Copyright infringement not intended.

Context

- Global sovereign borrowing will reach $10.4 trillion in 2022, nearly a third above the average before the coronavirus pandemic, S&P Global Ratings said in a report.

Key Findings of the Report

- 137 countries will borrow an equivalent of $10.4 trillion in 2022, an estimated 30 percent lower than 2020. But the overall figure is one-third higher than average borrowing between 2016 and 2019.

- Despite an economic recovery, borrowing will stay elevated because of high debt rollover requirements and war in Ukraine.

|

A rollover is the renewal of a loan. Rollover risk is a risk associated with the refinancing of debt. Rollover risk is commonly faced by countries and companies when a loan or other debt obligation (like a bond) is about to mature and needs to be converted, or rolled over, into new debt.

|

- Tightening monetary conditions will push up government funding costs. A moderate value is actually good for the economy. So, a tight money policy will pose additional difficulties to countries that have been unable to restart growth, reduce reliance on foreign currency financing, and where interest bills are already critically high on average.

|

Tight monetary policy, or contractionary monetary policy, typically occurs when a central bank wants to keep inflation under control. If there has been too much spending and borrowing by consumers and businesses, the economy can become overheated and that could considerably raise the price level of goods and services.

Read: https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

|

- Egypt, which has recently sought IMF assistance, is set to overtake Turkey as the region's largest issuer of sovereign debt, with $73 billion worth of bond sales.

- Kenya, Egypt and Japan have the biggest share of debt that needs to be rolled over this year.

- Commercial debt in emerging markets is set to increase to 37 percent of GDP from 31 percent in 2016. Debt is boosted by pandemic-related costs, a rise in commercial borrowing in Oman and Saudi Arabia and "persistently high fiscal deficits" in Egypt and Romania.

- The corporate default rate could reach 8.5% this year, more than double the 3.9% they expected before Russia invaded Ukraine and the highest since the global financial crisis.

Sovereign Debt/ Borrowing

- Sovereign borrowing is when securities are issued by a country's government to borrow money. Governments take loans directly from international creditors, banks, private businesses, individuals official lending institutions and multilateral lenders such as the World Bank/IMF. Some also borrow from other countries.

- Sovereign debt is how much a country's government owes. Thus it is also known as government debt, public debt, and national debt.

Reason behind borrowing

- A country can exercise three fiscal budget options: surplus, balanced, and deficit. The three differ in whether government revenue exceeds, equals, or is less than government spending.

- Under the fiscal deficit, government revenue is less than expenditure. The primary source of government revenue is from taxes. So, whenever it needs money to finance its growth initiatives during budget deficit, the state can only do it in two modes: raising taxes or going into debt.

- Tax increases are generally unpopular, burdensome to society, and require a lengthy ratification process. So, the government tends to choose to issue debt in the form of issuing government debt securities.

- Governments borrow for a variety of reasons, from financing public investments to boosting employment.

- The level of sovereign debt and its interest rates reflects the saving preferences of a country's businesses and residents, as well as the demand from foreign investors.

Types of sovereign debt

Based on the creditors, the state debt is divided into two categories:

- Domestic debt

- International debt

Domestic debt

- To fund domestic development initiatives, the government issues bonds which are then purchased by domestic investors. There are different types of investors who buy government bonds. They include pension funds, insurance companies, and banks.

- Because the investors come from domestic, this type of bond is considered risk free of capital flight. Thus, the effect on the exchange rate is minimal. When in economic turmoil, it is less likely that capital flows out of the bond market if most buyers are domestic investors.

International Debt

- International debt is part of the debt of a country where the buyer is an investor abroad. These loans, including interest, usually have to be paid in the currency in which the loan was made, such as US dollars, Euros, and Japanese Yen.

- A debt crisis can occur if a country with a weak economy cannot pay off its foreign debt. The state cannot pay the debt because of the inability to collect taxes. Usually, it occurs during periods of weak economic growth, such as recessions, in which business profits and household income fall.

