Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Context: Securities and Exchange Board of India (SEBI) has decided to launch a new consultation on the matter of total expense ratio (TER) for mutual funds. This was the outcome of the SEBI Board meeting held recently which has instructed SEBI to prepare and publish another consultation paper, based on the data collected.

Details

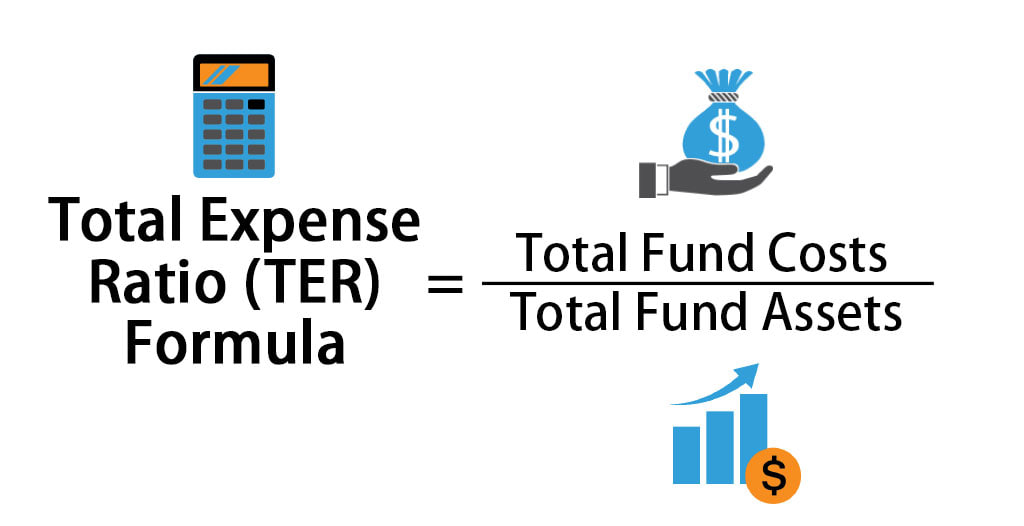

Total Expense Ratio (TER)

Challenges faced by mutual fund companies in managing their TER are:

Regulatory changes

Market competition

Investor awareness

Mutual fund companies can adopt some of the following measures:

Leverage technology

Focus on direct plans

Improve communication

Conclusion

Must-Read Articles:

Securities and Exchange Board of India (SEBI): https://www.iasgyan.in/daily-current-affairs/securities-and-exchange-board-of-india-sebi

|

PRACTICE QUESTION Q. Which of the following statements is true about the Total Expense Ratio (TER)? A) TER is the same as the management fee charged by the fund manager. B) TER is the ratio of the fund's total income to its total assets. C) TER is the percentage of the fund's assets that are consumed by fees and expenses each year. D) TER is the difference between the fund's net asset value (NAV) and its market price. Answer: C Explanation: TER is not the same as the management fee, which is only one component of the total costs. TER is not related to the fund's income or its market price, but rather to its total assets. Total Expense Ratio (TER) is a measure of the total costs associated with managing and operating an investment fund, such as a mutual fund or an exchange-traded fund (ETF). These costs consist primarily of management fees and additional expenses, such as trading fees, legal fees, auditor fees and other operational expenses. The total cost of the fund is divided by the fund's total assets to arrive at a percentage amount, which represents the TER. |

© 2024 iasgyan. All right reserved