Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context:

Exchange Rate Index (EER)

EER Calculation:

CPI Calculation:

Key Similarities:

Importance and Use:

Measures of EER

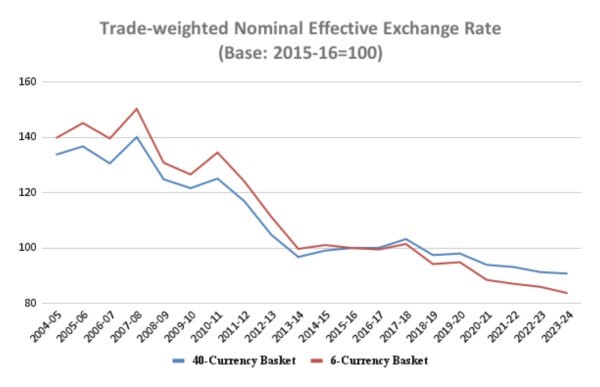

Nominal Effective Exchange Rate (NEER):

NEER Baskets:

Base Year and Calculation:

Recent Trends

Rupee's NEER Decline

Implications

Factors Contributing to the Decline

Policy Considerations

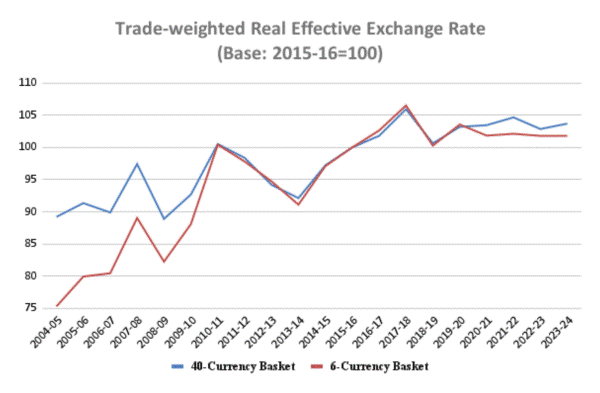

Real Effective Exchange Rate (REER)

Definition:

NEER vs. REER:

Illustration with Indonesian Rupiah:

Calculation and Impact:

Trend Analysis

Overvaluation Analysis

Assumption of Fair Valuation:

Impact of Overvaluation:

Implications for Trade Competitiveness

Loss of Competitiveness:

Trade Balance Concerns:

Policy Considerations

Exchange Rate Policy:

Structural Reforms:

Importance of Balanced Approach:

|

Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) Nominal Effective Exchange Rate (NEER) and Real Effective Exchange Rate (REER) are important indicators in international economics used to assess a country's currency value, trade competitiveness, and overall economic performance. Real Effective Exchange Rate (REER) REER is the weighted average of a country's currency against an index or basket of other relevant currencies, adjusted for inflation. It considers the relative trade balances of each country's currency to those of all other countries in the index. An increase in a nation's REER indicates that exports are becoming more expensive while imports are becoming more affordable. REER measures a country's competition with its trading partners on the world stage and is calculated using the formula:

Nominal Effective Exchange Rate (NEER) NEER is the unadjusted weighted average rate at which one country's currency is exchanged for a basket of foreign currencies. It measures a country's capacity to compete internationally in the foreign exchange market and is calculated using the formula:

Significance of NEER and REER NEER and REER are crucial for understanding a country's exchange rate dynamics, trade competitiveness, and overall economic performance. They provide insights into a nation's currency value in relation to its trading partners and real purchasing power. In India, these indicators play a significant role in assessing the country's external competitiveness and economic performance. |

|

PRACTICE QUESTION Q. Examine the factors contributing to the recent fluctuations in the Indian rupee against the US dollar. Assess the implications of these fluctuations on India's economy and strategies to enhance the rupee's stability. |

© 2024 iasgyan. All right reserved