A country’s public debt is considered sustainable if the government is able to meet all its current and future payment obligations without exceptional financial assistance or going into default.

Government debt health indicators

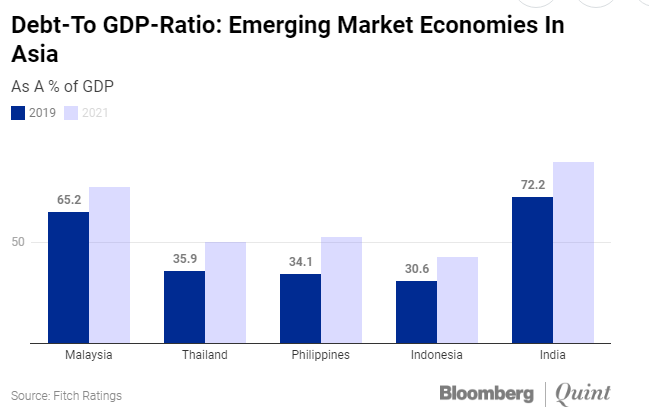

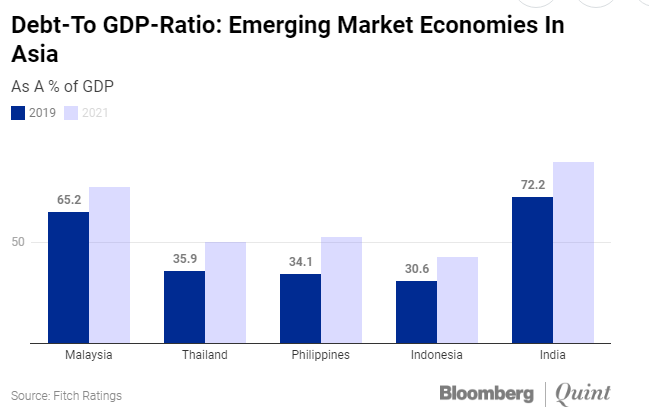

- An essential indicator of a country’s economic health and debt level is the debt-to-GDP ratio. A high debt-to-GDP ratio indicates a higher risk of default.

- Korea, Hong Kong, and Russia are some countries which had a debt to GDP ratio of less than 40% in 2019. Meanwhile, countries like Greece and Italy have a debt to GDP ratios of more than 100%.

- However, high ratios may not always be bad. Some countries with more stable economies have a high tolerance for the risk of default. For example, even though the United States has a high debt-to-GDP ratio of 111.95%, it is offset by a strong US economy.

- Despite all these things, debt creates obligations that must be paid. Countries must learn from the Greek debt crisis where debt has become a source of crisis, not only in the country but also in the world.

- Moreover, with the current era of globalization, the effects of the crisis can quickly spread. So, the government must handle sovereign debt problems with great care as it sends ripples worldwide.

The pros and cons of sovereign debt

Pros

Some supporters believe that debt is needed to run the economy. There are several advantages of government debt, including:

- First, it helps drive economic growth. Countries cover their deficits by borrowing. The government can use debt to fund development projects in the country. Developments such as infrastructure and education contribute to increasing the productive capacity of the economy. If loan funds are unavailable, development initiatives will certainly not work. And this can hinder a country’s development in the long run.

- Second, the government can use debt to manage monetary policy. Through economic policy, the government tries to avoid the adverse effects of inflation/deflation. To do so, the central bank can use debt securities in conducting monetary operations. When it wants to moderate economic growth and inflation, the central bank will sell government debt securities. Conversely, when it wants to encourage economic growth, the central bank will buy government debt securities in the market.

- Third, the issuance of debt securities stimulates a growing corporate bond market. Government debt securities are usually the benchmark for corporate debt securities. Thus, the development of the sovereign debt market allows the corporate bond market to develop as well.

Cons

However, critics argue that government debt has several drawbacks, including:

- First, government debt creates a crowding-out effect. If the government borrows too heavily on the domestic market, it reduces the money that the private sector can borrow.

