Disclaimer: Copyright infringement not intended.

Context

- The Department of Expenditure, Ministry of Finance has released the 3rd monthly instalment of Post Devolution Revenue Deficit (PDRD) Grant of Rs.7,183.42 crore to 14 States. The grant has been released as per the recommendations of the Fifteenth Finance Commission.

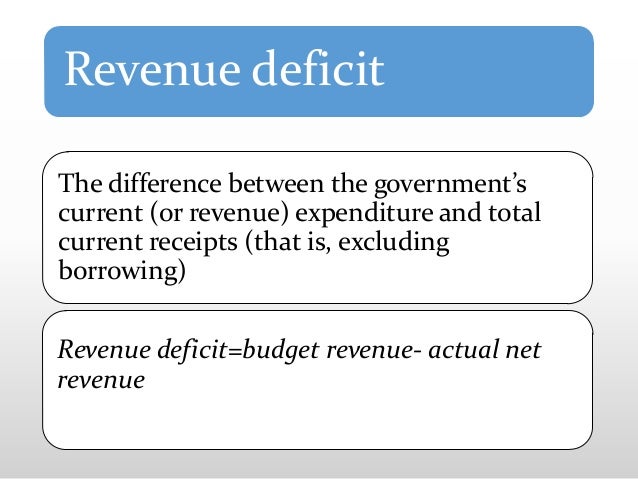

Revenue deficit

- Revenue deficit arises when the government’s revenue expenditure exceeds the total revenue receipts.

- Revenue deficit includes those transactions that have a direct impact on a government’s current income and expenditure.

- This represents that the government’s own earnings are not sufficient to meet the day-to-day operations of its departments.

- Revenue deficit turns into borrowings when the government spends more than what it earns and has to resort to the external borrowings.

Revenue Deficit: Total revenue receipts – Total revenue expenditure.

Or

Revenue deficit = Total Revenue expenditure – (Tax Revenue + Non Tax Revenue)

Revenue Deficit deals only with the government’s revenue receipts and revenue expenditures.

Note that revenue receipts are receipts which neither create liability nor lead to a reduction in assets.

It is further divided into two heads:

- Receipt from Tax (Direct Tax, Indirect Tax)

- Receipts from Non-Tax Revenue

Revenue Expenditure is referred to as the expenditure that does not result in the creation of assets reduction of liabilities. It is further divided into two types

- Plan revenue expenditure

- Non-plan revenue expenditure

How is Revenue deficit met?

To overcome such a financial situation, the government can take these measures:

- Through the borrowings or sale of existing assets, the deficit could be met from the capital receipts.

- The government can increase its non-tax or tax receipts.

- The government could try to reduce unnecessary expenditures.

What does Revenue Deficit indicate?

- Revenue Deficit is shown as a reference indicator in the Medium-term Fiscal Policy Statement (MTFP). The Revenue Deficit of the government has several implications, such as, it has to be met from the capital receipts, because of which a government either borrows or sells its existing assets. This brings in a reduction in assets.

- Also, to meet its consumption expenditure, since the government uses capital receipts, it leads to an inflationary situation in the economy.

- With more and more such borrowings, along with interest, the burden to repay the liability also increases which, in the future, results in huge revenue deficits.

