Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

About:

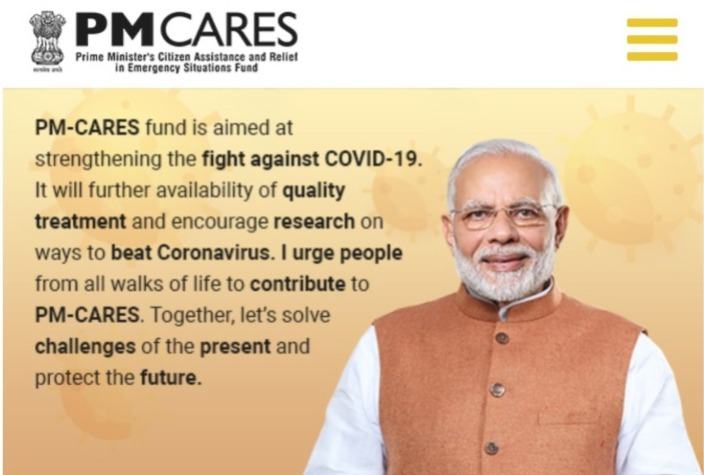

PM-CARES Fund:

Eligibility criteria under PM CARE:

Status of PM-CARE Fund:

Controversy related to PM-CARE Fund:

© 2024 iasgyan. All right reserved