Copyright infringement not intended

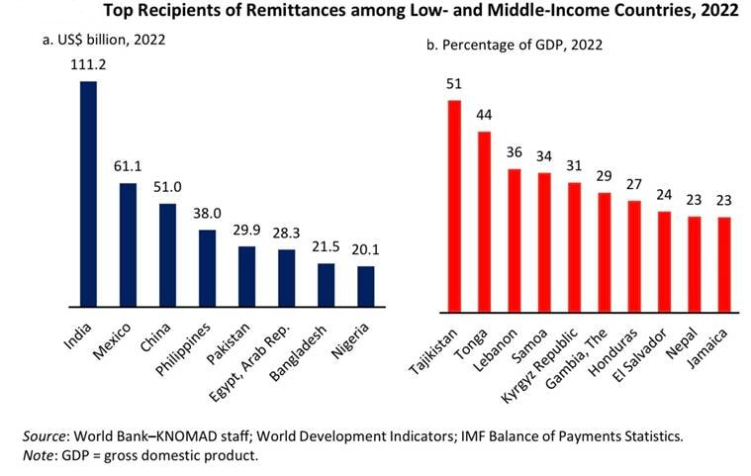

Context: According to a recent report by the World Bank, India's remittance inflows are expected to grow by a meagre 0.2% in 2023, a sharp contrast to the robust 24% growth recorded in 2022, when India received a record-high $111 billion from its diaspora.

Details

- According to the World Bank's latest Migration and Development Brief, remittance inflows growth could slow to just 0.2% in 2023, reaching $656 billion for low- and middle-income countries (LMICs). This marks a sharp contrast from 2022, when remittances to LMICs grew by 8%, reaching $647 billion.

What are the reasons behind this slowdown?

- The World Bank cites two main factors: slower growth in OECD and GCC economies, and high base effect.

Slower growth in OECD and GCC economies

- OECD stands for Organisation for Economic Co-operation and Development, an intergovernmental organisation with 38 member countries that are mostly developed and high-income.

- OECD countries are major destinations for migrants from developing countries, especially for skilled workers in the IT sector. The United States, for example, is the largest source of remittances for India, which received $111 billion in 2022.

- The World Bank expects slower growth in OECD economies in 2023, especially in the high-tech sector, which could affect the demand and income of IT workers. This could lead to a diversion of formal remittances toward informal money transfer channels, which are harder to track and measure.

Slower growth in GCC economies

- GCC stands for Gulf Cooperation Council, a regional bloc of six Arab countries that are rich in oil and gas resources. GCC countries are major destinations for migrants from developing countries, especially for low-skilled workers in the construction and service sectors.

- The World Bank expects lower demand for migrants in GCC countries in 2023, as declining oil prices have dented their economic growth and fiscal revenues. This could result in lower wages and employment opportunities for migrant workers, as well as tighter immigration policies and regulations.

High base effect

- Another reason for the slowdown in remittance inflows growth is the high base effect. This means that the growth rate in 2023 is calculated based on a higher level of remittances in 2022, which makes it harder to achieve a higher growth rate in 2023.

- In 2022, remittances were supported by several factors that boosted the incomes and transfers of migrant workers. These include strong oil prices in GCC countries, large money transfers from Russia to Central Asia due to currency appreciation, and strong labour market recovery in the United States and other advanced migrant destination economies.

Remittances were resilient during the Covid-19 pandemic, as migrant workers continued to send money back home despite the health and economic crisis. Remittances also benefited from government stimulus measures and cash transfers that supported household incomes and consumption. Therefore, remittances reached a record-high level in 2022, making it difficult to sustain or surpass that level in 2023.

Remittance inflows

About

- Remittance inflows are the money transfers that migrants send to their home countries from abroad. They are an important source of income for many developing countries, especially in regions like Africa, Asia and Latin America.

