RECORD UPI TRANSACTIONS: BOOST TO DIGITIZATION

Disclaimer: Copyright infringement not intended.

Context:

- The Unified Payments Interface (UPI) closed the year 2022 on a high note as the number of transactions reached a record 7.82 billion in December and totalled Rs 12.82 trillion, also a record high.

Overview:

- Technology is acting as a chronicler in India’s digital inclusion revolution by offering easy-to-use mobile applications, multiple regional language modes, speed, and offering safe and secure transactions to the masses.

- It is aiding digital financial inclusion across the country with the use of digital payment gateways like RuPay, BHIM, and other mobile payment solutions.

About UPI Service:

- Unified Payments Interface (UPI) is an instant real-time payment system developed by the National Payments Corporation of India (NPCI).

- It facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions.

- The system powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- NPCI launched Unified Payments Interface (UPI) with member banks in 2016.

Features of UPI Service:

- Immediate money transfer through mobile device round the clock 24*7 and 365 days .

- Single mobile application for accessing different bank accounts.

- Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines, yet provides for a very strong feature of seamless single click payment.

- The virtual address of the customer for Pull & Push provides for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

- Merchant Payment with Single Application or In-App Payments.

- Utility Bill Payments, Over the Counter Payments, QR Code (Scan and Pay) based payments.

- Donations, Collections, Disbursements Scalable.

- Raising Complaints from Mobile App directly.

Participants in UPI:

|

Payment System Player (PSP) —a new concept in the UPI world. This is not the same thing as a Payment Bank. This is someone who facilitates payments i.e. can move money.

|

- Payee PSP

- Remitter Bank

- Beneficiary Bank

- NPCI

- Bank Account holders

- Merchants

Steps involved in UPI Payments:

- UPI-based payments function broadly through three steps:

- First, one’s bank account is mapped to a Virtual Payment Address (VPA). A VPA eliminates the risk of mentioning account details in every transaction. It can be created in a couple of minutes using a UPI app. The only prerequisite is that the user’s bank account be linked to a mobile number.

- Secondly, a Payment Service Provider (typically a bank) takes care of the to-and-fro transactions to this VPA (and hence to the underlying bank account) and

- Finally, the UPI software orchestrates the fund movement from a customer’s VPA to a target VPA and completes the transaction.

- This transaction is different from paying with a debit card or credit card as it does not involve a Merchant Discount Rate (MDR). The MDR is a fee that the recipient bank collects from the merchant.

- For UPI transactions, there is no MDR(like in the case of the Indian government’s Rupay card which also does not have an MDR) and hence there is no price to be paid by the merchant.

Evaluation of UPI Ecosystem in India:

- The Economic Survey 2021-22 highlighted the growing trend of increasing digital transactions over the years and the emergence of the Unified Payments Interface (UPI) as the most preferred mode of transaction since its launch in 2016.

- UPI emerged as the single largest retail payment system in India in terms of the number of transactions.

- The volume of transactions in December 2022 increased by 7.12 percent when compared to November 2022. And the value of transactions increased by 7.73 percent during the same period, according to data issued by the National Payments Corporation of India (NPCI).

- According to NPCI data, approximately 74 billion transactions worth Rs 125.94 trillion were conducted using UPI in the calendar year 2022. The platform handled more than 38 billion transactions totaling Rs 71.54 trillion in 2021. As a result, nearly 90 percent more transactions took place on the platform in a year, and their average value increased by 76 percent.

- Commensurate with growing participation in equity markets, UPI also emerged as a popular method of participation in the primary market by investors. In 2018, SEBI introduced UPI as a payment channel to invest in IPO. Over time, RBI has increased the transaction limit for IPO participation from Rs 1 lakh to Rs 5 lakh.

- Bhutan recently became the first country to adopt UPI standards for its QR code. It is also the second country after Singapore to have BHIM-UPI acceptance at merchant locations.

- Reserve Bank of India launched a new Unified Payments Interface (UPI) payments solution - ‘UPI123Pay’for feature phone users. So, UPI service, which was limited to smartphones to date, will be now available for feature phones without internet. The service is expected to benefit 40 crore feature phone users and is likely to increase digital financial inclusion, especially in the rural parts of the country.

- In the last two years, UPI's popularity has multiplied to the point where, in volume terms, the platform currently processes more peer-to-merchant (P2M) transactions than peer-to-peer (P2P) transactions.

