Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

About UPI Service

Features of UPI Service

Participants in UPI

|

Payment System Player (PSP) —new concept in the UPI world. This is not the same thing as a Payment Bank. This is someone who facilitates payments i.e. can move money. |

Steps involved in UPI Payments

Evaluation of UPI Ecosystem in India

|

National Payments Corporation of India (NPCI) It is an umbrella organization for operating retail payments and settlement systems in India. It is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007. It has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013). The ten core promoter banks are State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC. In 2016 the shareholding was broad-based to 56 member banks to include more banks representing all sectors. NPCI is the firm that handles RuPay payments infrastructure, i.e. similar to Visa and MasterCard. |

Reasons behind penetration of UPI in the country

Cost of running UPI

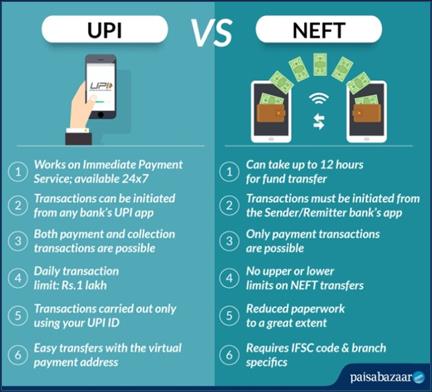

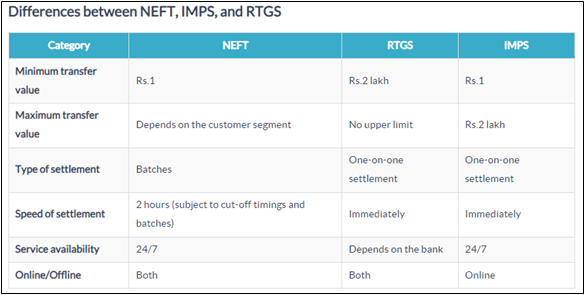

Some Key Differences

Final Thought

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GP3A0F47M.1&imageview=0

© 2024 iasgyan. All right reserved