Disclaimer: Copyright infringement not intended.

Context

- The global share of steelmaking through electric arc furnaces had been around 25 per cent until 2012 for almost a decade, after which it started to increase further.

READ ABOUT INDIA’S STEEL SECTOR: https://www.iasgyan.in/daily-current-affairs/steel-sector-in-india

Growth of Electric Arc Furnace (EAF) Steelmaking

Historical Trends

- Stable Share Pre-2012:

- For almost a decade, the global share of steelmaking through electric arc furnaces (EAF) remained steady at around 25%.

- This stability reflected a period where traditional steelmaking methods, primarily through blast furnaces (BF) and basic oxygen furnaces (BOF), dominated the industry.

- Post-2012 Increase:

- 2017 Growth: EAF steelmaking saw a significant year-over-year growth of 7.5%, marking a shift towards increased adoption of this technology.

- 2018 Surge: The growth rate accelerated to 12.3%, bringing the EAF share of global steel production to 29%, equivalent to approximately 404 million tonnes out of 1.8 billion tonnes produced globally.

- These increases indicate a rising trend in the adoption of EAF technology, driven by factors such as environmental concerns, cost efficiency, and advancements in EAF technology.

Recent Developments

- 2021 Statistics:

- Production Share: By 2021, EAF-based steel production accounted for 30% of the global steel output, around 560 million tonnes.

- Resource Input: This production level required:

- 60 million tonnes of hot metal from blast furnaces (BF).

- 120 million tonnes of direct reduced iron (DRI).

- 450 million tonnes of steel scrap.

