Copyright infringement not intended

Context: The Reserve Bank of India is constantly monitoring systems that enable direct, or peer-to-peer (P2P), lending between individuals. RBI has sent comprehensive questions to registered peer-to-peer lending startups.

Details

- While P2P businesses must submit business updates with the regulator regularly as regulated non-banking finance entities, the RBI has now asked them about partnership models with consumer-facing applications, the flow of funds, risk sharing among partners, and other topics.

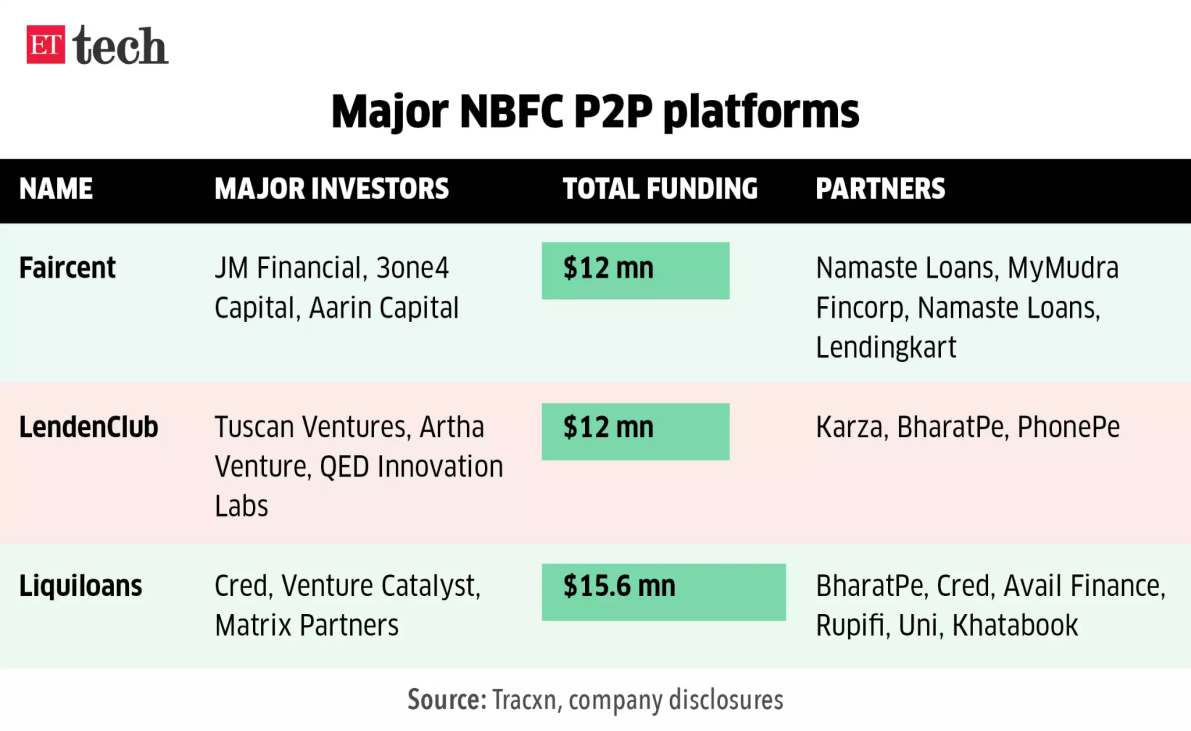

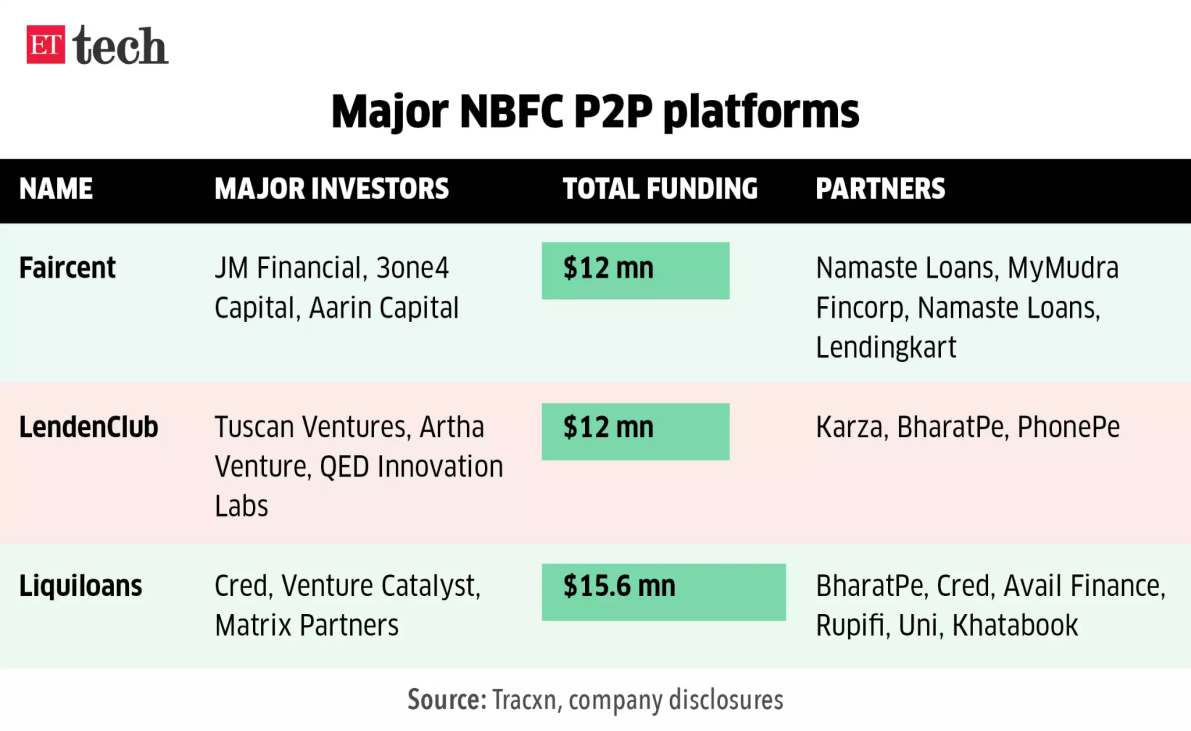

- Consumer-focused applications such as BharatPe, Jupiter, and Cred collaborate extensively with NBFC P2P platforms. P2P firms like Liquiloans and LenDenClub have formed alliances with these and other consumer-focused platforms.

