Disclaimer: Copyright infringement not intended.

Context

- As per the latest Financial Stability Report published by the RBI, the gross non-performing assets (GNPA) declined to a six-year low of 5.9% in March 2022.

Findings of the latest Financial Stability Report

The gross non-performing assets (GNPA) declined to a six-year low of 5.9% in March 2022.

Projections:

Weak Loans

- The banking sector's weak loans will decline to 5-5.5% of gross loans by March 31, 2024.

Credit Costs

- The credit costs to stabilize at 1.5% for fiscal 2023 and further normalise to 1.3%, making credit costs comparable to those of other emerging markets and India's 15-year average.

Rising Interest Rates and High Inflation

The small and midsize enterprise sector and low-income households are vulnerable to rising interest rates and high inflation.

Economic Growth Prospects

- India's economic growth prospects should remain strong over the medium term, with GDP expanding 6.5-7% annually in fiscal years 2024-2026.

Long Term Growth Rate

- The economy's long-term higher growth rate versus peers highlights its historical resilience. India's wide range of structural trends including healthy demographics and competitive unit labour costs, work in its favour

Government stance

- The government is likely to remain supportive of the system and there is a very high likelihood the government will continue to support public-sector banks, notwithstanding plans to privatize two such banks.

Loan Growth

- In the next few years, loan growth to stay somewhat in line with the trajectory of nominal GDP, and loan growth to the retail sector to continue to outperform the corporate sector.

Corporate borrowing

- Corporate borrowing is also picking up momentum, with both working-capital needs and capital expenditure-related growth driving demand. Still, if risk management does not improve, the coming growth cycle could produce a new crop of sour loans.

About NPA

- NPA or Non Performing Assets are those kinds of loans or advances that are in default or in arrears.

- In simpler terms, if the customers do not repay principal amount and interest for a certain period of time, then such loans are considered as Non Performing Assets or NPA.

- In India, the timeline given for classifying the asset as NPA is 180 days.

- This is as against 45 to 90 days of international norms.

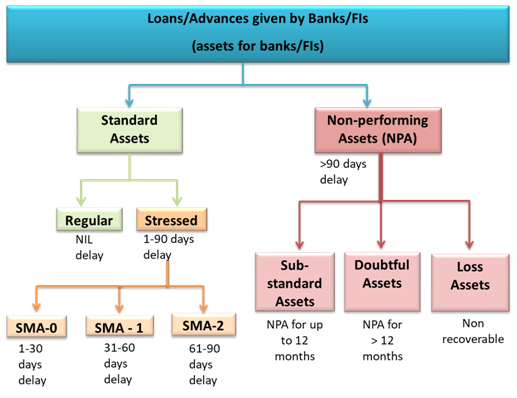

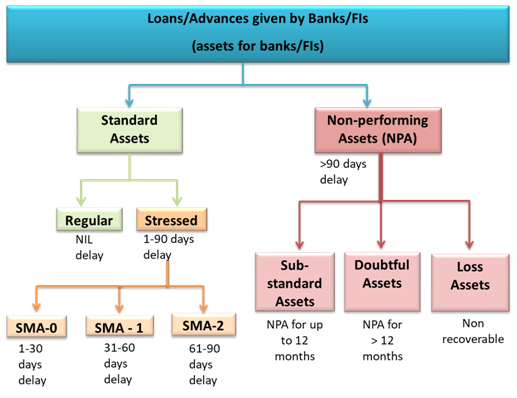

Types of NPAs

- Standard Assets: It is a kind of performing asset which creates continuous income and repayments as and when they become due. These assets carry a normal risk and are not NPA in the real sense of the word. Hence, no special provisions are required for standard assets.

- Sub-Standard Assets: Loans and advances which are non-performing assets for a period of 12 months, fall under the category of Sub-Standard Assets.

- Doubtful Assets: The Assets considered as non-performing for a period of more than 12 months are known as Doubtful Assets.

- Loss Assets: All those assets which cannot be recovered by the lending institutions are known as Loss Assets.

Impact of NPAs

- The crisis of NPAs in the Indian banking system is one of the foremost and the most formidable problems that had impacted the entire banking system.

Profitability

- NPAs impact profitability, banks stop to earn income on one hand and attract higher provisioning (set aside an amount in an organization's account) compared to standard assets on the other hand.

Capital Adequacy

- According to the Basel norms, banks are required to maintain adequate capital on risk-weighted assets. − Every increase in the NPAs level adds to risk-weighted assets which require banks to increase their capital.

Liability Management

- In the light of high non-performing assets, banks tend to lower the interest rates on deposits on one hand and likely to levy higher interest rates on advances. This may hamper economic growth.

Public confidence

- The credibility of the banking system is also affected greatly due to higher level NPAs because it has impacted the confidence of the general public of the society with respect to soundness of the banking system.

The banks then try to recover their loss by restructuring the loan or liquidating the assets or selling the loans to asset reconstruction companies at steep discounts.

Tackling NPAs

Asset reconstruction company (ARC)

- Asset reconstruction companies (ARCs) are specialised financial institutions that buy NPAs from banks and financial institutions and aid them in cleaning up their balance sheets.

- This saves the time and effort of banks in going after defaulters and thus allows them to focus on normal banking activities.

- They function under the regulatory oversight of the Reserve Bank of India.