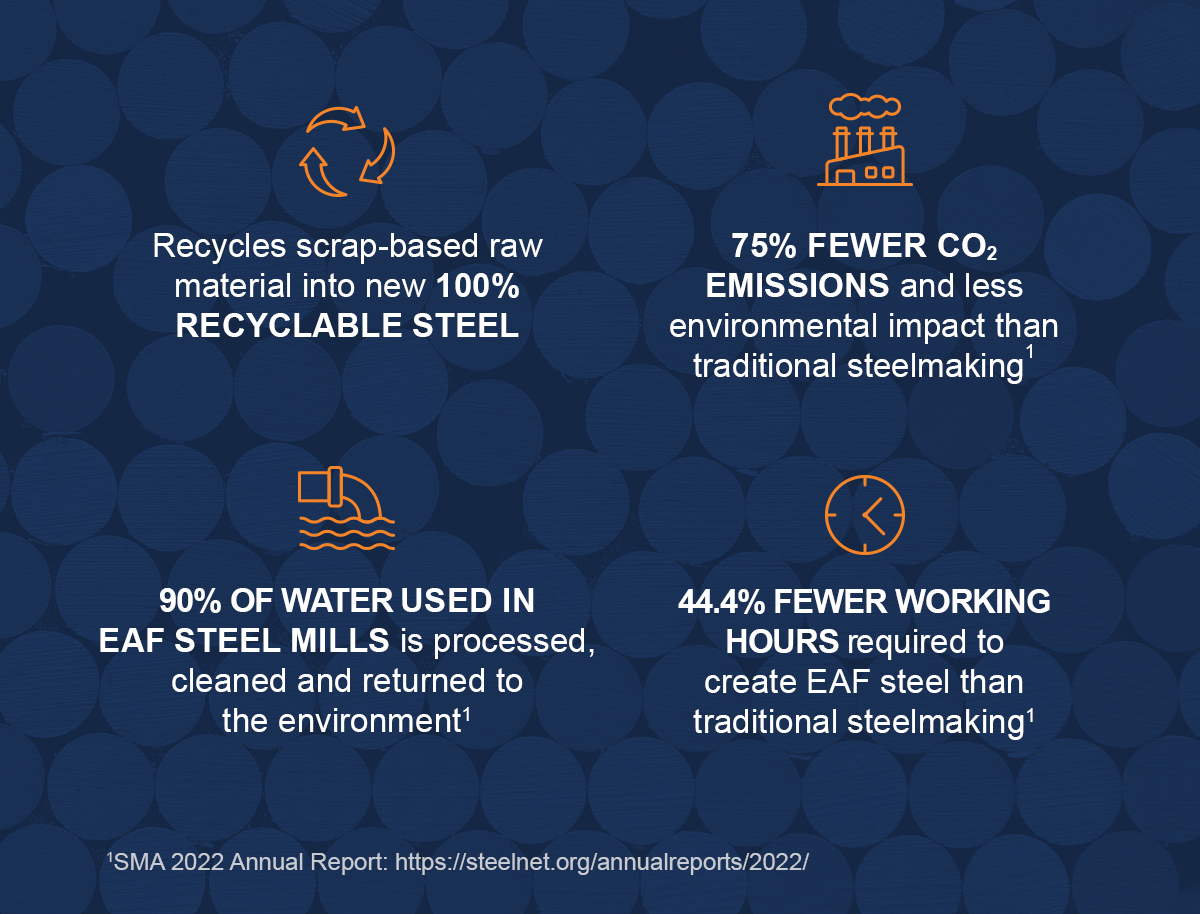

- The heavy reliance on scrap steel highlights EAF’s role in recycling and sustainability in the steel industry.

- Capacity Planning (March 2022):

- Capacity Proportions: According to a 2023 Global Energy Monitor report, planned EAF capacity matched the existing EAF share at 33%.

- This indicates an initial balance in the industry's expansion plans between traditional and electric arc furnace methods.

- Revised Capacity Planning (March 2023):

- Increased EAF Plans: The proportion of planned capacity for EAF steelmaking rose dramatically to 43%.

- Traditional Methods: Only 57% of the planned capacity is now through the coal-based BF-BOF route.

- This shift suggests a growing preference for EAF technology, possibly due to its environmental benefits and efficiency.

Future Projections

IEA Net Zero by 2050 Scenario:

- Required EAF Adoption: To meet net-zero carbon emissions by 2050, the International Energy Agency (IEA) states that 53% of steelmaking capacity needs to use EAF technology.

- Hydrogen-based DRI: 42% of primary steelmaking should employ EAFs with hydrogen-based direct reduced iron (DRI) to align with environmental goals.

- Current Shortfall: Despite the increased capacity planning, the current trajectory leaves only 32% of total capacity as EAF by 2050, highlighting a significant gap in achieving the IEA's targets.

- This discrepancy underscores the need for accelerated adoption and investment in EAF technology to meet global environmental targets.

Market Research and Projections

Transparency Market Research Report (2022):

- Current Market Value: The global EAF industry was valued at $800 million in 2022.

- Growth Forecast: This value is projected to increase to $1.3 billion by 2031, with an estimated compound annual growth rate (CAGR) of 5.7% from 2023 to 2031.

- The steady growth reflects the increasing demand for sustainable and efficient steel production methods.

Fatpos Global Market Study:

- Future Market Potential: A more recent study suggests that the market size for EAF could rise to $2.45 billion by 2034.

- Higher Growth Rate: This study predicts a much higher CAGR of 9.2% between 2024 and 2034, indicating robust growth prospects and significant investment in EAF technology.

- The rapid market expansion aligns with global trends towards more sustainable and cost-effective steelmaking processes.

Analysis

- The adoption of electric arc furnaces (EAF) in steelmaking has seen significant growth over the past decade and continues to rise.

- Despite ambitious goals set by the International Energy Agency for 2050, current capacity plans suggest that more effort is needed to achieve the necessary transition to EAF technology.

- Market research predicts a substantial increase in the market size of EAF, reflecting growing industry and investor confidence in this technology.

- The shift towards EAF is driven by its environmental benefits, efficiency, and the global steel industry's move towards more sustainable production methods.

EAF Replacing BF-BOF

Transitioning from Blast Furnaces to Electric Arc Furnaces (EAF)

Tata Steel's Plan:

- Port Talbot Plant: Tata Steel announced plans to shut down two blast furnaces at its Port Talbot plant in the United Kingdom.

- EAF Replacement: They intend to replace them with a 3-million-tonne, state-of-the-art, scrap-based electric arc furnace (EAF).