Remittance inflows have several features that make them distinct from other forms of financial flows

- They are more stable and resilient than other sources of external finance, as they tend to increase during economic downturns or crises in recipient countries.

- They are more directly linked to the welfare of households and communities, as they can be used for consumption, education, health, investment and social protection.

- They have positive spillover effects on the local economy, as they stimulate demand, production and employment.

Remittance inflows have significant implications for the development of the recipient countries

- They can reduce poverty and inequality, improve human capital and social outcomes, enhance financial inclusion and access to credit, foster entrepreneurship and innovation, and support macroeconomic stability and growth.

- They can contribute to the achievement of the Sustainable Development Goals (SDGs), especially those related to poverty reduction, education, health, gender equality and decent work.

Remittance inflows also face several challenges that limit their potential impact. Some of these challenges are:

- High transaction costs: The average cost of sending remittances is still around 7%, which is far above the SDG target of 3%. This reduces the amount of money that reaches the beneficiaries and discourages formal channels of transfer.

- Regulatory barriers: The lack of harmonized and transparent regulations across countries can create obstacles for remittance service providers and users, such as identification requirements, licensing procedures, exchange controls and anti-money laundering rules.

- Financial exclusion: Many remittance senders and receivers do not have access to formal financial services or products, such as bank accounts, savings instruments, insurance or credit. This limits their ability to use remittances for productive purposes or to cope with shocks.

- Data gaps: The availability and quality of data on remittance flows and markets are still limited and inconsistent across countries and regions. This hampers the analysis and monitoring of remittance trends and impacts.

To address these challenges and maximize the benefits of remittance inflows for development, there is a need for a comprehensive and coordinated approach that involves multiple stakeholders at different levels.

Some of the possible actions that can be taken are:

Reducing transaction costs

- This can be achieved by promoting competition and innovation in the remittance market, enhancing transparency and consumer protection, leveraging digital technologies and platforms, and facilitating cross-border cooperation and integration.

Improving regulatory frameworks

- This can be done by harmonizing and simplifying regulations across countries and regions, adopting risk-based approaches and proportional measures, strengthening supervision and enforcement mechanisms, and fostering dialogue and collaboration among regulators and service providers.

Expanding financial inclusion

- This can be facilitated by linking remittances with financial services and products that meet the needs and preferences of remittance users, such as mobile money, microfinance, diaspora bonds or crowdfunding platforms.

Improving data collection and analysis

- This can be supported by developing common definitions and methodologies for measuring remittance flows and markets, enhancing data quality and comparability across sources and countries, disseminating data in a timely and accessible manner, and conducting regular surveys and studies on remittance impacts.

Remittance inflows are a vital lifeline for millions of people around the world. By addressing the challenges they face and harnessing their potential for development, we can make a difference in achieving our shared goals of prosperity, peace and sustainability.

Remittance Inflows in India

- Remittances are an important source of income for many developing countries, especially in South Asia. India is the largest recipient of remittances in the world, accounting for about 12% of the global remittance flows.

Background

- India has a long history of migration and remittance inflows. According to the United Nations, about 18 million Indians were living abroad in 2020, making India the largest country of origin for international migrants. Most of these migrants are concentrated in the Gulf Cooperation Council (GCC) countries, the United States, the United Kingdom and Singapore.

- Almost 36% of India’s remittances are from the high-skilled and largely high-tech Indian migrants in three high-income destinations — the US, the United Kingdom, and Singapore.

Remittance inflows to India have some distinctive features that reflect the diversity and dynamism of its migration patterns and diaspora communities. Some of these features are:

- The regional distribution of remittance inflows is uneven, with Kerala, Uttar Pradesh, Bihar, Tamil Nadu and Punjab being the top five recipient states.

- The source countries of remittance inflows are also diverse, with GCC countries accounting for about 50%, followed by North America (23%), Europe (11%) and Asia-Pacific (10%).

