Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

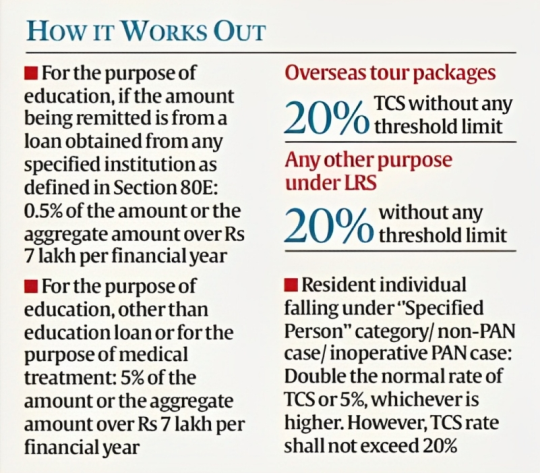

Context: Banks are preparing their systems to track purchases made with foreign credit cards and mobilise tax collected at source (TCS) on outgoing remittances in anticipation of the Reserve Bank of India's Liberalised Remittances Scheme (LRS) 20% tax taking effect on 1st July.

Details

Banking sources reported that banks needed help determining and collecting TCS on exemptions when using credit and debit cards outside of India. On the other hand, the Reserve Bank of India (RBI) has left the banks to fend for themselves to collect the levy levied by the government in the FY23–24 budget.

Liberalised Remittances Scheme (LRS)

Recent steps

Some of the significances and challenges are:

Way Forward

Must Read Articles:

Tax Collection at Source under LRS: https://www.iasgyan.in/daily-current-affairs/tax-collection-at-source-under-lrs

|

PRACTICE QUESTION Q. Which of the following purposes are allowed under the LRS? 1. Education 2. Medical treatment 3. Gift 4. Donation How many of the above statements is/are correct? A) Only 1 B) Only 2 C) Only 3 D) All Answer: D Explanation: The LRS covers a wide range of purposes for which resident individuals can remit foreign exchange abroad. Some of the common purposes are education, medical treatment, gift, donation, the maintenance of relatives, travel, investment, etc. |

© 2024 iasgyan. All right reserved