- Capacity and Decarbonization: Port Talbot, one of the UK's largest steel manufacturing facilities, has a capacity to produce around 5 million metric tonnes of crude steel.

- Government Funding: In September 2023, Tata reached an agreement with the UK government for funding of $1.6 billion to decarbonize Port Talbot, with the government contributing $635 million.

Impact and Protests

- Job Losses: Tata Steel estimates that the shutdown will impact 2,800 jobs, with the first 2,500 affected within 18 months.

- Worker Protests: The decision sparked protests by worker unions in the UK, highlighting concerns about job losses.

- Environmental Benefits: Tata Steel states that the transformation will lead to a reduction of 5 million tonnes of carbon dioxide (CO2) emissions, contributing to 1.5% of the UK’s total emissions.

Transition Plans by Other Companies

British Steel’s Announcement:

- Blast Furnace Replacement: British Steel, now owned by a Chinese group, announced plans to replace blast furnaces with electric arc furnaces.

- Facilities Involved: This includes two blast furnaces at the Scunthorpe steelworks in the UK, aiming to start operations by 2025.

- Potential Job Losses: Unions estimate up to 2,000 job losses due to these changes.

Decarbonization Efforts in Japan:

- JFE Steel's Initiative: JFE Steel aims to replace its blast furnace at the Kurashiki plant in western Japan with a large-scale electric arc furnace by 2027 to reduce CO2 emissions.

- Kobe Steel's Consideration: Kobe Steel is considering building a large electric arc furnace to replace one of its blast furnaces in Kakogawa, western Japan, to accelerate its decarbonization efforts.

