Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

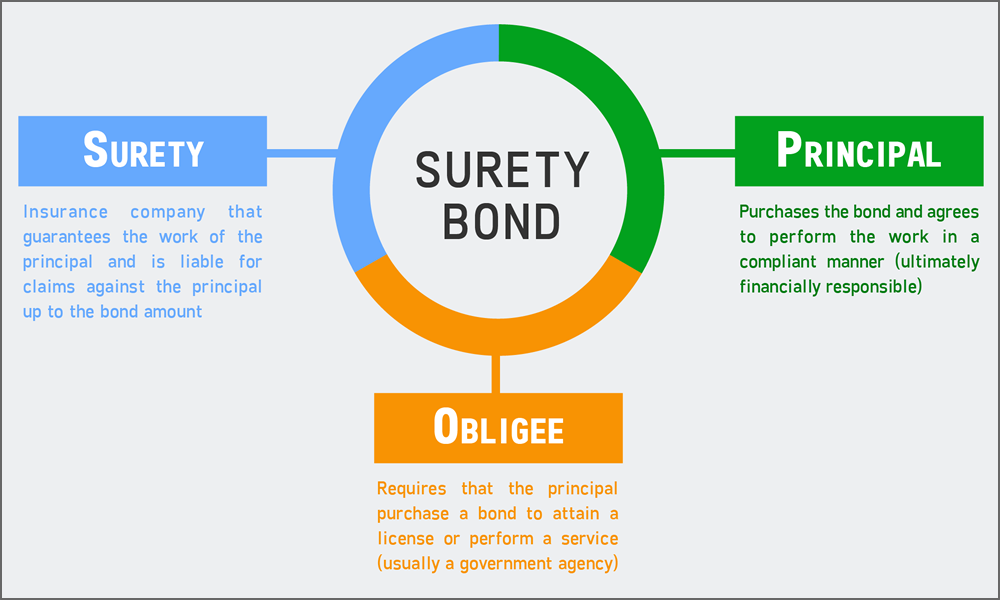

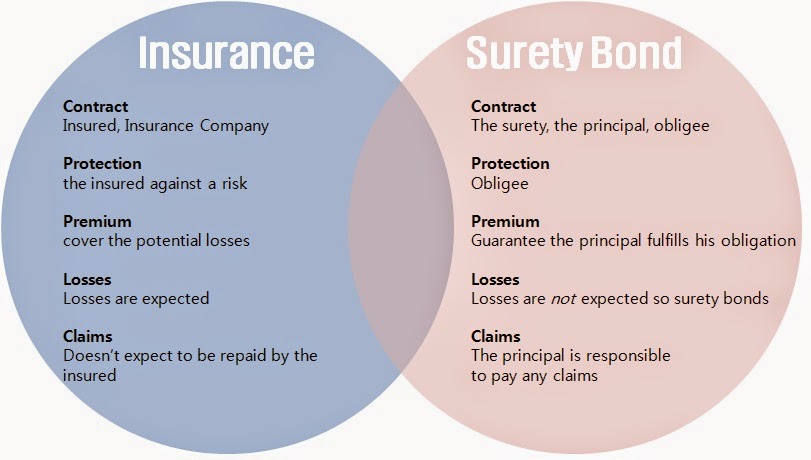

What purpose does a surety bond serve?

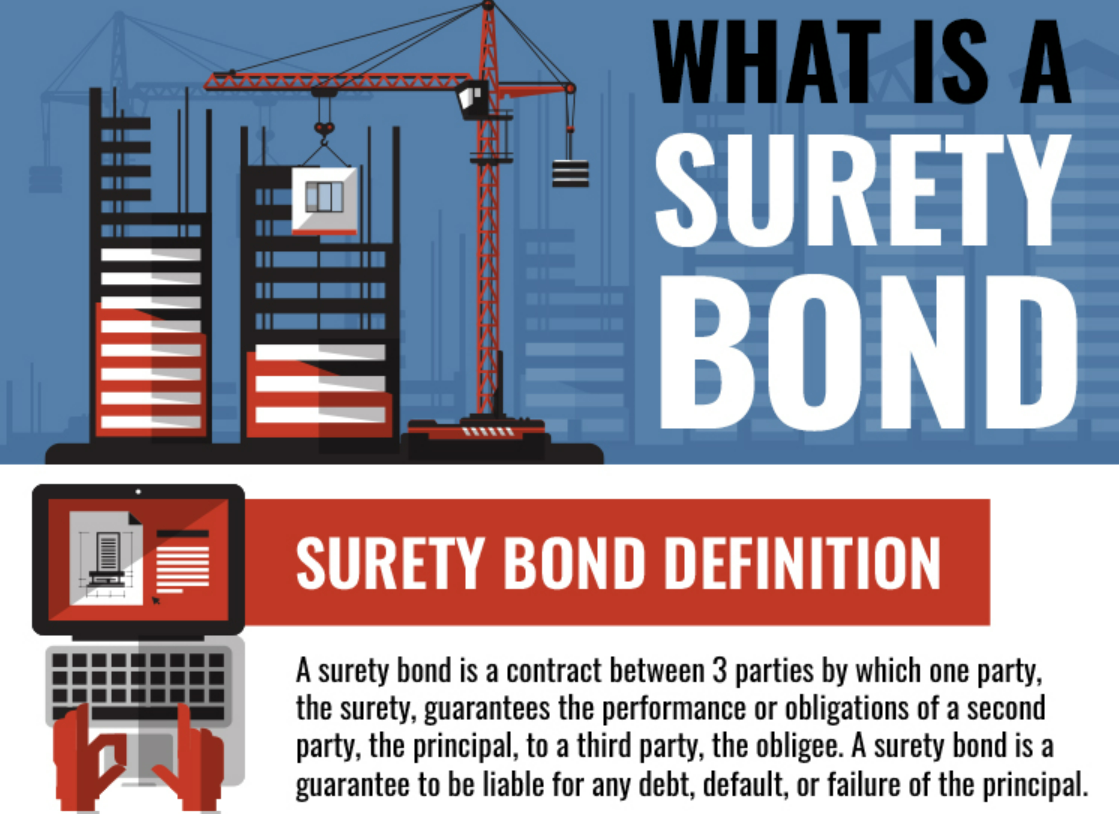

What Does a Surety Bond Mean?

Relevance of Surety Bonds in India

© 2024 iasgyan. All right reserved