Disclaimer: Copyright infringement not intended.

Context:

- India Inc.'s direct overseas investment declined 67% to $753.61 million in February this year - the Reserve Bank.

Overseas Direct Investment (ODI):

- Overseas Direct Investment in Joint Venture (JV) or Wholly Owned Subsidiary (WOS) is a way of promoting business globally by Indian entrepreneurs.

- In simplified words, Overseas Direct Investment is an investment made by Indians outside India.

- Investment can be made either by way of subscription to the Memorandum of Association (MOA) of a foreign entity or through the purchase of existing shares of a foreign business/entity. [but it does not include portfolio investment.]

- Overseas Direct Investment is made with the view to diversify the business outside the country.

- It enables businesses to take the opportunity given by the overseas market by utilising the full capacity.

- It is a medium of connecting two countries through business co-operation.

Permissible Investment:

- As per the Liberalised Remittance Scheme (LRS), an Indian resident can remit up to the limit prescribed by the Reserve Bank of India (RBI) for - capital and current account transactions, purchase of securities and setting up of acquisition of Joint Ventures or wholly-owned subsidiary.

Benefits of Overseas Direct Investment (ODI):

- Indian Companies get better access to technological know-how.

- Global Expansion of Business.

- Extensive Market Access.

- Global Customer Base.

Overseas Direct Investment (ODI) Framework in India:

- ODI is governed by the following in India:

- Section 6(3)(a) of Foreign Exchange Management Act (FEMA) 1999 read with FEM (Permissible Capital Account Transactions) Regulations, 2000

- FEM (Transfer or Issue of any Foreign Security) Regulations, 2000

- Circulars issued by RBI

- Guidelines released by RBI on Overseas Direct Investment

- Liberalized Remittance Scheme & FAQ (Applicable for resident Individuals)

Modes of Overseas Direct Investment:

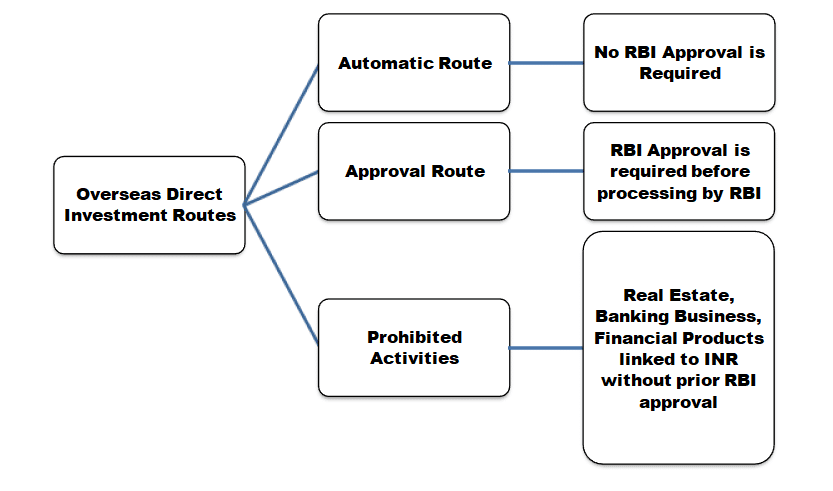

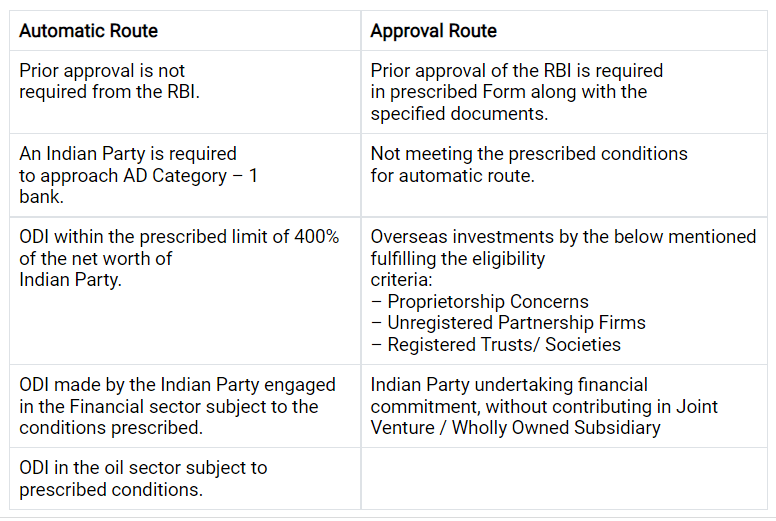

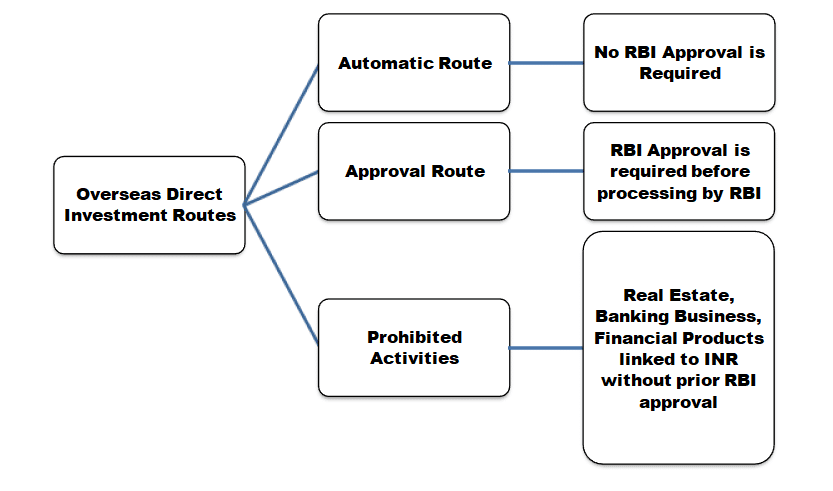

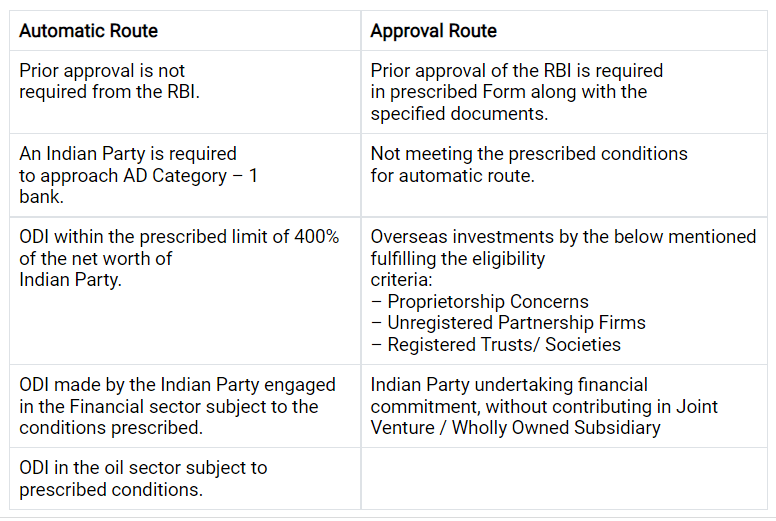

- Direct investment outside India can be investments, either under the Automatic Route or the Approval Route.

Eligibility for Overseas Direct Investment (ODI):

An Indian Party is eligible to make Overseas Direct Investment (ODI) into a Joint Venture or Wholly Owned Subsidiary.

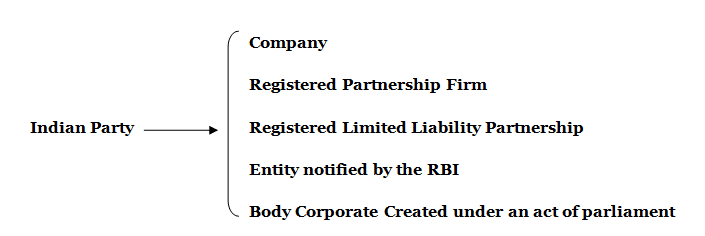

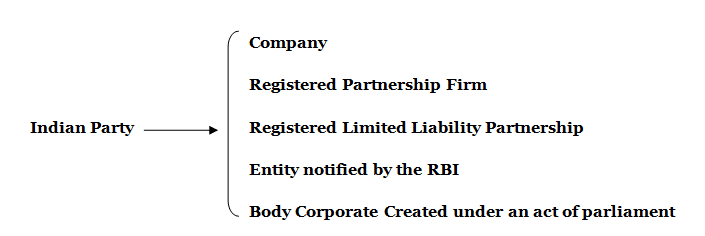

Indian Party

An Indian Party covers the following:

Joint Venture

- A foreign entity created by the Indian party where foreign promoters are holding stake with Indian Party is termed as Joint Venture.

