Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Small Finance Banks

Features

Objectives

The objective of small finance banks

How is Small Finance Bank different from Commercial Banks?

Small Finance Bank

Commercial Bank

In a nutshell,

Rules for Small Finance banks

Eligibility Criteria for Banks

Registration of SFBs

Norms of SFBs

FDI in SFBs

What will be their transition path?

|

A universal bank is a bank that combines the three main services of banking under one roof. The three services are wholesale banking, retail banking, and investment banking. In other words, it is a retail bank, a wholesale bank, and also an investment bank. |

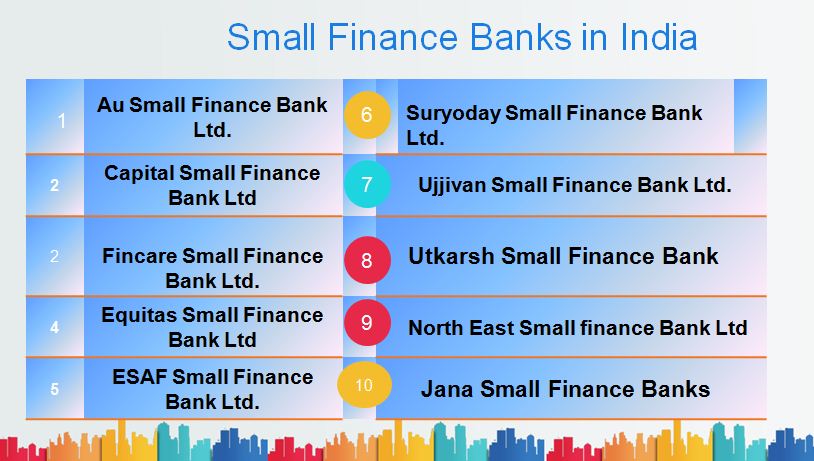

SFBs in India

The operational SFBs in India are as follows:

Conclusion

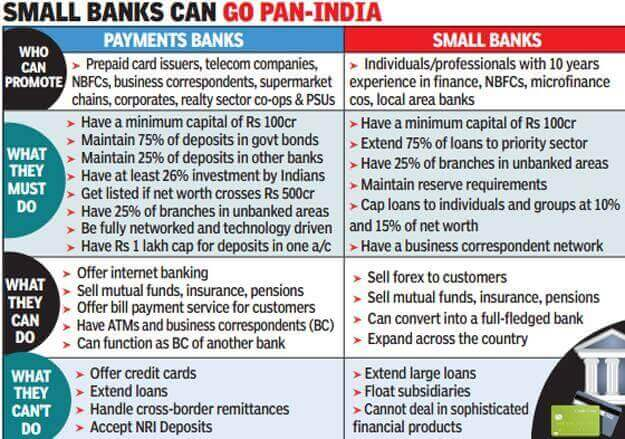

Small Finance Bank Vs Payments Bank Vs Commercial Bank

|

Basis of Difference |

Small Finance Bank |

Payments Bank |

Commercial Bank |

|

Who can promote |

Individuals/ professional having 10 years experience in finance, NBFCs, microfinance companies, local area banks, etc. |

Can be promoted by Telecom Companies, Prepaid Card Issuers, NBFCs, Supermarket Chains, PSUs, etc. |

As per guidelines issued by RBI |

|

Promoter's Share |

40% in starting Then can be gradually brought down to 26% in 12 years |

40 % for first Five 5 years from the date of commencement of business |

As per guidelines issued by RBI |

|

Capital Required |

Minimum Paid Up capital should be 100 Crores |

Minimum Paid Up capital should be 100 Crores |

Commercial banks have enormous amounts of capital. |

|

Regulatory Requirements |

Meet CRR and SLR set by the RBI |

Meet CRR and SLR set by the RBI |

Meet CRR and SLR set by the RBI |

|

Customer Reach |

Customers are reached through its branches |

Customers are reached through Mobile banks |

Customers are reached through its branches |

|

Demand Deposit |

Can accept demand deposit like savings deposit without any fixed limit |

Can accept demand deposit like savings deposit only upto Rs. 1 lakh |

Can accept deposit without any fixed limit |

|

Time Deposit |

Can accept Time Deposit such as Fixed Deposit and Recurring Deposit |

Can't accept Time Deposit such as Fixed Deposit and Recurring Deposit |

Can accept Time Deposit such as Fixed Deposit and Recurring Deposit |

|

Loan |

Can offer loan. Must extend 75% loans to priority sectors |

Cannot offer loan |

Can offer loan to its customers |

|

Remittance Services |

Can provide Remittance Services |

Can provide Remittance Services |

Can provide Remittance Services |

|

Online Banking Solutions |

Can offer online banking services |

Can offer online banking services such as bill payment, etc. |

Can offer online banking services |

|

Revenue |

Earns revenue through leding services |

Earns revenue through transaction charges and fee income for remittances |

Earns revenue through leding services, transaction charges, etc. |

|

Debit Card |

Can issue Debit Card and ATM Card |

Can issue Debit Card and ATM Card |

Can issue Debit Card and ATM Card |

|

Credit Card |

Can issue credit cards |

Can't issue credit cards |

Can issue Credit Card |

|

Target Customers |

MSME, Small Farmers, Small Businessman, Unorganized Workers, etc. |

Poor migrant labourers, unbanked Indians, under-banked customers, low-income households and small businesses |

Not restricted to any region |

|

Forex Services |

Can provide Forex Services and can charge less than commercial bank for these products |

Can provide foreign exchange services, however, different banks charges are different for these services |

|

|

Adoption of Technology |

Should be fully technology driven right from the beginning |

Should be fully technology driven right from the beginning |

Gradually implementing latest technology like online transactions, mobile banking, etc. |

|

Branches |

For Initial 3 years, 25% branches must be in rural areas to tap those areas |

Must have 25% branches in rural areas |

Can open branches anywhere in India |

|

Third Party Products |

Can sell third party products like mutual funds, indurance, pension products, etc. |

Can sell third party products like mutual funds, indurance, pension products, etc. |

Can sell third party products like mutual funds, indurance, pension products, etc. |

Read:

Microfinance Institutions:

https://www.iasgyan.in/daily-current-affairs/microfinance-institutions-mfis

Cooperative Banks:

© 2024 iasgyan. All right reserved