Disclaimer: Copyright infringement not intended.

Context

Central Banks across the world are trying to formulate the appropriate set of policies to ensure that inflation, currently running at multi-decade highs in some advanced economies including the U.S., is cooled without triggering a recession.

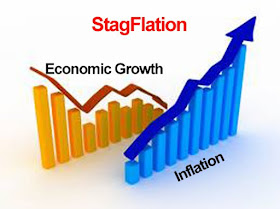

What is Stagflation?

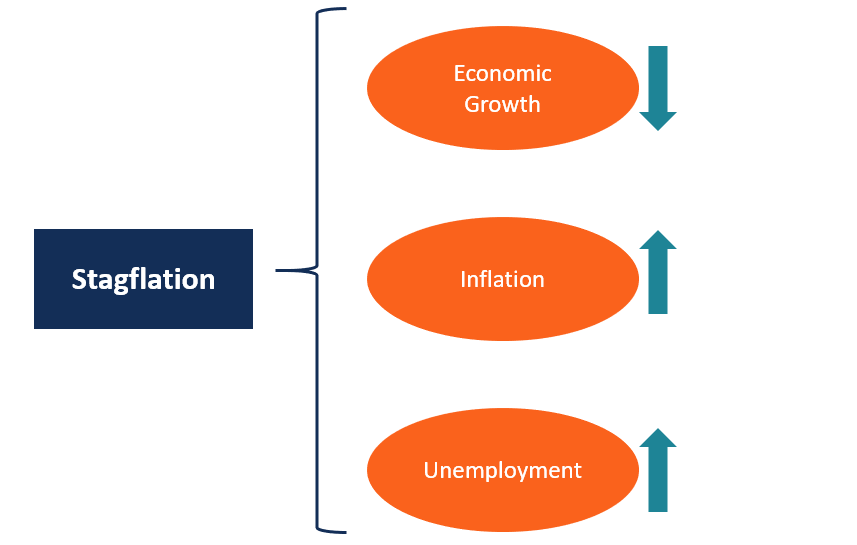

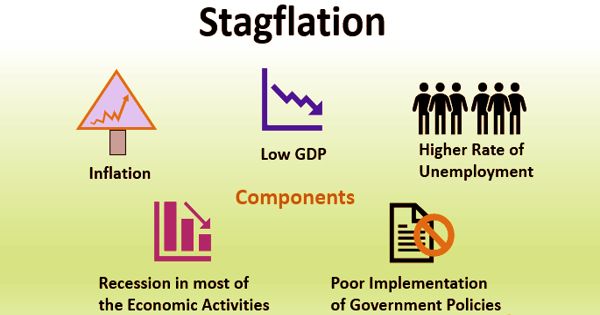

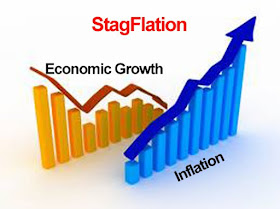

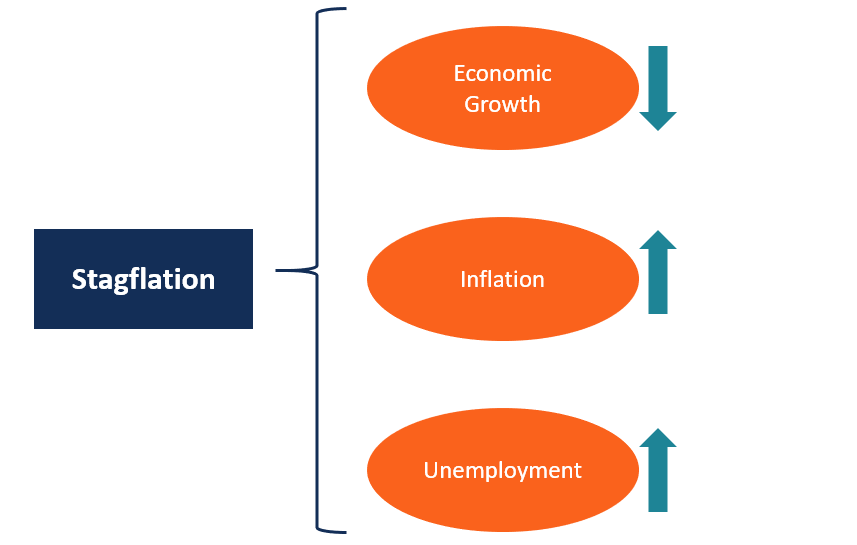

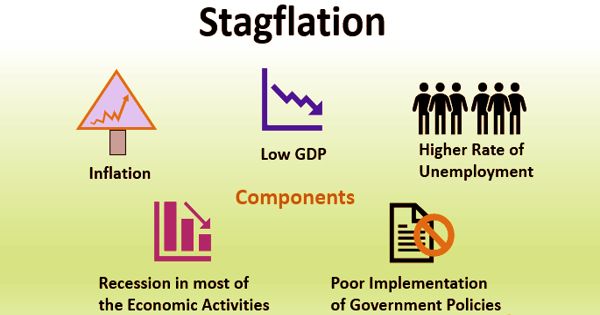

- Stagflation or recession-inflation is a combination of stagnant economic growth, high unemployment, and high inflation.

- It presents a dilemma for economic policy, since actions intended to lower inflation may exacerbate unemployment. It’s an unnatural situation because inflation is not supposed to occur in a weak economy.

- Iain Macleod, a Conservative Party MP in the United Kingdom, is known to have coined the phrase during his speech on the UK economy in November

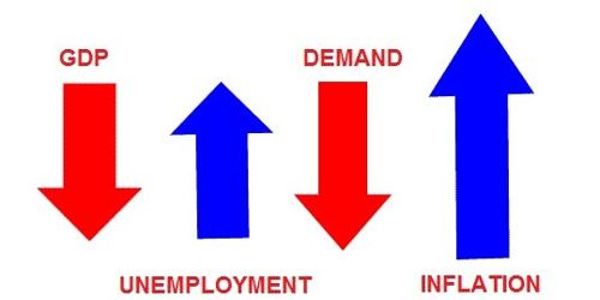

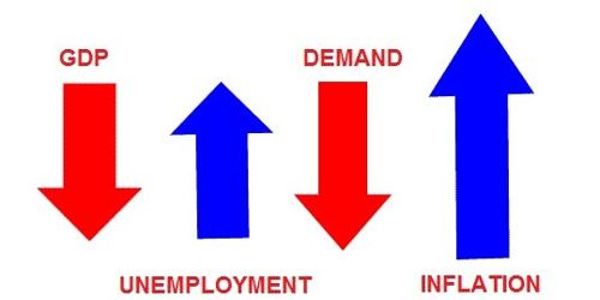

Typically, rising inflation happens when an economy is booming — people are earning lots of money, demanding lots of goods and services and as a result, prices keep going up. When the demand is down and the economy is in the doldrums, by the reverse logic, prices tend to stagnate (or even fall).

But stagflation is a condition where an economy experiences the worst of both worlds — the growth rate is largely stagnant (along with rising unemployment) and inflation is not only high but persistently so.

Causes of stagflation