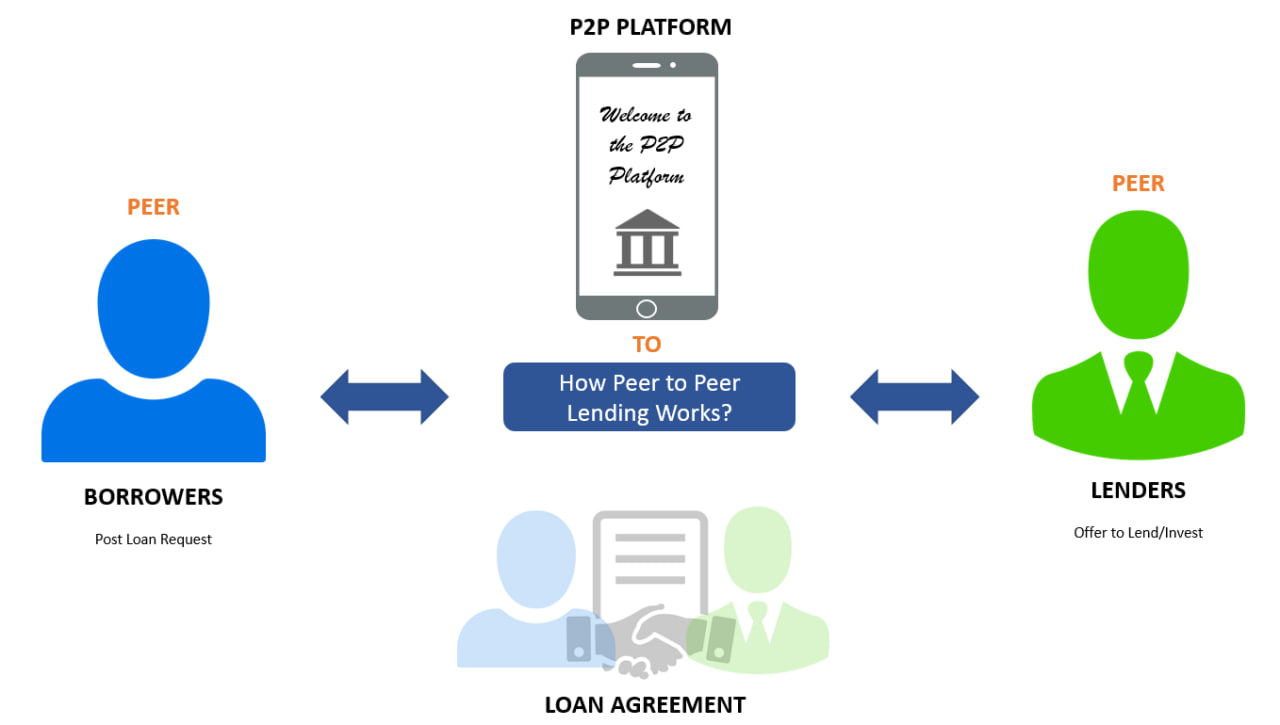

P2P lending

- P2P lending is a form of debt financing that allows individuals to borrow and lend money directly from each other, without the involvement of any financial institution.

- P2P lending has emerged as a popular alternative to traditional banking in India, especially for the underbanked and unbanked segments of the population, who often face difficulties in accessing formal credit.

- P2P lending platforms use technology to assess the creditworthiness of borrowers, match them with suitable lenders, and facilitate loan transactions. P2P lending offers benefits such as lower interest rates for borrowers, higher returns for lenders, faster processing, and wider access to credit.

Intermediaries between borrowers and lenders

- P2P lending platforms act as intermediaries between borrowers and lenders, facilitating the matching process, conducting due diligence, verifying documents, disbursing loans, collecting repayments and managing defaults.

Partnered with various consumer-facing applications

- P2P lending platforms have partnered with various consumer-facing applications to expand their reach and offer innovative products and services. For instance;

- BharatPe, a digital payments platform for merchants, has partnered with Liquiloans, a P2P lending platform, to offer instant credit to its users based on their transaction history.

- Jupiter, a neobank for millennials, has partnered with LenDenClub, another P2P lending platform, to provide overdraft facilities to its customers.

- Cred, a credit card payment and rewards app has also tied up with multiple P2P lending platforms to enable its members to lend money to other creditworthy individuals and earn interest.

However, P2P lending also poses several benefits and drawbacks for both borrowers and lenders

- For borrowers, the benefits include lower interest rates, faster loan approval and disbursal, flexible repayment options, and wider eligibility criteria. The drawbacks include higher default risk, limited legal protection, lack of credit history verification, and potential misuse of personal data.

- For lenders, the benefits include higher returns, diversification of portfolio, lower transaction costs, and greater control over lending decisions. The drawbacks include higher credit risk, lack of liquidity, regulatory uncertainty, and operational challenges.

