Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

About RBI

Legal Framework of RBI

The Reserve Bank of India comes under the following laws:

Main Functions

Monetary Authority

Regulator and supervisor of the financial system

Manager of Foreign Exchange

Issuer of currency

Developmental role

Regulator and Supervisor of Payment and Settlement Systems

Related Functions

Offices

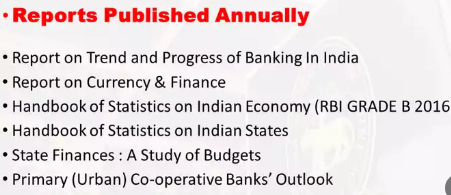

Reports published by RBI

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GU79S12IC.1&imageview=0

© 2024 iasgyan. All right reserved