Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

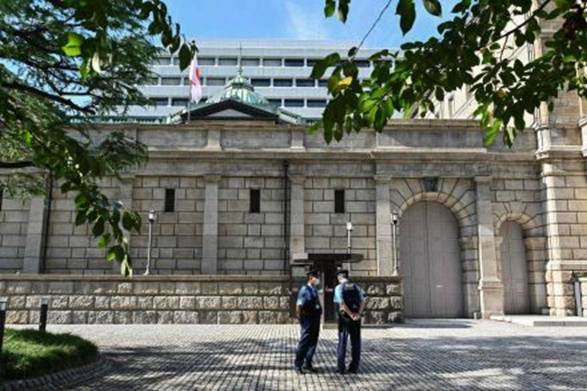

Context: Bank of Japan’s (BOJ) yield curve-control policy has gained some extra breathing space as longer-maturity Treasury yields dropped due to increasing concern over a global recession.

Details:

What is yield curve control, and why does it matter?

What do we learn from the Bank of Japan’s use of yield curve control?

How would YCC affect the economy?

© 2024 iasgyan. All right reserved