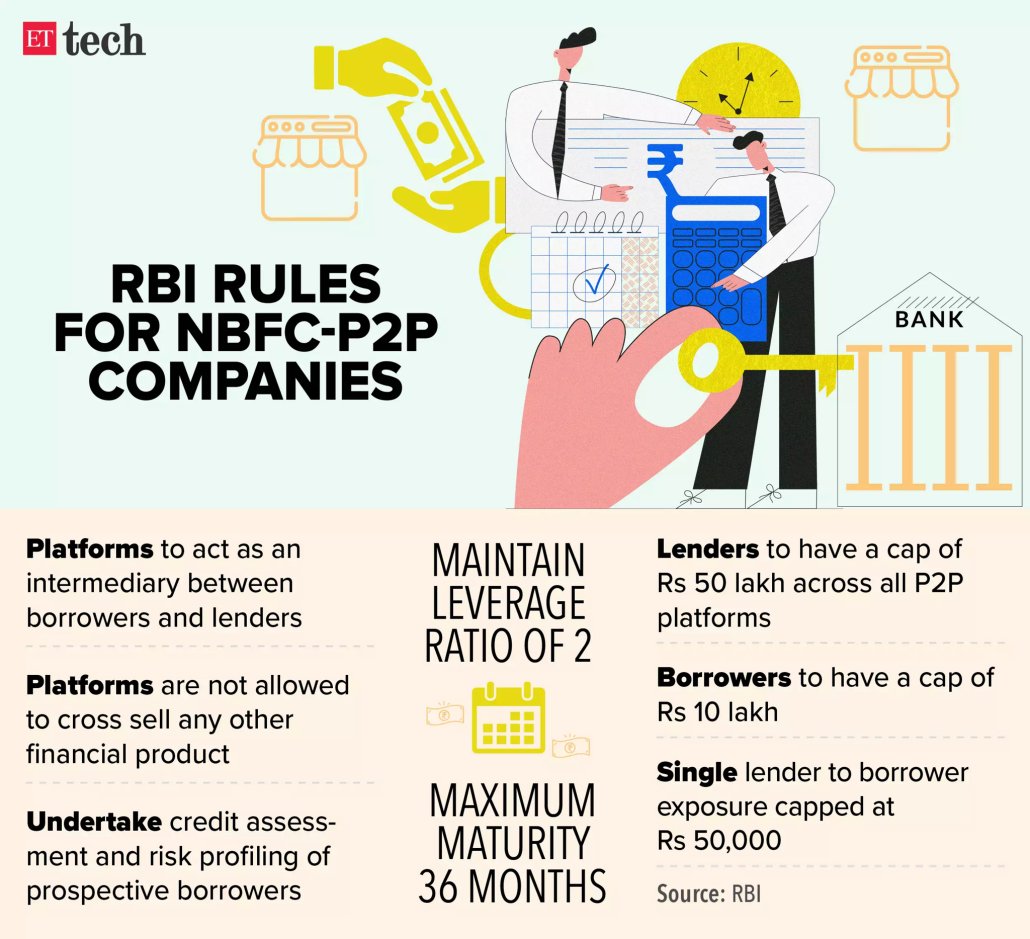

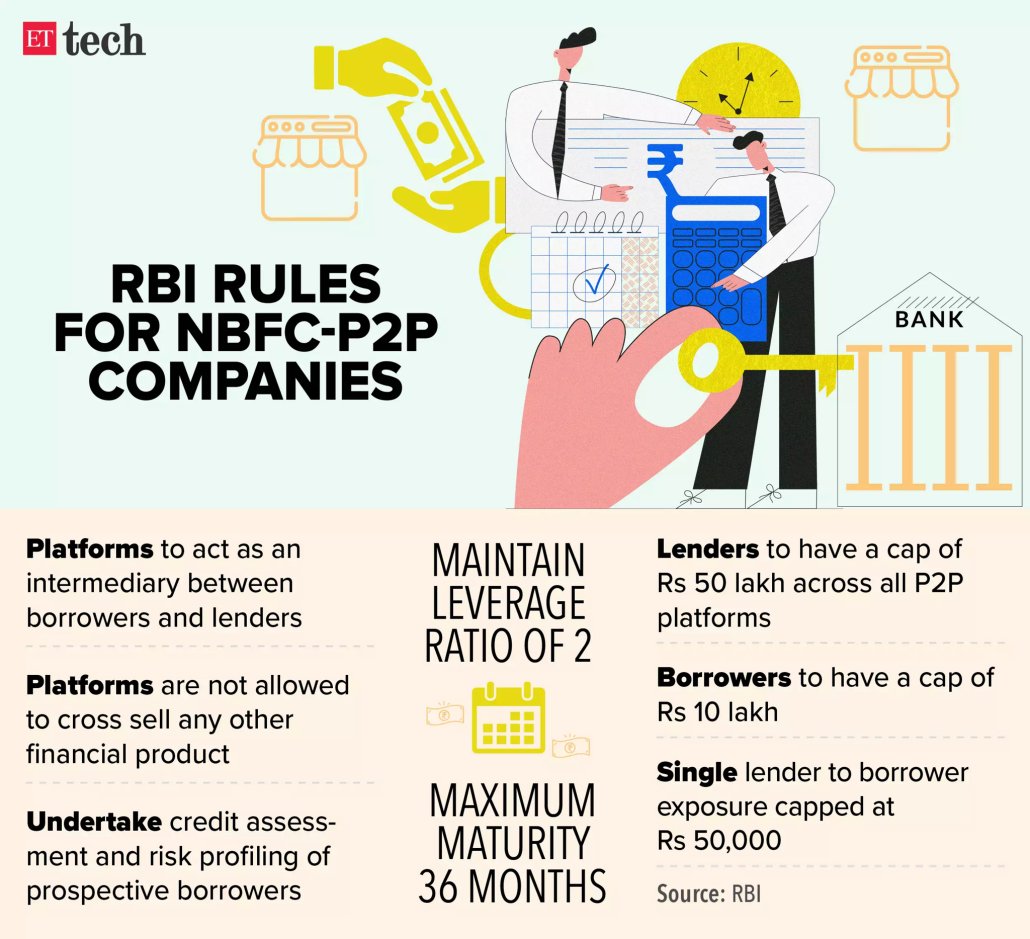

The RBI directions lay down the eligibility criteria, registration process, prudential norms, operational guidelines, and disclosure requirements for P2P lending platforms in India. Some of the key features of the RBI directions are:

- P2P lending platforms are required to obtain a certificate of registration from the RBI and operate as non-banking financial companies (NBFCs).

- P2P lending platforms should have a minimum net owned fund (NOF) of Rs 20 million or such higher amount as may be specified by the RBI.

- P2P lending platforms should act as intermediaries that provide loan facilitation services to borrowers and lenders. They should not raise deposits or lend on their balance sheet.

- P2P lending platforms should ensure that the aggregate exposure of a lender to all borrowers across all P2P platforms does not exceed Rs 10 lakh at any point of time.

- P2P lending platforms should ensure that the exposure of a single lender to a single borrower does not exceed Rs 50,000.

- P2P lending platforms should carry out due diligence on the participants, assess the creditworthiness of the borrowers, disclose all relevant information to the participants, and share credit information with credit information companies (CICs).

- P2P lending platforms should adopt a fair and transparent pricing mechanism for determining the interest rates on loans. They should also have a grievance redressal mechanism for resolving complaints from participants.

- P2P lending platforms should maintain an escrow account with a scheduled commercial bank for transferring funds between borrowers and lenders. The escrow account should be operated by a trustee appointed by the bank.

- An escrow account is a type of account where a third party holds money or assets on behalf of two other parties who are involved in a transaction. The escrow account ensures that both parties meet their obligations before the money or assets are released.

- P2P lending platforms should comply with the provisions of the Prevention of Money Laundering Act, 2002 and other applicable laws and regulations.

The RBI directions aim to provide a regulatory framework for P2P lending platforms that balances the interests of all stakeholders and fosters innovation and competition in the sector. The directions also seek to protect the interests of consumers and promote financial inclusion by facilitating access to credit for underserved segments of society.

Challenges and risks associated with P2P Lending in India

Lack of awareness and trust

- Many borrowers and lenders are still unaware of or sceptical about P2P lending as a viable option for their financial needs. They may have concerns about the security, transparency, and reliability of P2P platforms and their processes.

Regulatory Uncertainty and Compliance Burden

- Although RBI has issued guidelines for P2P lending in India, there are still some areas that need more clarity and consistency. For instance, there is no clear definition of what constitutes a P2P loan, how it should be taxed, how it should be reported, and how it should be treated under various laws such as insolvency, consumer protection, money laundering, etc. Additionally, there may be a high compliance burden for P2P platforms to meet the regulatory requirements and standards.

