Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

In News

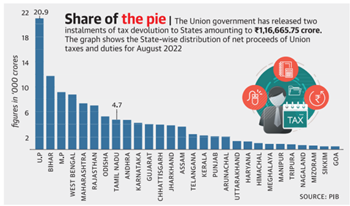

Financial Relations between Union and State

Grants-in-Aid to the States: The Constitution provides for grants-in-aid to the states from Central resources in addition to revenue sharing between the Centre and the states. Statutory grants and discretionary grants are the two forms of grants-in-aid:

Borrowing by the Centre and the States

Report of the 15th Finance Commission for 2021-26

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GM4A4SJPG.1&imageview=0

© 2024 iasgyan. All right reserved