Disclaimer: Copyright infringement not intended.

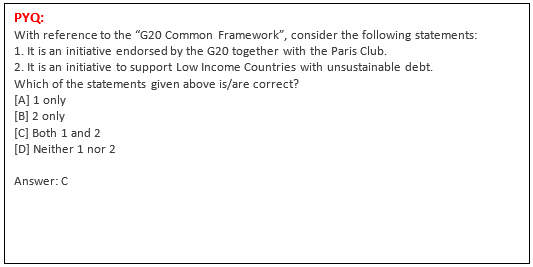

Context: An assurance from the Paris Club, as well as other bilateral creditors, is one of the conditions that Sri Lanka has to fulfil for the IMF to begin disbursing a $2.9 bn bailout package to the beleaguered nation that all but collapsed last year under a severe economic crisis.

Details:

WHAT IS THE PARIS CLUB?

- The Paris Club is a group of mostly western creditor countries that grew from a 1956 meeting in which Argentina agreed to meet its public creditors in Paris.

- Their objective is to find sustainable debt-relief solutions for countries that are unable to repay their bilateral loans.

- It describes itself as a forum where official creditors meet to solve payment difficulties faced by debtor countries.

- All 22 are members of the group called Organisation for Economic Co-operation and Development (OECD).

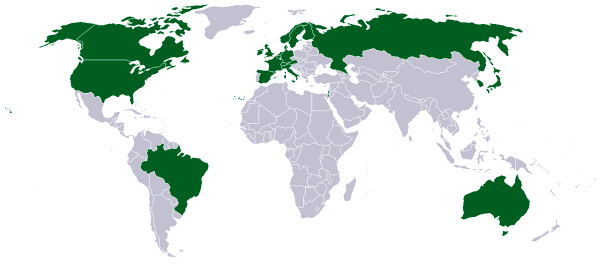

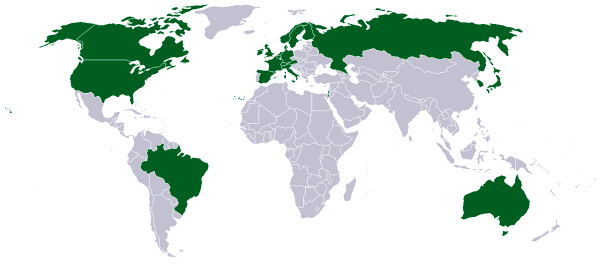

MEMBERS:

Australia, Australia, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Japan, Netherlands, Norway, Russia, South Korea, Spain, Sweden, Switzerland, the United Kingdom and the United States.

HOW HAS PARIS CLUB BEEN INVOLVED IN DEBT AGREEMENTS?

- Paris Club has reached 478 agreements with 102 different debtor countries.

- Since 1956, the debt treated in the framework of Paris Club agreements amounts to $ 614 billion.

.jpeg)

Principles:

- It operates on the principles of consensus and solidarity. Any agreement reached with the debtor country will apply equally to all its Paris Club creditors.

- A debtor country that signs an agreement with its Paris Club creditors, should not then accept from its non-Paris Club commercial and bilateral creditors such terms of treatment of its debt that are less favourable to the debtor than those agreed with the Paris Club.

THE ROLE OF THE PARIS CLUB:

- The Paris group countries dominated bilateral lending in the last century, but their importance has receded over the last two decades or so with the emergence of China as the world’s biggest bilateral lender.

- In Sri Lanka’s case, for instance, China, Japan and India are the largest bilateral creditors.

- Sri Lanka’s debt to China is 52 per cent of its bilateral debt, 19.5 per cent to Japan, and 12 per cent to India. With Japan a member of the Paris Club, Sri Lanka needed assurances from China and India as well.

- The Paris Club had tried to get both countries on board a centralised effort, but Delhilaunched its own bilateral negotiations with Colombo.

- Last month, during a visit to Colombo, External Affairs Minister S Jaishankar announced that India had written to the IMF providing the necessary financial assurances, adding that it hoped others would follow suit.

- The reported readiness by the Paris Club comes against this background. That still leaves China, whose Exim Bank offered a two-year moratorium on its loans soon after the Indian announcement. This has been deemed to be insufficient.

https://indianexpress.com/article/explained/everyday-explainers/imf-sri-lanka-debt-paris-club-meaning-8421521/