Credit risk

- This is the risk of default or delayed repayment by the borrower, which can result in loss of principal and interest for the lender. P2P lending platforms use various methods to assess the creditworthiness of borrowers, such as credit scores, income verification, social media data, etc. However, these methods may not be foolproof or accurate, and there may be cases of fraud or misrepresentation by borrowers.

Liquidity risk

- This is the risk of not being able to withdraw or exit from an investment when needed. Unlike traditional financial instruments such as bank deposits or mutual funds, P2P loans are not liquid and cannot be easily sold or transferred to another party. Lenders have to wait until the maturity of the loan or rely on secondary markets (if available) to exit from their investments. This may pose a problem if lenders need cash urgently or want to diversify their portfolios.

Operational risk

- This is the risk of disruptions or failures in the systems or processes of P2P lending platforms that may affect their functioning or performance. For example, there may be issues such as cyberattacks, data breaches, technical glitches, human errors, etc. that may compromise the security, privacy or reliability of P2P lending platforms. These issues may result in loss of data, reputation or trust for P2P lending platforms and their users.

Market risk

- This is the risk of changes in macroeconomic factors or market conditions that may affect the demand and supply of P2P loans. For example, there may be factors such as inflation, interest rates, unemployment, business cycles, etc. that may influence the borrowing and lending behaviour of individuals. These factors may affect the availability, affordability and quality of P2P loans.

The way forward for P2P lending in India is to address these challenges and leverage the opportunities that lie ahead. Some of the possible steps that can be taken are:

Enhancing awareness and trust

- P2P platforms should focus on educating and informing their potential and existing customers about the benefits and risks of P2P lending. They should also ensure that they follow ethical and transparent practices, maintain high standards of customer service and satisfaction, and comply with all applicable laws and regulations.

Improving credit assessment and risk management

- P2P platforms should invest in improving their credit assessment models and algorithms, using data analytics, artificial intelligence, machine learning, etc. They should also adopt effective risk management strategies such as diversification, portfolio optimization, insurance, etc.

Collaborating with stakeholders

- P2P platforms should collaborate with various stakeholders such as RBI, government agencies, industry associations, banks, fintech companies, etc., to create a conducive ecosystem for P2P lending in India. They should also seek feedback and suggestions from their customers and partners to improve their products and services.

Regulatory clarity

- The RBI should provide clear and consistent guidelines for P2P lending platforms that cover all aspects of their operations, such as licensing, capital adequacy, governance, disclosure, reporting, taxation, etc. The RBI should also establish a robust supervisory mechanism to monitor and enforce compliance by P2P platforms.

Technological advancement

- P2P lending platforms should invest in enhancing their technology and data capabilities to improve their credit assessment, risk management, and transaction processing functions. They should also adopt best practices for cybersecurity and data protection to safeguard their systems and users from potential threats.

Market awareness

- P2P lending platforms should educate their users about the benefits and risks of P2P lending, as well as their rights and responsibilities as borrowers and lenders. They should also promote transparency and trust among their users by providing accurate and timely information about their products, services, fees, terms and conditions, etc.

Conclusion

- P2P lending in India is an emerging and promising sector that can transform the consumer lending industry. It can provide access to affordable and convenient credit to millions of underserved borrowers and offer attractive returns to lenders. However, it also faces some challenges and risks that need to be addressed with prudence and innovation. By adopting best practices and leveraging technology, P2P platforms can overcome these challenges and achieve sustainable growth in the future.

|

PRACTICE QUESTION

Q. How has peer-to-peer (P2P) lending evolved in India and what are its benefits and drawbacks for borrowers and lenders? What are the current regulatory frameworks and challenges for this emerging sector and what are the possible solutions to address them?

|

https://economictimes.indiatimes.com/tech/technology/after-online-payments-digital-loans-now-p2p-lending-under-rbi-lens/articleshow/100775366.cms