A massive issuance means more supply. There is a possibility of excess supply, and the market cannot absorb government debt securities. In such a situation, the government may offer high-interest rates to lure investors and attract demand.

Higher interest rates can discourage private investment because capital costs are higher. Reductions in private investment can dampen economic growth more than government spending can stimulate.

- Second, it can have an effect on currency devaluation. If a country experiences default, the natural tendency is to lower its debt burden. This is often achieved by devaluing local currency. Devaluation means reducing the purchasing power of the domestic currency. This can erode confidence in the domestic economy.

- Third, debt is vulnerable to capital flight. The high level of foreign ownership in government debt securities makes the economy vulnerable to speculative action. Investors are flexible in withdrawing their investment to pursue short-term gains or to secure their investment.

The outflow of foreign capital creates pressure on the exchange rate. Pressure on the exchange rate is more significant if, at the same time, the country runs a trade deficit.

|

All goes well until creditors start to doubt whether they will be repaid. These doubts start to creep in when sovereign debt reaches 77% of the country's annual economic output. For emerging market countries, the tipping point comes sooner, at the 64% debt-to-gross domestic product ratio.

|

Sovereign debt crisis

- Not all economies can manage large debts. Some countries have unstable economic conditions, so debt can make things worse.

- Countries with high inflation or volatile exchange rates usually have to issue debt securities with high coupons. Its aim is to attract investors who are willing to take risks. This, of course, is a burden on the government budget.

- When borrowing too much and cannot pay off the principal and pay the debt’s interest, the country experiences what is known as default. Because states cannot file bankruptcy when they default, they must bid exchange offers to the debt securities holders.

- Exchange negotiations are often deadlocked and protracted. If this condition occurs, the government will generally take steps to devaluate the national currency to reduce its debt burden.

- Devaluation reduces the purchasing power of the country’s currency. Devaluation can indeed drive exports more widely, which can help increase GDP. But, currency devaluation also means that domestic money is of less value when exchanged for goods and services.

- As a result, the public could not buy as much as before. And domestic and international confidence in the economy falls.

|

A country’s debt-carrying capacity depends on several factors—among them the quality of institutions and debt management capacity, policies, and macroeconomic fundamentals. A country’s capacity to carry debt can change over time, as it is also influenced by the global economic environment.

|

Defaults

- Debt crises have occurred for centuries, as a result of wars or recessions. In the 1980s, a wave of defaults occurred in East Europe, Africa, and Latin America. This was a result of a boom in bank lending in the 1970s. When the 1981 recession hit, interest rates rose, triggering defaults in the emerging market countries.

- In the 1998 debt crisis, Russia defaulted after plummeting oil prices decimated its revenue. Russia's default led to a wave of defaults in other emerging market countries. The IMF prevented many debt defaults by providing needed capital.