The ARCs undertake various resolution strategies like:

- taking over/changing the management of the business of the borrower;

- the sale/lease of the business of the borrower;

- entering into settlements;

- restructuring or rescheduling of debt; and

- enforcement of security interest.

Bad bank

- A bad bank is a corporate structure that isolates illiquid and high-risk assets or non-performing loans held by a bank or a financial organisation. It is also referred to as Asset Management Company (AMC).

- The concept of a bad bank originated at the Pittsburgh headquartered Mellon Bank in 1988. The idea and discussions over bad bank have been in place since 2015 when former RBI Governor Raghuram Rajan started a debate on bad bank as a possible solution to the problem of NPAs.

- Afterwards, former Interim Finance Minister Piyush Goyal put forth the idea of National ARC on a recommendation of the Committee headed by Sunil Mehta. The Economic Survey 2017 also propounded to create a Public Sector Asset Rehabilitation Agency (PARA).

|

National Asset Reconstruction Company Ltd

National Asset Reconstruction Company Ltd.(NARCL), India’s first-ever Bad Bank, was set up in 2021, and RBI has recently granted the same under the SARFAESI Act 2002.

If the bad bank is unable to sell the bad loan or has to sell it at a loss, then the government guarantee will be invoked.

To manage assets with the help of market professionals and turnaround experts, the Government will also set up India Debt Resolution Company Ltd. (IDRCL) along with NARCL. The IDRCL is a service company or an operational entity wherein public sector banks (PSBs) and PFIs will hold a maximum of 49% stake and the rest will be with private-sector lenders. When the assets are sold, with the help of IDRCL, the commercial banks will be paid back the rest.

|

- Bad Bank is aimed at easing the burden of banks holding a pile of stressed assets and allowing them to lend more actively. It generally does not have a primary purpose of generating profits. It will mainly focus on resolving and restructuring accounts.

- It works by demarcating assets into good assets (that are repaid within time) and toxic or bad assets (defaulted loans).

- Such toxic assets are meant to be transferred from the books of banks to bad bank at a price below their book value, for the sole purpose of recovery of risky assets.

Roadblocks in existing mechanisms

- There are many other options of getting rid of bad debts to clean up books, like insolvency resolution under the Insolvency and Bankruptcy Code, 20169 (IBC, 2016) and ARCs in the SARFAESI Act, 2002.

- However, unlike its initial success in terms of recovering debts over 50%, lately, haircuts have increased and lenders are able to recover hardly 5-6% of debts.

- Besides, the disproportionate number of National Company Law Tribunal (NCLT) Judges when compared to instituted cases, causes resolutions to take more time than specified under IBC, 2016.

- Concerning ARCs under the SARFAESI Act, asset reconstruction has slowed down due to capital issues and downgraded ratings for security receipts. Consequently, ARCs are also reluctant to take up NPAs.

Concerns hovering over bad bank

- The bad bank should not go on in perpetuity and so a definite time period of its existence should be decided upon. The intent should clearly be a faster resolution.

- A major criticism is that public sector banks (PSBs) are themselves holding substantial stakes in the NARCL which implies that PSBs are paying to buy their own bad loans. This mingling of roles, as PSBs are both investors and customers of NARCL, can blur the objective of this institution and impact decision-making.

- A major challenge is the development of a clear resolution strategy. The bad bank is not a panacea in itself and so it remains to be seen whether the bad bank has the requisite resources and operational framework to accomplish its purpose.

- NARCL will be purchasing assets at net book value (NBV) whereas ARCs purchase NPAs on an arm’s length basis at market-determined prices. This variance in RBI regulations might lead to ambiguity and regulatory uncertainty with reference to the validity of such transfers.

Concluding remarks

- There must be a sunset clause to the resolution process through Bad Banks. It is quintessential to develop time-bound strategies for the resolution of assets, or else the bad bank will be reduced to a mere parking space of bad loans.

- Bad Banks should have a suitable mechanism in place that can facilitate funding for maintaining the quality of assets till their resolution.

- Banks have to accept losses on loans (or ‘haircuts’). They should be able to do so without any fear of harassment by the investigative agencies.

- The Indian Banks’ Association has set up a six-member panel to oversee resolution plans of lead lenders. To expedite resolution, more such panels are required.

- An alternative is to set up a Loan Resolution Authority, if necessary through an Act of Parliament. Also, the government must infuse at one go whatever additional capital is needed to recapitalise banks — providing such capital in multiple instalments is not helpful.

- The pandemic has hit the economy hard and has exposed the vulnerabilities of our banking system.

- Concerns and loopholes raised over bad bank (NARCL) make it imperative to clearly lay down a mechanism to set its accountability and to ensure its independence. It must be ensured that bureaucratic delays do not occur in NARCL, unlike other similar entities. Global experiences portray that it must be made flexible as per the needs of the country.

|

Financial Stability Report (FSR)

Reserve Bank of India’s (RBI) atest Financial Stability Report (FSR) details the state of financial stability in the country, and it is prepared after taking into account the contributions from all financial sector regulators. FSR is published twice each year.

|

Read: https://www.iasgyan.in/blogs/decoding-a-bad-bank

https://www.thehindu.com/business/Economy/banks-npa-ratio-likely-to-fall-to-5-555-by-march-2024-sp-global/article65667250.ece