- The MSME sector was the most impacted due to such transactions as illustrated by more than 87.3 percent of transactions conducted across the MSME ministry digitally.

- In 2022, UPI transactions have increased dramatically in both volume and value over the last year, demonstrating the success of UPI in India. Its use has grown not only in urban areas but also in the rural parts of India, helping the masses to easily transact and avail of services.

Reasons behind the penetration of UPI in the country:

- The popularity of UPI is evident — from tiny roadside shops to large brands, many merchants accept UPI-based payments.

The reasons for this kind of penetration of UPI are the following:

- Transaction amount: It accepts transactions as small as one rupee and for merchants,

- The absence of MDR that they have to pay to their banks is a significant incentive to accept UPI payments.

- Simple process: Since just a smartphone is needed to complete a transaction it makes the process as simple as it can get, instead of using devices like the Point-of-Sale card-swiping machines.

- Ecosystem in which UPI thrives: The presence of high-speed internet, cloud computing and modern software engineering technologies that fulfil a transaction in a few seconds.

- Security: The security of a UPI transaction is tied to the user’s authentication with the mobile phone — there is a mobile personal identification number (MPIN) for the UPI application and there is one more layer of security when the bank’s online transaction PIN is to be keyed in as part of every UPI transaction. If a user blocks a mobile number due to theft, for example, then UPI transactions on that mobile number will also be halted.

- Innovation: The NPCI has come up with multiple new innovations over the past few years: recurring payments for monthly bills, international payments, linking UPI to credit cards, 123PAY which allows people without smartphones but with only ordinary mobile phones to use UPI using missed calls, allowing one-time payment by letting a merchant generate a QR (Quick Response) code that is valid for just that specific transaction and many more features.

Cost of running UPI:

- There is no extra price to be paid by the customer or merchant, but still NPCI manages the cost of running the infrastructure for UPI.

- This is because cost savings from the reduction in hassles and overheads for banks (by supporting UPI) is used to bear the cost of operating UPI in the long run.

Closing Thought :

- Consumers have benefited greatly from the digitization of payments as well as the revolution in investing on the demand front. India’s Unified Payment Interface (UPI) has been appreciated by the World Bank and others.

- While India to a great extent has covered digital literacy grounds, digital financial inclusion remains the need of the hour for the country.

- The usage of digital literacy created a bridge for inclusion in the new digital finance system. This degree of inclusion is now the need of the hour for the whole of India to advance its economy.

- The cumulative participation of the whole country in digital finance will pave the way for economic growth in tandem with global numbers.

- As a young nation, digital financial inclusion is the key to ensuring the egalitarian percolation of digitalization’s benefits. It is the most effective step towards inclusive development.

- Eventually, financial inclusiveness will give the freedom to dream and live on one’s own terms. It will provide wind to the hopes of millions of Indians across the country.

Must Read:

Digital Economy: https://www.iasgyan.in/daily-current-affairs/digital-economy

.jpeg)

MANNATHU PADMANABHAN

Disclaimer: Copyright infringement not intended.

Context

- Prime Minister Narendra Modi has paid tributes to Mannathu Padmanabhan on his birth anniversary.

About

- Mannathu Padmanabhan was an Indian social reformer and freedom fighter from the southwestern state of Kerala. He is recognized as the founder of the Nair Service Society(NSS). On 31 October 1914, he established the Nair Service Society. His main ambition was to uplift the status of the Nair community.

- He fought for social equality, the first phase being the Vaikom Satyagraha, demanding the public roads near the temple at Vaikom be opened to low-caste Hindus. He took part in the Vaikom(1924) and Guruvayoor(1931) temple-entry Satyagrahas; the anti-untouchability agitations. He opened his family temple for everyone, irrespective of caste distinction.

- He became a member of the Indian National Congress in 1946 and took part in the agitation against Sir C. P. Ramaswamy Iyer's administration in Travancore.

https://newsonair.gov.in/News?title=PM-Modi-pays-tributes-to-Mannathu-Padmanabhan-on-his-birth-anniversary&id=453358

SIACHEN

Disclaimer: Copyright infringement not intended.

Context:

- PM Modi applauds Captain Shiva Chauhan on becoming the first woman officer to be operationally deployed at the highest battlefield of the world Siachen.