India’s Sovereign Borrowing: Current scenario

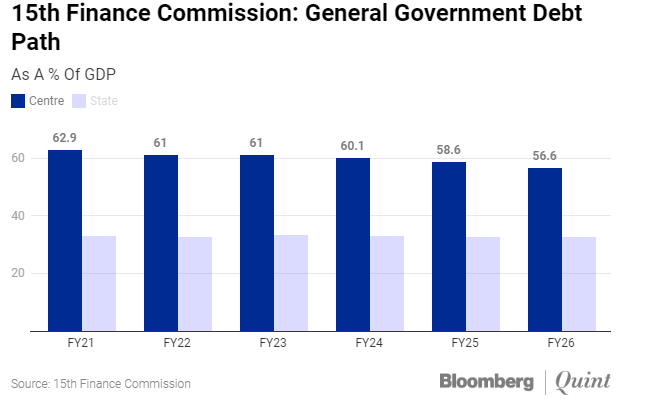

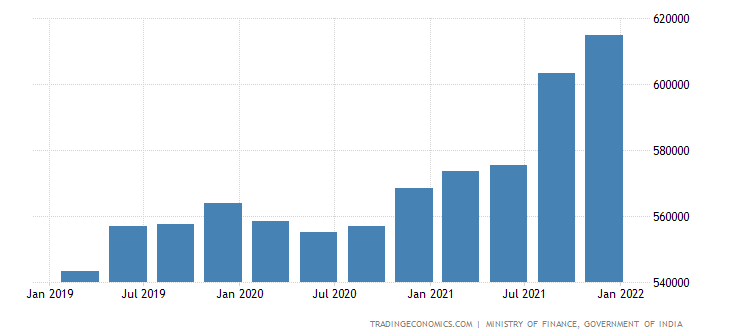

- The Covid-19 crisis has led to a ballooning of government debt across nations. India is no exception.

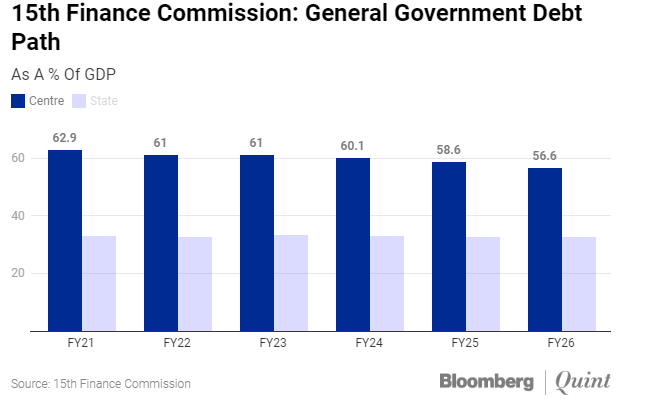

- India's debt-to-GDP ratio rose to 87.8% in FY21.

- According to the Credit Rating Agency Fitch-India currently has the highest debt level among our ‘BBB’ emerging market sovereigns and we expect it to remain the highest in this category over the next several years.

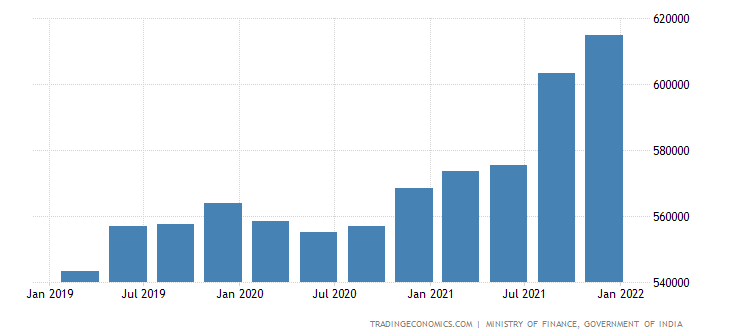

- India’s External Debt as of March 2022 is $614.9B.

Copyright infringement is not intended

- Given that India's economic growth has slowed significantly for over seven years, and the fixed investment-to-GDP ratio has decelerated at an unprecedented rate during this period, there is an urgent need to boost public investment to stimulate investment demand and pull-in private investment.

Final Thoughts

- As noted earlier, public debt is one way to raise money for development. There are other ways to mobilize financing, such as by raising domestic revenue, improving the efficiency of spending, reducing corruption, and improving the business environment. But these may take time to materialize and may not be enough.

- Countries should be prepared to keep debt sustainable and ensure it does not jeopardize growth and stability.

- Unsustainable debt can lead to debt distress—where a country is unable to fulfill its financial obligations and debt restructuring is required.

- Defaults can cause borrowing countries to lose market access and suffer higher borrowing costs, in addition to harming growth and investment.

Read:https://www.iasgyan.in/daily-current-affairs/sovereign-ratings#:~:text=Credit%20Rating%20Information%20Services%20of,ICRA%20Limited

https://www.thehindu.com/business/global-bond-sales-to-cross-10-trillion-in-2022-sp/article65293708.ece