- The size and frequency of remittance transactions vary according to the income level, occupation and duration of stay of migrants. For instance, low-skilled and short-term migrants tend to send smaller but more frequent remittances than high-skilled and long-term migrants.

- The mode and channel of remittance transfers also differ according to the availability, accessibility and affordability of formal and informal options. For instance, bank transfers are more popular among high-skilled migrants who have bank accounts in both host and home countries, while cash transfers are more common among low-skilled migrants who rely on money transfer operators or informal agents.

Remittance inflows have significant positive impacts on India's economy and society at various levels. Some of these impacts are:

- Remittance inflows contribute to India's balance of payments by increasing its current account receipts and foreign exchange reserves.

- It helps mitigate external shocks and stabilize exchange rate fluctuations.

- It augments the income and consumption of recipient households by providing a stable and non-debt source of finance.

- It enables households to invest in human capital (education and health), physical capital (housing and assets) and social capital (community development).

- It stimulates economic activity and employment generation by creating demand for goods and services in various sectors.

- It fosters financial inclusion and innovation by increasing the access and usage of formal financial products and services.

Despite its positive effects, remittance inflows also pose some challenges for India's economy and society that need to be addressed. Some of these challenges are:

- The high cost and low efficiency of remittance transfers, especially in formal channels, reduce the net value and benefit of remittances for both senders and receivers.

- The lack of transparency and regulation of remittance transfers, especially in the informal channels, expose migrants and their families to various risks such as fraud, theft, money laundering and terrorism financing. According to some estimates, informal remittances account for about 30 to 40% of the total remittance flows to India.

- The social and psychological costs of migration and remittance dependence, especially for left-behind families and communities, affect their well-being and cohesion. For instance, migration can cause family separation, marital conflict, child neglect, gender inequality and social isolation.

To maximize the potential and minimize the pitfalls of remittance inflows, India needs to adopt a holistic and proactive approach that involves various stakeholders and interventions. Some of these interventions are:

Enhancing the competitiveness and convenience of remittance transfers

- Enhancing the competitiveness and convenience of remittance transfers by reducing the cost, increasing the speed and improving the quality of formal channels. This can be done by promoting digitalization, competition, collaboration and innovation among remittance service providers.

Strengthening the governance and security

- Strengthening the governance and security of remittance transfers by increasing the transparency, accountability and regulation of formal and informal channels. This can be done by enforcing anti-money laundering and counter-terrorism financing norms, improving data collection and analysis, and raising awareness and education among remittance users.

Leveraging the development impact of remittance inflows

- Leveraging the development impact of remittance inflows by increasing the savings, investment and productive use of remittances by recipient households and communities. This can be done by providing financial literacy and counselling, offering financial products and incentives, and facilitating diaspora engagement and contribution.

Remittance inflows are a vital lifeline for India's economy and society. By addressing the challenges and harnessing the opportunities of remittance inflows, India can enhance its resilience and prosperity in a post-pandemic world.

Conclusion

- Remittances are an important source of external financing and social protection for many developing countries and households. However, remittance inflows growth could slow to just 0.2% in 2023 due to slower growth in OECD and GCC economies and a high base effect. This could pose challenges for countries that rely heavily on remittances to fund their current account and fiscal deficits. Therefore, it is essential to improve data collection and analysis on remittance flows and costs, as well as to leverage remittances to mobilize private sector capital through diaspora bonds and improved sovereign ratings.

Must Read Articles:

Remittance: https://www.iasgyan.in/daily-current-affairs/remittances-9

|

PRACTICE QUESTION

Q. Remittance inflows in India have been steadily increasing over the years, reaching $111.2 billion in 2022. Remittances are an important source of income for millions of households and contribute to the country's economic development. However, remittances also pose some challenges and risks for the Indian economy and society. How can India leverage the potential of remittances while addressing the associated issues?

|

https://indianexpress.com/article/explained/explained-economics/remittances-growth-2023-slow-8664191/