About:

Location

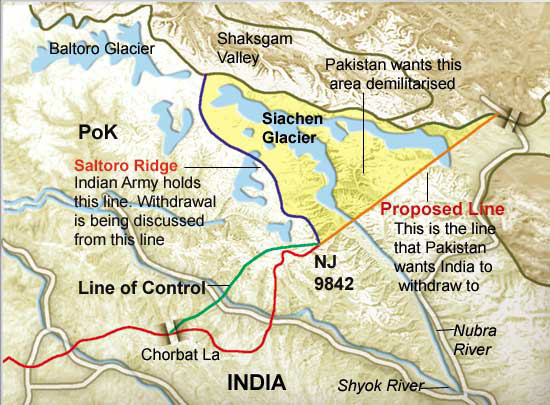

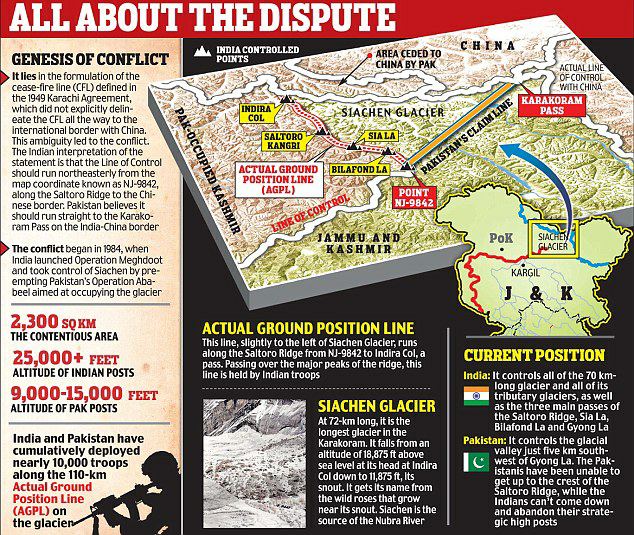

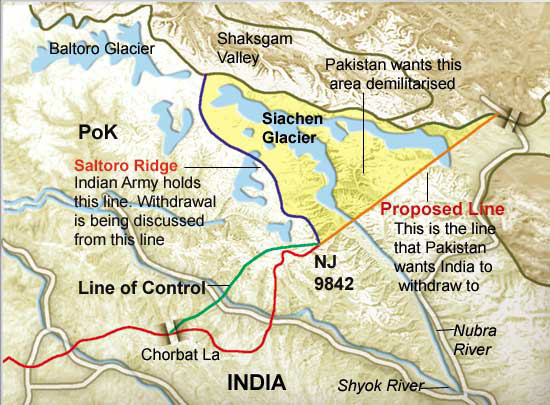

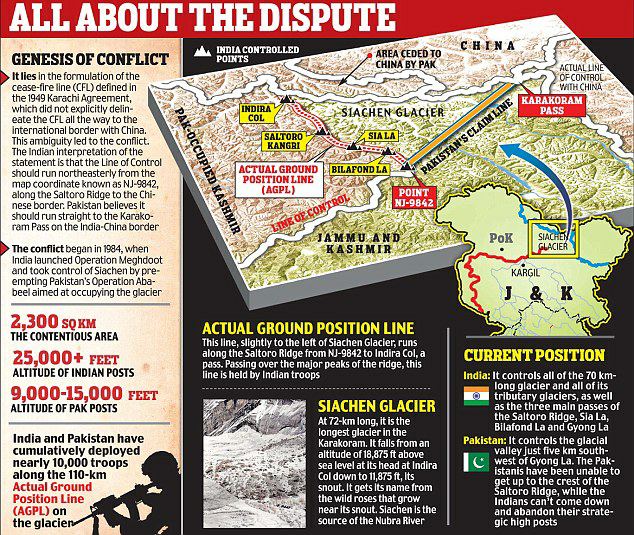

- The Siachen Glacier is a glacier located in the eastern Karakoram range in the Himalayas just northeast of the point NJ9842 where the Line of Control between India and Pakistan ends.

- The Siachen Glacier lies immediately south of the great drainage divide that separates the Eurasian Plate from the Indian subcontinent in the extensively glaciated portion of the Karakoram sometimes called the "Third Pole".

- The glacier lies between Saltoro Ridge immediately to the west and the main Karakoram range to the east.