- Oil price rise: Stagflation is often caused by a supply-side shock. For example, rising commodity prices, such as oil prices, will cause a rise in business costs (transport more expensive) and short-run aggregate supply will shift to the left. This causes a higher inflation rate and lower GDP.

- Powerful trade unions:If trade unions have strong bargaining power – they may be able to bargain for higher wages, even in periods of lower economic growth. Higher wages are a significant cause of inflation.

- Falling productivity:If an economy experiences falling productivity – workers becoming more inefficient; costs will rise and output fall.

- Rise in structural unemployment:If there is a decline in traditional industries, we may get more structural unemployment and lower output. Thus we can get higher unemployment – even if inflation is also increasing.

What has sparked the latest concerns about stagflation?

- Outbreak of the COVID-19 pandemic and the curbs imposed to contain the spread of the virus caused the first major recent economic slowdown worldwide.

- Subsequent fiscal and monetary measures taken to address the slowdown, including substantial liquidity infusion in most of the advanced economies, fuelled a sharp upsurge in inflation.

- The ongoing war between Ukraine and Russia and the consequent Western sanctions on Russia have caused a fresh and as yet hard-to-quantify ‘supply shock’.

Business leaders are warning of an impending ‘recession’

In a nutshell,

Note:

The idea of stagflation is closely linked to the Phillips curve which tried to establish that there was a negative empirical relationship between unemployment and inflation. That is, according to the Philips curve, when unemployment is high, inflation is low and when unemployment is low, inflation is high.

Explained | How are fears of stagflation impacting markets? - The Hindu

1.png)