Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Settlement Cycle

Practice in India

International Practices

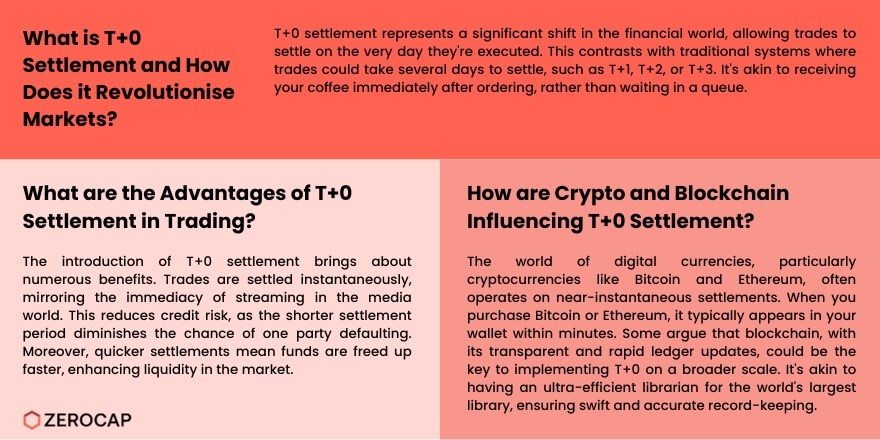

What is the T+0 settlement?

How will T+0 settlement be implemented?

How will it work?

Implications for Stakeholders

Investors:

Intermediaries:

Regulators and Market Infrastructure Institutions:

Feasibility Analysis:

Mitigation Measures:

Conclusion and Way Forward

|

What is a rolling settlement? Rolling settlement refers to the process whereby security trades are settled on a rolling basis instead of on a fixed date. In this setup, securities traded on the current date are settled on successive dates. In July 2001, SEBI introduced the rolling settlement system, replacing the fixed settlement cycle, which was blamed for poor delivery, distrust among traders, and frequent defaults. By December 20021, all listed companies started following a T+5 settlement (5 business days from the trade date) cycle. Eventually, the settlement cycle was reduced to T+3 in April 2002 and further to T+2 in April 2003. In September 2021, the SEBI allowed stock exchanges to introduce a T+1 settlement cycle on any of the securities available in the equity segment starting January 1, 2022. With the huge inflow of equity investors in recent years, the market regulator's new settlement process is expected to benefit traders. |

|

PRACTICE QUESTION Q. Which of the following statements accurately describes the characteristic feature of a rolling settlement in asset trading? A) Trades completed on any given day are settled on the same day. B) Settlement dates for trades depend on the specific date when the trade was executed. C) All trades are settled on a fixed date after the trade date, regardless of when they were initiated. D) Trades are settled periodically, typically every month, regardless of the trade date. Choose the correct option: 1.A 2.B 3.C 4.D Answer 2. B) |

© 2024 iasgyan. All right reserved