Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

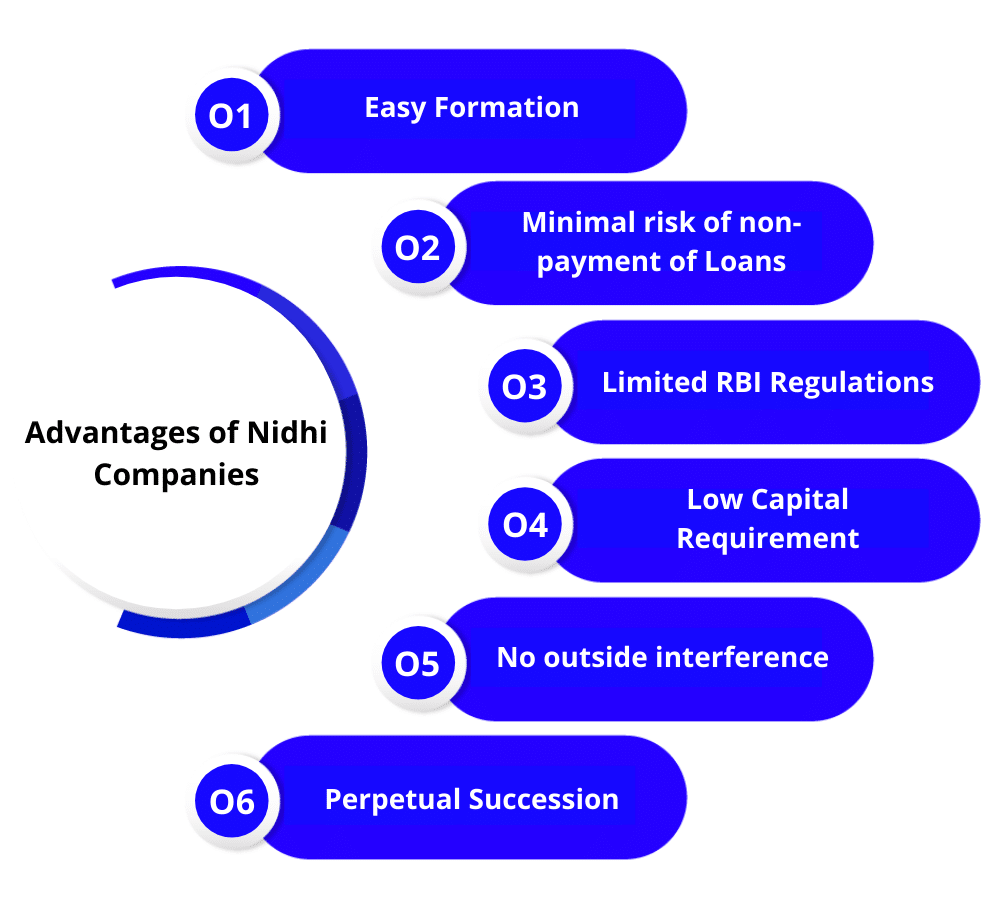

About Nidhi Company

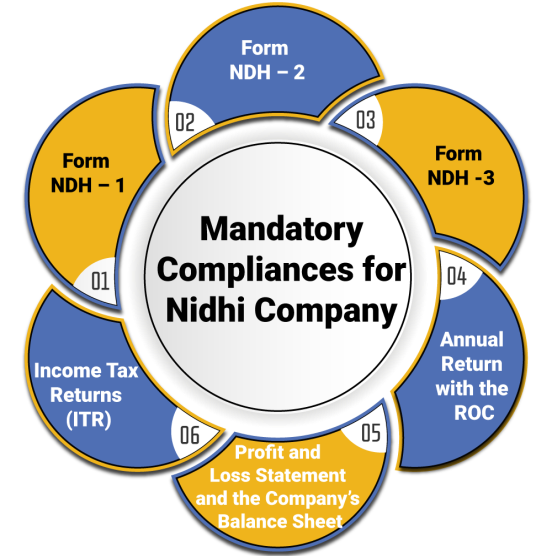

Mandatory requirements to form/incorporate a Nidhi company

Mandatory requirements to be adhered after incorporation of Nidhi Company

Within a period of one year of incorporation, the Nidhi Company has to ensure the following compliances:

Restrictions for Nidhi Company

A Nidhi Company shall not:

Deposits and its Acceptance

A Company shall accept deposits only on compliance with the following conditions:

Rules relating to Director

New Amended Rules

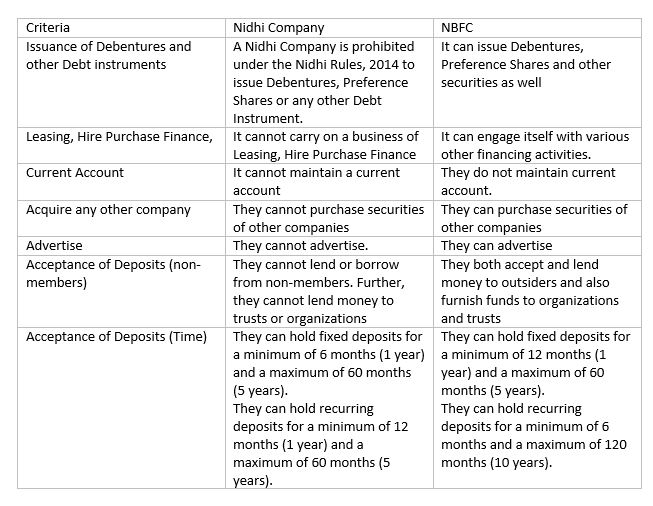

Nidhi Vs NBFC

NBFC Company

Requisites for NBFC

https://pib.gov.in/PressReleasePage.aspx?PRID=1818298

© 2024 iasgyan. All right reserved