EAF BS BF-BOF

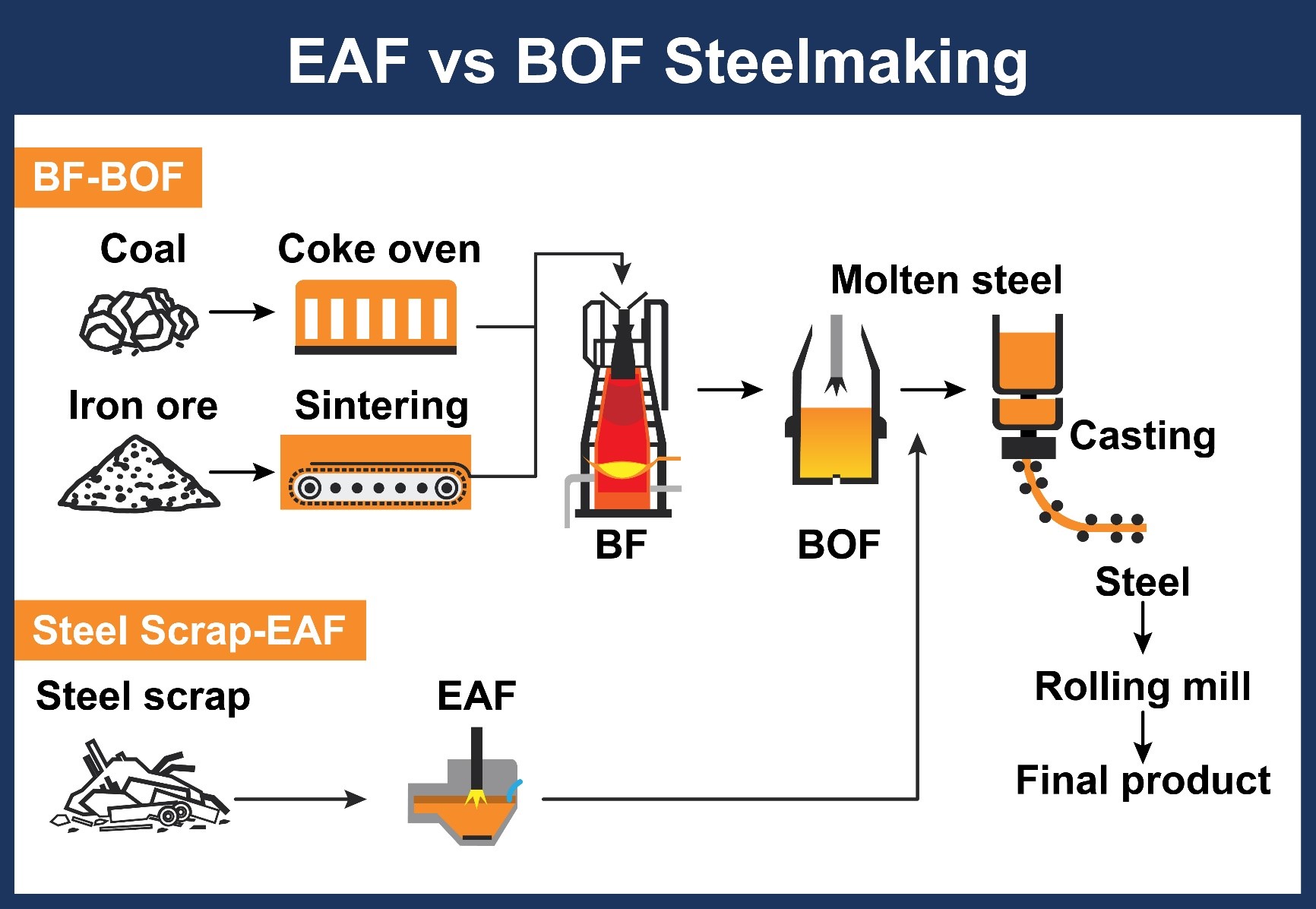

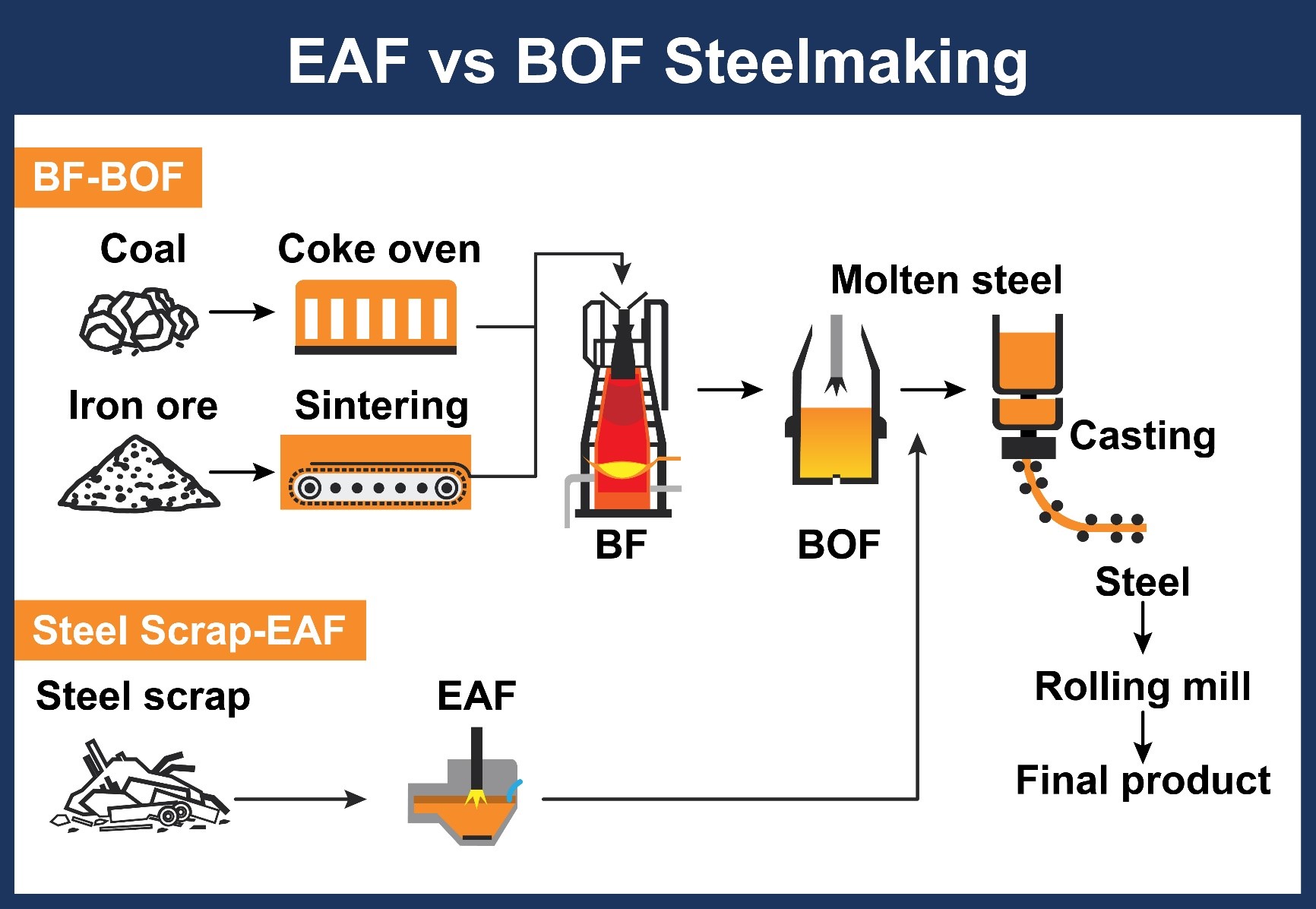

- Steel is produced via two main methods: the blast furnace-basic oxygen furnace (BF-BOF) route and electric arc furnace (EAF) route. Variations and combinations of production routes also exist.

- The key difference between the routes is the type of raw materials they consume.

- For the BF-BOF route these are predominantly iron ore, coal, and recycled steel, while the EAF route produces steel using mainly recycled steel and electricity.