Wholly Owned Subsidiary

- In wholly owned subsidiary company, entire capital is owned by the Indian Party.

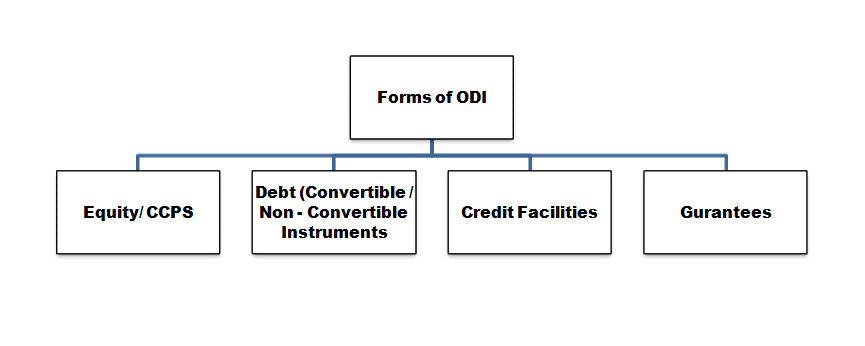

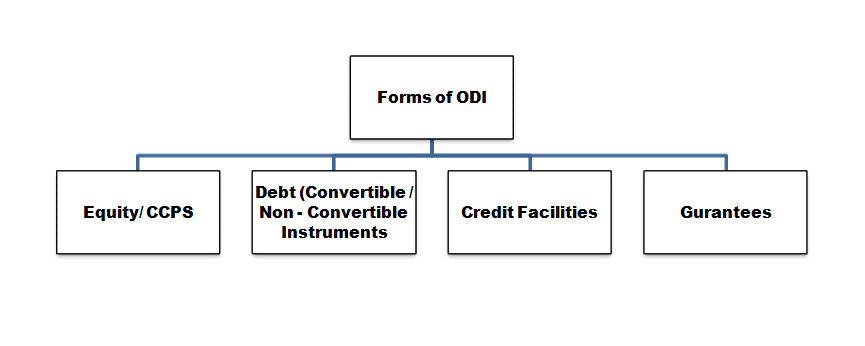

Components of Overseas Direct Investment (ODI):

Overseas Direct Investments by Resident Individuals:

- A resident individual (with single or in association with another resident or with an Indian entity) may make ODI in the equity shares and JV or WOS outside India under the Liberalised Remittance Scheme.

- As per this scheme, all the resident individuals, including the minors, are permitted to freely remit up to USD 125000 per financial year.

- As per the RBI, the resident individuals in India are permitted to form a company outside India under the LRS within limits prescribed there under. However, the reporting mechanisms and also make it applicable to the resident individuals.

Overseas Direct Investment (ODI) in the Financial Sector:

- Trading in overseas commodities exchanges and trading in overseas exchanges setting up joint ventures / wholly-owned subsidiary will be considered as financial activity.

Pre – Conditions

- Proper registration with the regulatory authority in India.

- Net profits earned from the financial services during the preceding three financial years.

- For making such investment, concerned regulator’s approval in India and abroad.

- Compliance with the capital adequacy norms prescribed by the regulatory authority in India.

Prohibited Activities under Overseas Direct Investment:

- An Indian Individual / Party cannot make Overseas Direct Investments in Real estate, Banking Business.

- The ODI cannot be made for dealing in Financial products linked to INR without specific approval of RBI.

- Note: Buying and selling real estate and dealing in TDR (does not include township, residential and commercial premises, roads and bridges).

|

Foreign direct investment (FDI) occurs when a company purchases an interest in a company by a company located outside its own borders. ODI occurs when a resident company invests in a wholly-owned subsidiary (or joint venture) in a non-resident country, in order to expand the business.

|

Read: https://www.iasgyan.in/rstv/limited-liability-partnership-amendment-bill-2021

https://www.thehindu.com/business/india-incs-direct-overseas-investment-plunges-67-to-754-mn-in-feb/article65212133.ece