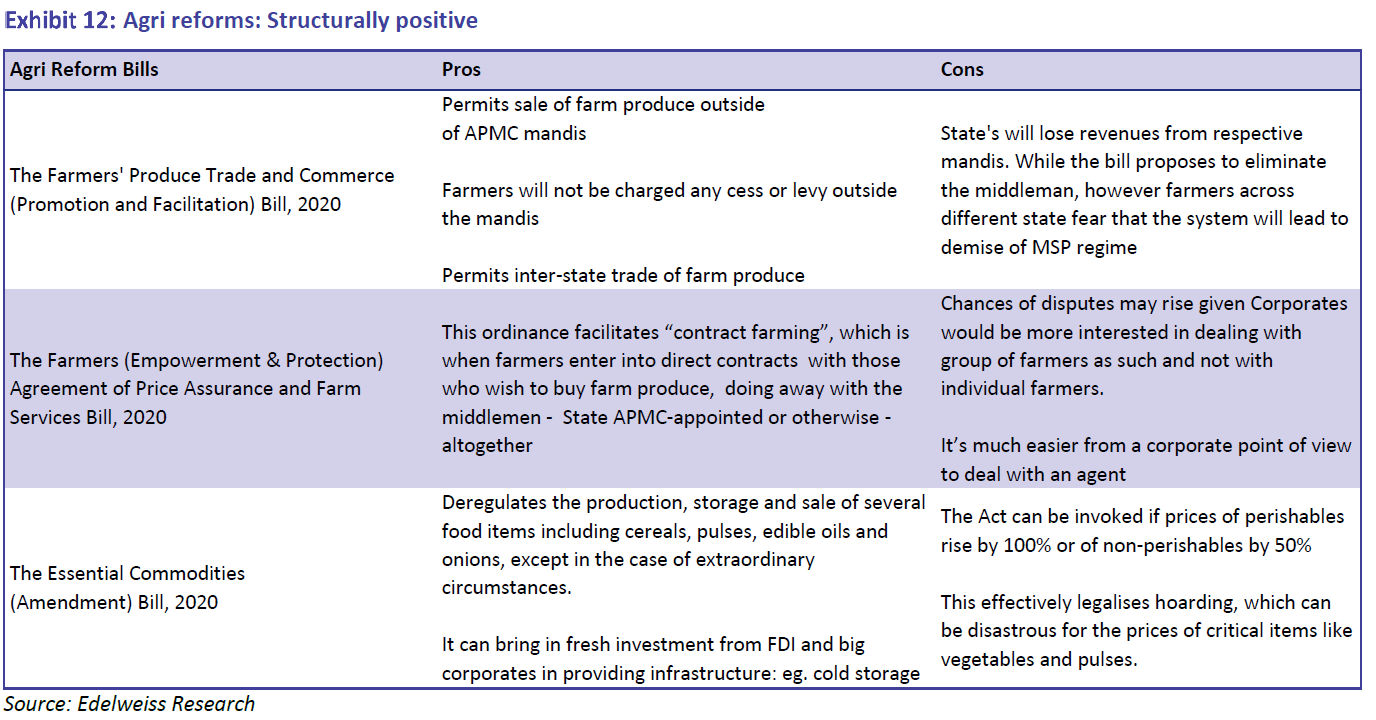

The Acts

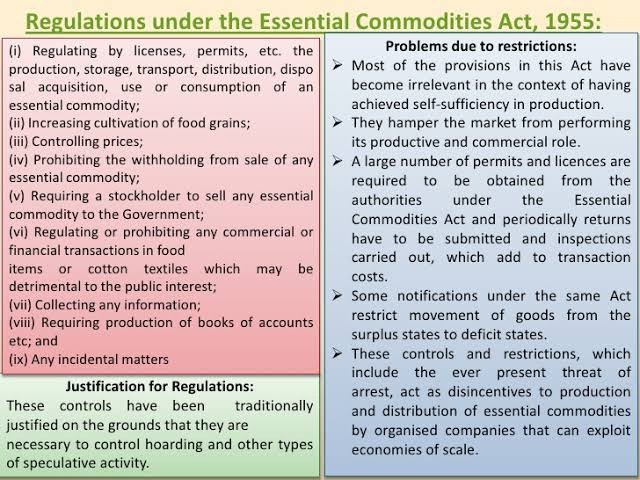

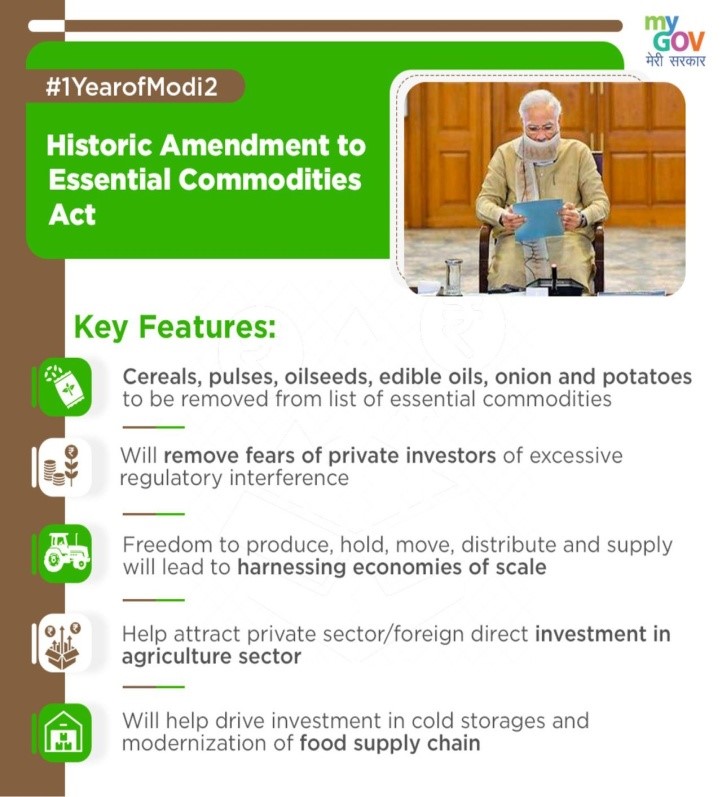

Essential Commodities (Amendment) Ordinance, 2020

Regulation of food items

Imposition of stock limit

(ii) demand for export in case of an exporter.

|

Note: The provisions of the Ordinance regarding the regulation of food items and the imposition of stock limits will not apply to any government order relating to the Public Distribution System or the Targeted Public Distribution System. |

Conclusion

© 2024 iasgyan. All right reserved