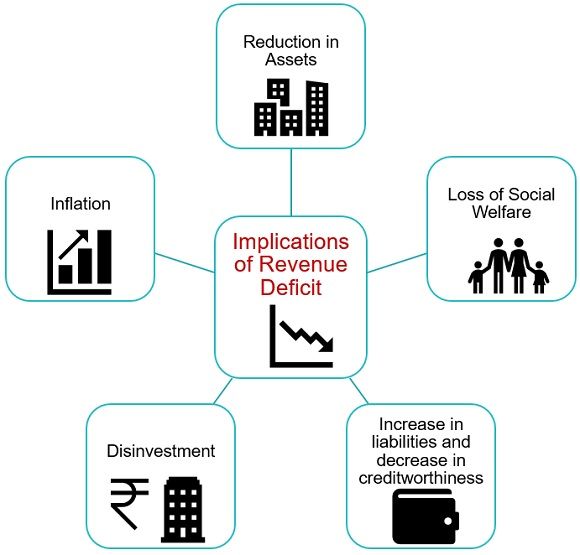

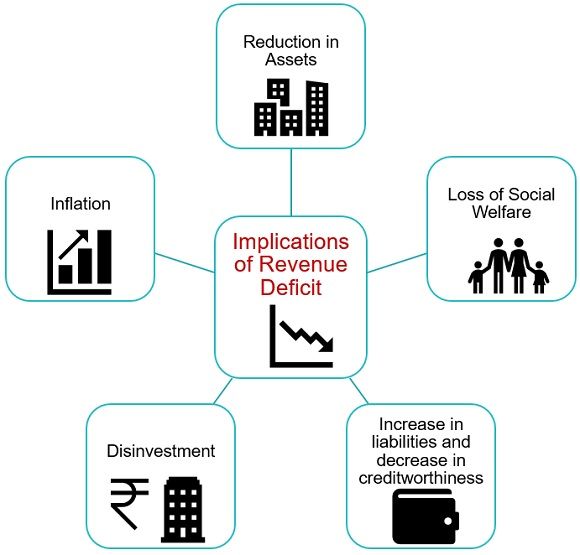

Implications of Revenue Deficit

The implications of revenue deficit are:

- Reduction in Assets: To meet its revenue expenditure, the government needs to borrow or sell its assets.

- Loss of Social Welfare: The government may have to reduce its expenditure on a number of welfare programs, and subsidies provided to the people, which results in loss of social welfare.

- Increase in liabilities and decrease in creditworthiness: The government may need to raise funds by way of borrowings from the general public, RBI, World Bank, etc, which not just increases liabilities but also reduces its creditworthiness.

- Disinvestment: The government is left with an option of disinvestment i.e. selling the ownership stake in public sector undertaking, i.e. either to foreign companies or private individuals.

- Inflation: To meet consumption expenditure capital receipts are utilized by the government. As borrowed funds do not amount to investments, it is used up for the purpose of consumption, which results in inflation.

Post Devolution Revenue Deficit Grants

- The Post Devolution Revenue Deficit Grants are provided to the States under Article 275 of the Constitution.

- The grants are released to the States as per the recommendations of the successive Finance Commissions to meet the gap in Revenue Accounts of the States post devolution.

- The eligibility of States to receive this grant and the quantum of grant for the period from 2020-21 to 2025-26 was decided by the Fifteenth Commission based on the gap between assessment of revenue and expenditure of the State after taking into account the assessed devolution during this period.

Comparison Chart

|

BASIS FOR COMPARISON

|

REVENUE DEFICIT

|

FISCAL DEFICIT

|

|

Meaning

|

Revenue Deficit is the excess of estimated government expenditure over receipts during a fiscal year in revenue account.

|

Fiscal Deficit is the excess of the total government expenditure over receipts from both tax and non tax sources excluding borrowings, during a fiscal year in both current and capital account.

|

|

Occurs when

|

Realized net income is less than the projected net income.

|

Government spends more than it earns or beyond its resources.

|

|

Borrowing

|

Shows the need of borrowing by government for the purpose of managing budgetary expenditure.

|

Shows the extent of borrowings by the government when interest payment is accounted for.

|

|

Represents

|

Dis-savings of the government and intertemporal shift to present consumption.

|

Additional requirement of financial resources to meet government expenditure.

|

|

Indicator of

|

Insufficient funds with the government to finance the functioning of government departments.

|

Increase in future liabilities of the government on interest payment and loan payment.

|

1.png)

https://www.pib.gov.in/PressReleaseIframePage.aspx?PRID=1831578