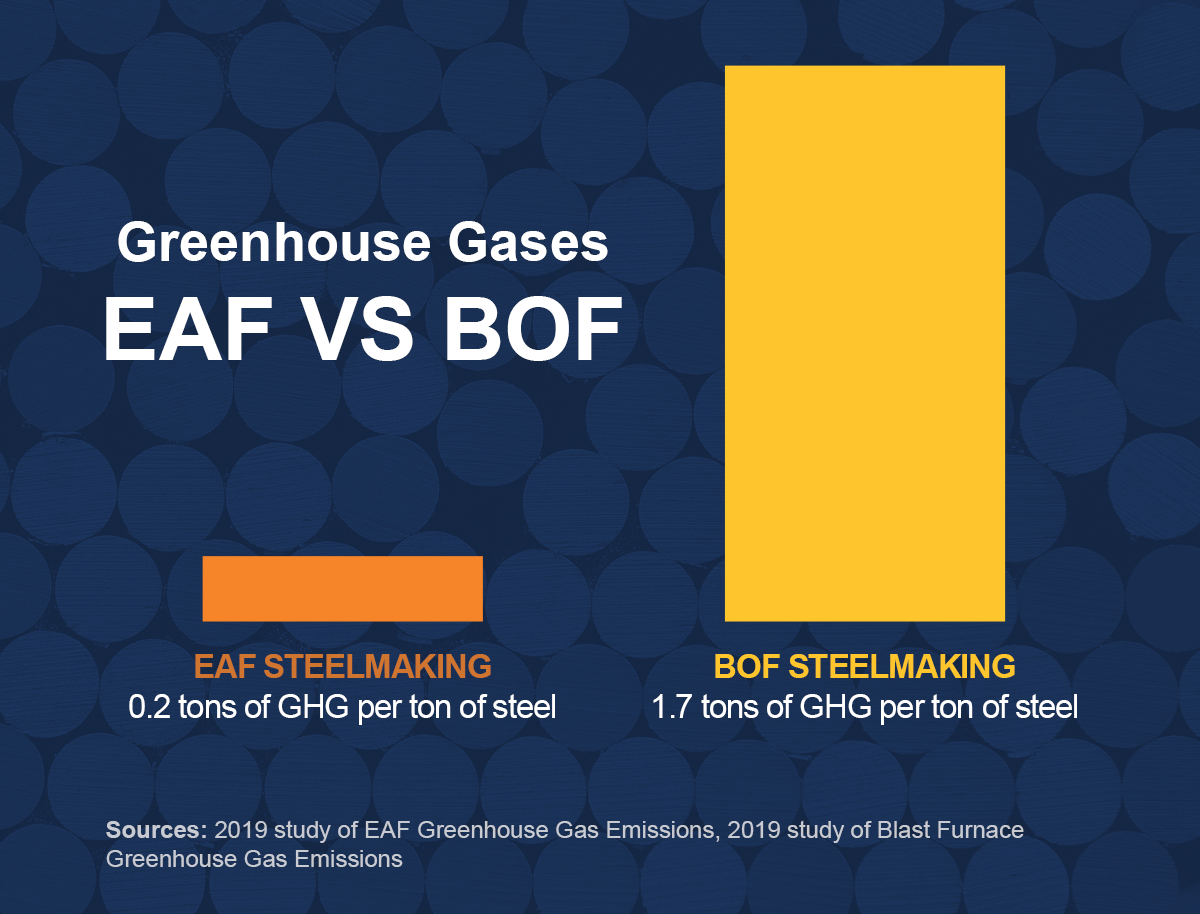

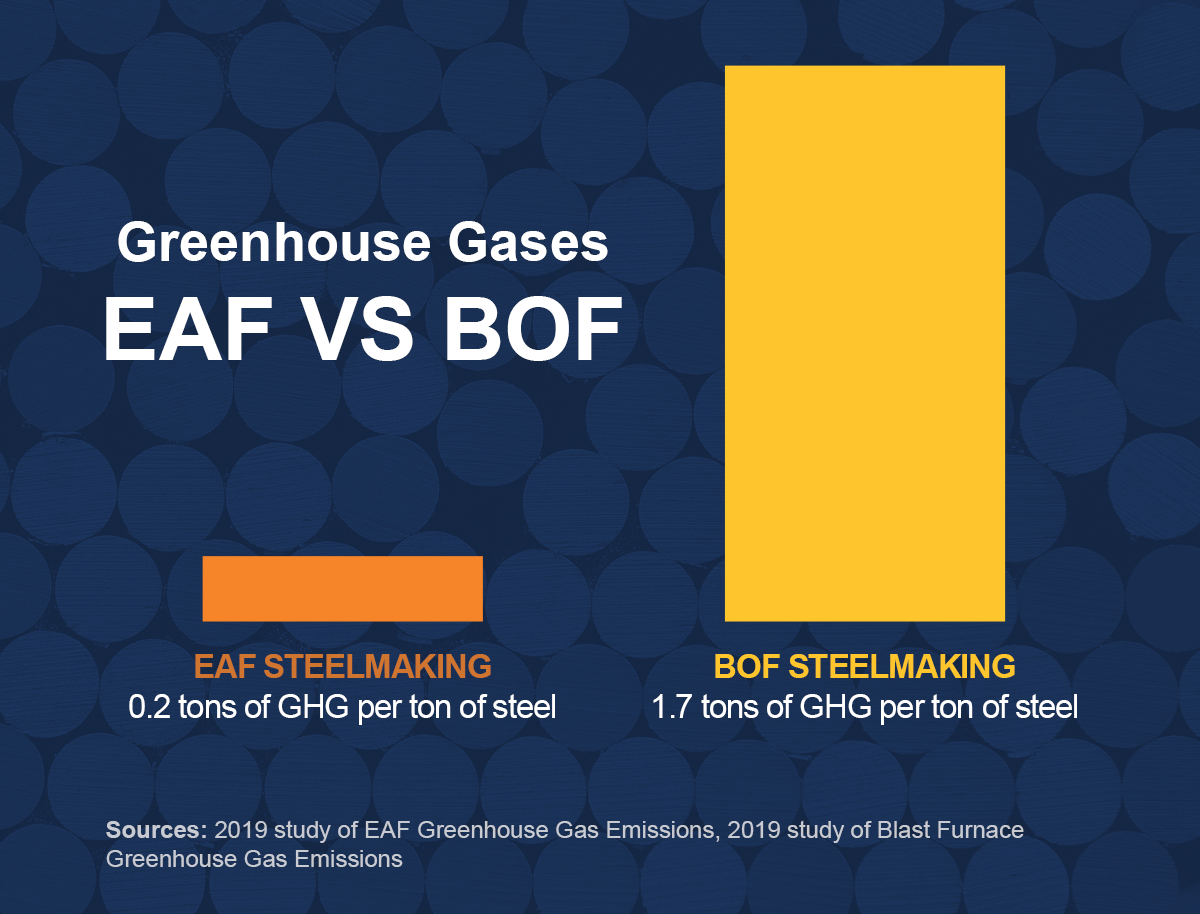

- While EAF steelmaking relies on electricity and recycled metals, Blast Furnace/BOF depends on raw materials like Iron Ore and Metallurgical Coke as part of a process where oxygen is blown into the furnace at a high velocity. This process uses significantly more energy, depends on using raw materials and is limited in its evolution towards more sustainable

