Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Objectives

The objective of the support is

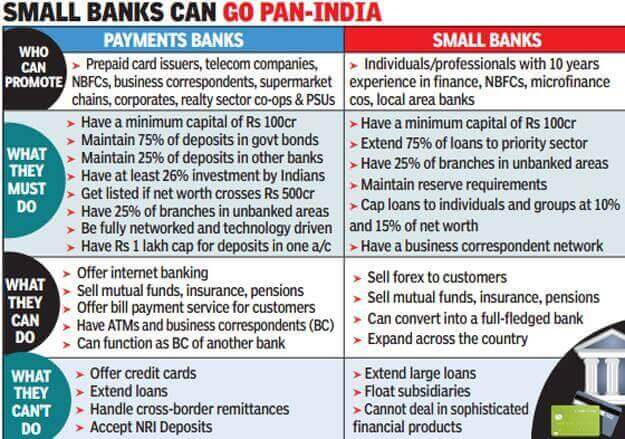

What are Payment Banks?

Features of Payment Banks

Activities that can be performed by Payment Banks

Activities that cannot be undertaken by Payment Banks

Advantages of Payment Banks

Challenges faced

IPPB

Services offered by the Bank

According to the data released in January 2022, the India Post Payment Bank had crossed the landmark of 5 crore customers.

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1820526

© 2024 iasgyan. All right reserved