Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: www.financialexpress.com

Context: The increase in the subsidy bill for the government's second term compared to the first term can be attributed to several factors, including changes in global economic conditions, policy decisions, and external events like the COVID-19 pandemic and the Russia-Ukraine war.

Key Highlights

2014-2019

After 2019

Impact of COVID-19 Pandemic

Russia-Ukraine War

|

The increase in the subsidy bill can be attributed to a combination of policy decisions, external factors like the COVID-19 pandemic and the Russia-Ukraine war, and the government's commitment to supporting farmers and vulnerable sections of society through subsidies and transfers. |

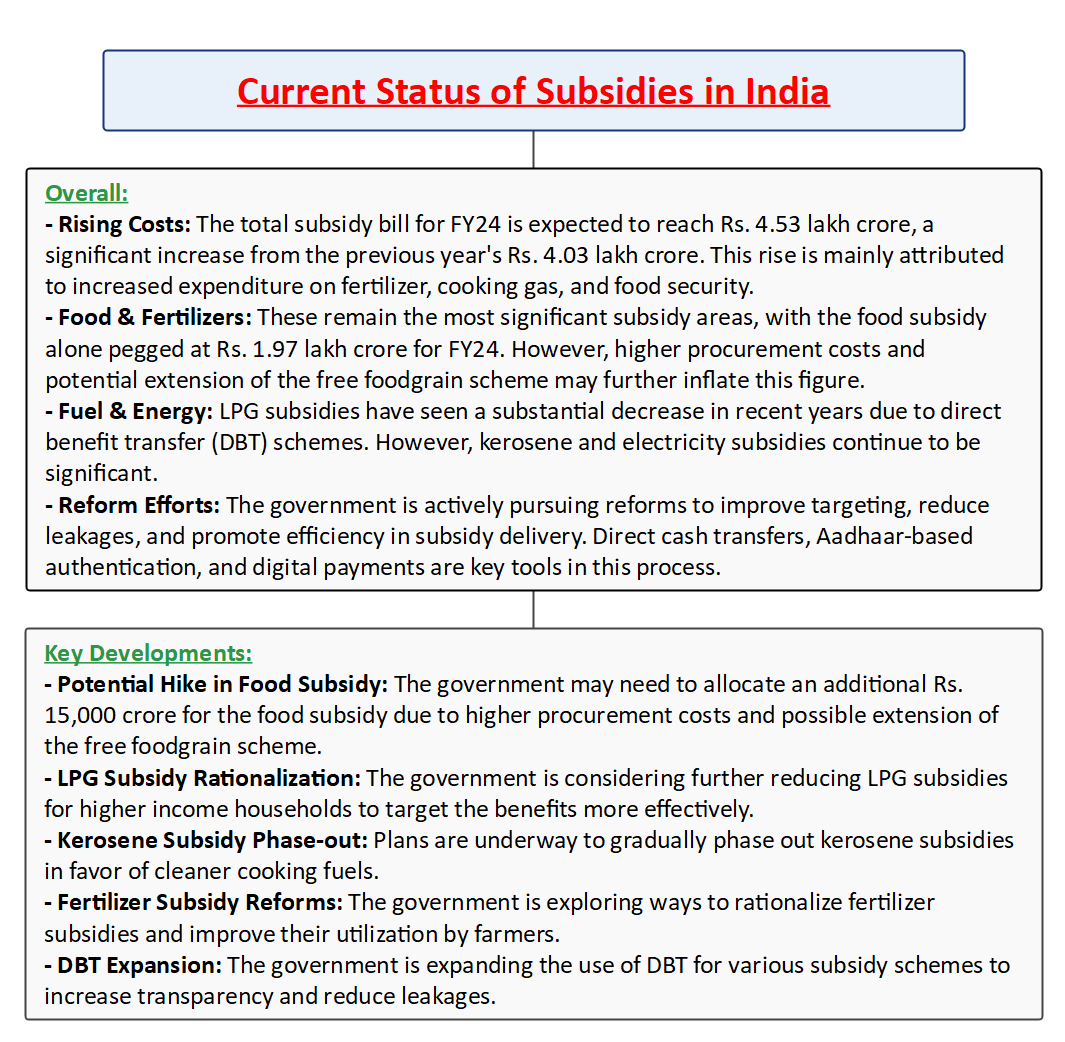

Future Outlook

Subsidies

Types of Subsidies

Implementation Mechanisms

Challenges and Criticisms

Reforms and Initiatives

Conclusion

Must Read Articles:

Fertilizers Subsidy: https://www.iasgyan.in/daily-current-affairs/fertilizers-subsidy

|

PRACTICE QUESTION Q. Can India's current fiscal situation sustain the increasing burden of subsidies, particularly in the face of rising global food and energy prices? How can the government balance the immediate needs of vulnerable populations with the long-term fiscal sustainability of subsidy programs? |

© 2024 iasgyan. All right reserved