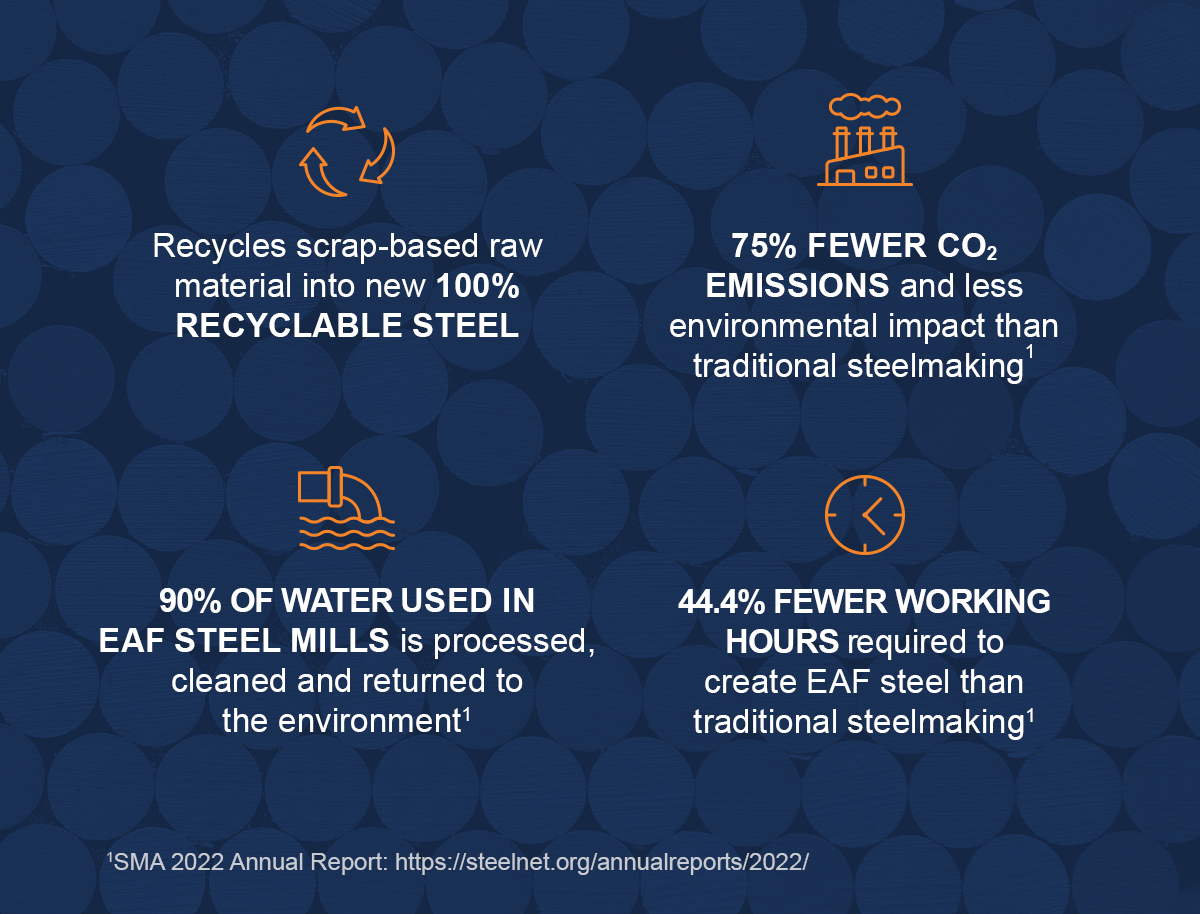

- By using recycled steel as part of the EAF, we’re contributing to a circular economy—producing less landfill waste, using less energy and generating fewer emissions from production, transportation and shipping.

Advantages of EAF over BF-BOF

- Electric arc furnaces may have a lower share of overall steel production but have many advantages over the traditional BF-BOF route. Some of these advantages are:

- Flexibility in terms of production as per the changing market demand

- Flexibility in terms of the variety and quantity of raw materials/charge they accept

- They are considered more efficient compared to blast furnaces

- They can produce steel with a much lower level of greenhouse gas emissions compared to the blast furnace route. They can take 100 per cent steel scrap as raw material and also have the possibility to use green hydrogen-based sponge iron as raw material, which are the two cleanest steel-producing routes worldwide.

- Capable of producing a whole range of steel products

- Have a low capital cost compared to BF-BOF

EAF Adoption in China and India

Steel Capacity Trends in Asia

- Dominance of Asia: Three-quarters of the upcoming global steel capacity is in Asia, with China and India contributing significantly.

- BF-BOF Developments: In terms of the blast furnace-basic oxygen furnace (BF-BOF) route, 99% of new developments are in Asia, with China and India leading.

China's Initiatives

- Operating Capacity: China currently holds 49% of the operating BF-BOF capacity globally.

- Upcoming Capacity Share: Despite this, India surpasses China in terms of upcoming BF-BOF capacity share, with India holding 40% compared to China's 39%.

- EAF Goals: China aims to increase its EAF-based steel production share from less than 10% in 2022 to 15% by 2025, with a proposed goal of reaching 20% by 2030.

EAF Development in India

- Current Status: Nearly 28% of steel in India is produced through electric arc furnaces, primarily relying on coal-based sponge iron and steel scrap.

- Major Players: Companies like JSW Steel, Jindal Steel and Power, and ArcelorMittal Nippon Steel (AM/NS) have set up EAF and conarc furnaces in India.

- Challenges: Issues with increasing prices and availability of natural gas for DRI production have prompted plans to increase scrap usage.

- Scrap Processing Centers: Players like JSW and AM/NS are planning to set up scrap processing centers across the country to reduce dependence on DRI.

Innovative Approaches in India

- Coal Gasification: Companies like JSPL are exploring coal gasification to produce DRI for EAF, with a focus on carbon capture to mitigate emissions.

- Scrap-Based EAF: Tata Steel India has announced plans to set up a scrap-based electric arc furnace in Ludhiana, Punjab, with similar initiatives planned in other parts of the country.

- Policy Alignment: India's National Steel Policy 2017 aims for 35-40% of steel production capacity through the EAF/induction furnace route by 2030, but challenges remain in transitioning to gas/green hydrogen-based DRI and steel scrap.

Conclusion

- The steel industry in China and India is undergoing significant transformation, with a shift towards electric arc furnaces (EAF) playing a key role in sustainability and decarbonization efforts.

- While both countries face challenges in transitioning to EAF technology, initiatives by major players and policy alignment indicate a growing commitment towards achieving environmental goals and reducing reliance on traditional steelmaking methods.

READ ABOUT INDIA’S STEEL SECTOR: https://www.iasgyan.in/daily-current-affairs/steel-sector-in-india

|

PRACTICE QUESTION

Q. Discuss the challenges and opportunities in India's steel sector, highlighting the role of technological advancements, government policies, and global market dynamics. Evaluate the potential impact of recent initiatives and future strategies on India's position as a leading player in the global steel industry.

|

SOURCE: DOWN TO EARTH