- Note: The Saltoro Ridge originates in the north from the Sia Kangri peak on the China border in the Karakoram range.

Length

At 76 km (47 mi) long, it is the longest glacier in the Karakoram and the second-longest in the world's.

Major passes

- The major passes on this ridge are, from north to south, Sia La, Bilafond, and Gyong La.

Drainage

- The glacier's melting waters are the main source of the Nubra River in the Indian region of Ladakh, which drains into the Shyok River.

- The Shyok in turn joins the 3000-kilometer-long Indus River which flows through Pakistan.

- Thus, the glacier is a major source of the Indus and feeds the largest irrigation system in the world.

Administration

- The entire Siachen Glacier, with all major passes, has been under the administration of India(currently as part of the union territory of Ladakh, located in the Kashmir region) since 1984.

- Pakistan maintains a territorial claim over the Siachen Glacier and controls the region west of Saltoro Ridge, lying west of the glacier, with Pakistani posts located 3,000 ft below more than 100 Indian posts on the ridge.

Border Conflict

- Both India and Pakistan claim sovereignty over the entire Siachen region.

- and Pakistani maps in the 1970s and 1980s consistently showed a dotted line from NJ9842(the northernmost demarcated point of the India-Pakistan cease-fire line, also known as the Line of Control) to the Karakoram Pass, which India believed to be a cartographic error and in violation of the Shimla Agreement.

- In 1984, India launched Operation Meghdoot, a military operation that gave India control over all of the Siachen Glacier, including its tributaries.

- Indian troops under Operation Meghdoot pre-empted Pakistan's Operation Ababeel by just one day to occupy most of the dominating heights on Saltoro Ridge to the west of Siachen Glacier.

- The glacier's region is the highest battleground on Earth, where Pakistan and India have fought intermittently since 1984.

- Both countries maintain a permanent military presence in the region at a height of over 6,000 m (20,000 ft).

- India and Pakistan have wished to disengage from the costly military outposts.

- However, after the Pakistani incursions during the Kargil War in 1999, India abandoned plans to withdraw from Siachen without official recognition of the current line of control by Pakistan, wary of further Pakistani incursions if they vacate the Siachen Glacier posts without such recognition.

- Prime Minister Manmohan Singh became the first Indian Prime Minister to visit the area. After that present Prime Minister, Narendra Modi also visited this place.

Actual Ground Position Line (AGPL)

- The Actual Ground Position Line (AGPL) divides current positions of Indian and Pakistani military posts and troops across the entire 110 kilometers long front line in the disputed region of Siachen Glacier.

- AGPL generally runs along the Saltoro Mountains range, beginning from the northernmost point of the (LOC) at Point NJ 9842 and ending in the north on the Indira Ridge at the India-China-Pakistan LAC tri-point near Sia Kangri about 4 km northwest of Indira Col West.

https://newsonair.gov.in/News?title=PM-Modi-applauds-Captain-Shiva-Chauhan-on-becoming-first-woman-officer-to-be-operationally-deployed-at-highest-battlefield-of-world-Siachen&id=453500

MAKIIVKA

Disclaimer: Copyright infringement not intended.

