Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Details

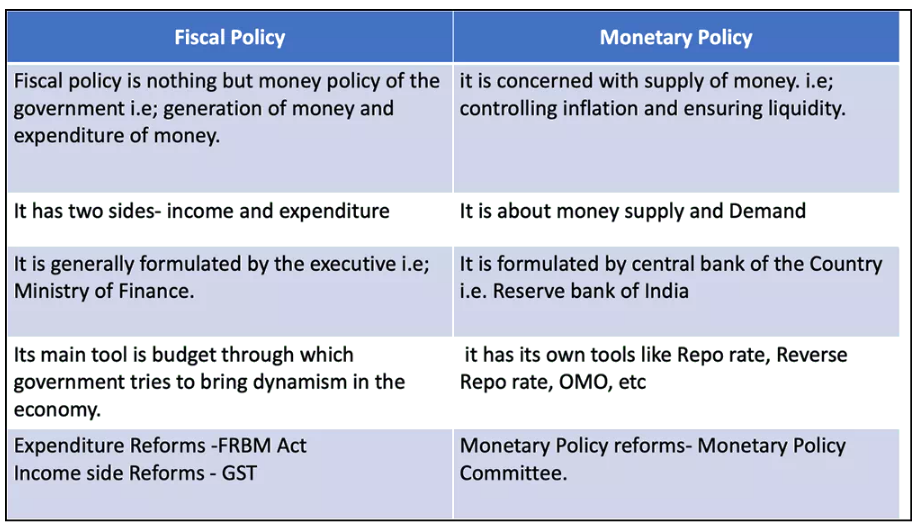

Monetary Policy:

Expansionary and Contractionary Policies:

Expansionary Policy:

Contractionary Policy:

Objectives:

Inflation Management:

Unemployment Control:

Currency Exchange Rates:

Monetary Policy Tools:

Quantitative Tools:

Reserve Ratio:

Open Market Operations (OMO):

Market Stabilization Scheme (MSS):

Policy Rates:

Monetary Policy Committee (MPC):

Inflation Targets:

Time Frame:

Trivia

|

PRACTICE QUESTION Q. Which committee proposed the establishment of the Monetary Policy Committee (MPC) in India, aimed at formulating and implementing monetary policies? a) Rajan Committee b) Raghuram Rajan Committee c) Urjit Patel Committee d) Y. V. Reddy Committee Correct answer: c) Urjit Patel Committee |

© 2024 iasgyan. All right reserved