Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

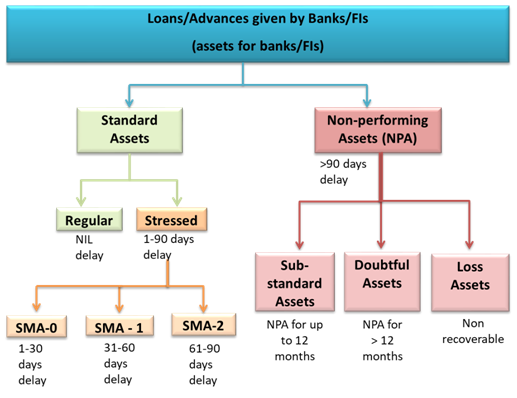

About NPA

Types of NPAs

Impact of NPAs

Profitability

Capital Adequacy

Liability Management

Public confidence

The banks then try to recover their loss by restructuring the loan or liquidating the assets or selling the loans to asset reconstruction companies at steep discounts.

Tackling NPAs

Asset reconstruction company (ARC)

The ARCs undertake various resolution strategies like:

Bad bank

|

National Asset Reconstruction Company Ltd National Asset Reconstruction Company Ltd.(NARCL), India’s first-ever Bad Bank, was set up in 2021, and RBI has recently granted the same under the SARFAESI Act 2002. If the bad bank is unable to sell the bad loan or has to sell it at a loss, then the government guarantee will be invoked. To manage assets with the help of market professionals and turnaround experts, the Government will also set up India Debt Resolution Company Ltd. (IDRCL) along with NARCL. The IDRCL is a service company or an operational entity wherein public sector banks (PSBs) and PFIs will hold a maximum of 49% stake and the rest will be with private-sector lenders. When the assets are sold, with the help of IDRCL, the commercial banks will be paid back the rest. |

Roadblocks in existing mechanisms

Concerns hovering over bad bank

Concluding remarks

Read: https://www.iasgyan.in/blogs/decoding-a-bad-bank

https://indianexpress.com/article/business/banking-and-finance/co-operative-banks-in-kerala-reel-under-bad-loans-npas-crossed-38-at-end-of-last-year-7869911/#:~:text=Together%2C%20the%20cooperative%20banks%20%E2%80%94%20including,Rs%2053%2C032%20crore%20of%20loans.&text=A%20banking%20source%20noted%20that,are%20very%20high%20and%20unsustainable

© 2024 iasgyan. All right reserved