Context

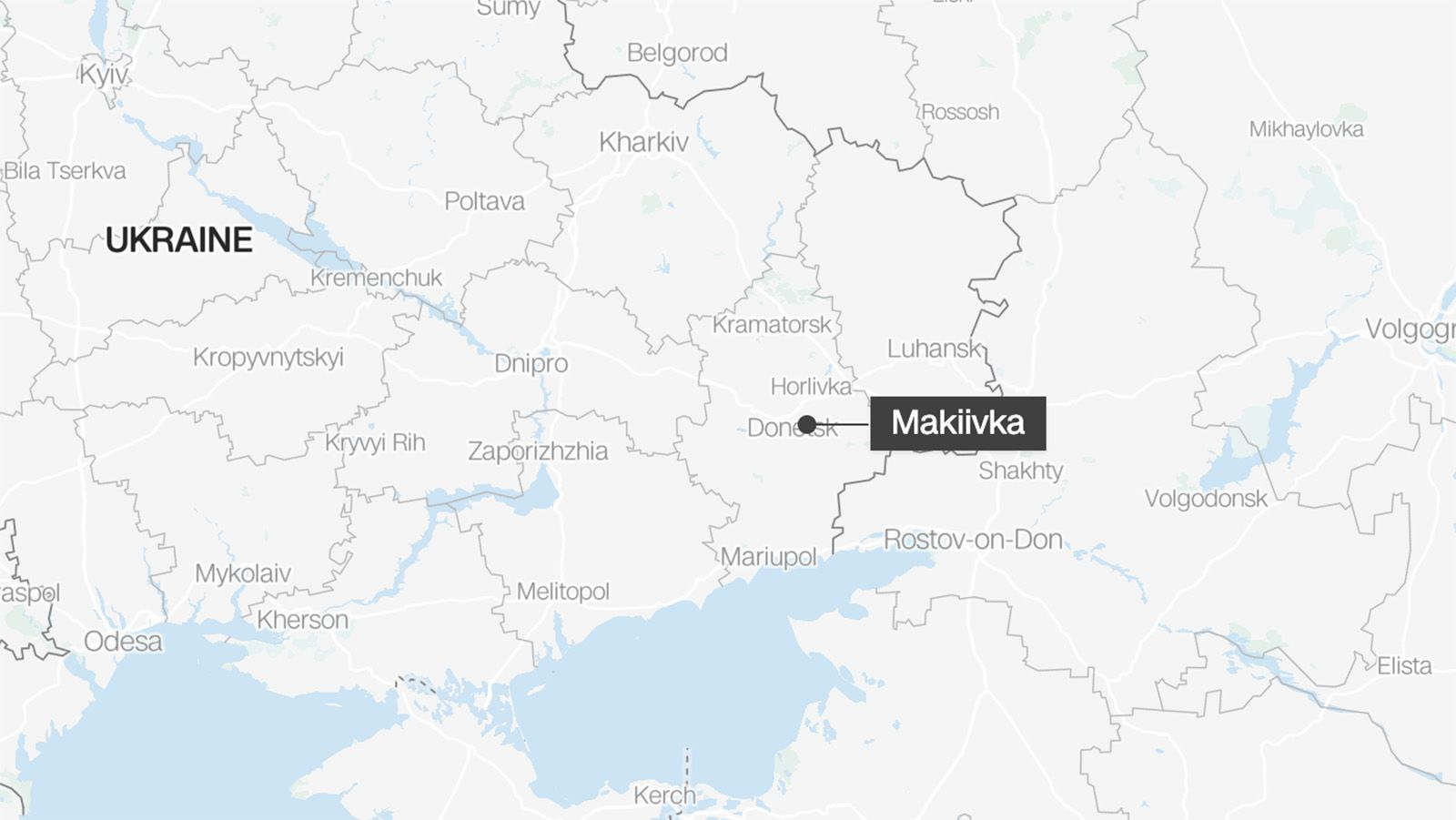

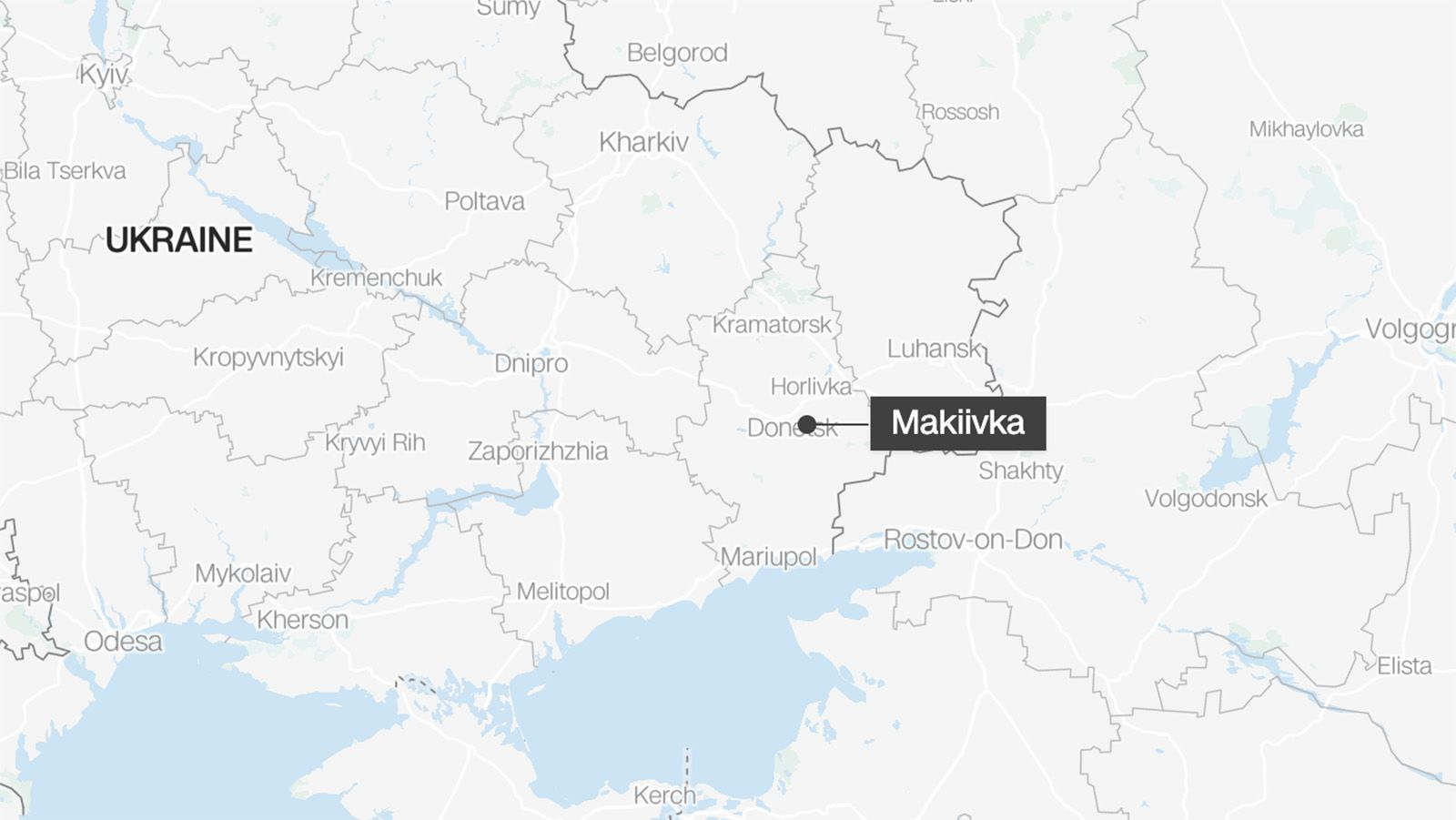

- Russia has said more than 60 of its soldiers were killed in a Ukrainian strike on Russian-controlled territory in a New Year assault. The strike took place in the city of Makiivka in the Donetsk region in eastern Ukraine on New Year's Eve.

About

- Makiivka, formerly Dmytriivsk is an industrial city in Donetsk Oblast in eastern Ukraine, located 15 kilometers east of the capital Donetsk.

- Makiivka is a leading metallurgical and coal-mining center of the Donets Basin, with heavy industry and coking plants supporting the local steel and coal

- While internationally recognized as part of Ukraine, the city has been under Russian occupation since its capture by Russian forces in 2014.

https://newsonair.gov.in/News?title=More-than-60-Russian-soldiers-killed-in-a-Ukrainian-strike-on-Moscow-controlled-territory-in-Donetsk&id=453427

.jpeg)

IMOINU IRATPA

Disclaimer: Copyright infringement not intended.

Context

- The people of Manipur celebrated the Imoinu Eratpa.

About

https://newsonair.gov.in/News?title=Manipur%3a-People-to-celebrate-Imoinu-Eratpa-tomorrow&id=453366

GAAN NGAI FESTIVAL

Disclaimer: Copyright infringement not intended.

Context

- In Manipur, the Gaan Ngai festival of the Zeliangrong community is being celebrated.

Details

- Gaan-Ngai also known as "Chakaan Gaan-Ngai" is a festival of the Zeliangrong people of Assam, Manipur and Nagaland states of India. It is the biggest festival out of many festivals observed throughout the indigenous calendar of Rongmei Naga/Kabui tribe.

- It is also a post-harvestfestival. It is mainly performed by the followers and devotees of Zeliangrong Indigenous religion of ‘Poupei Chapriak’(including Tingkao Ragwang Chapriak and other sects) and ‘Heraka’.

https://newsonair.gov.in/News?title=Manipur%3a-Gaan-Ngai-festival-of-Zeliangrong-community-to-be-celebrated-on-4th-January&id=453424

.jpeg)