AIR SPOTLIGHT: FERTILIZER SUBSIDY ENHANCEMENT

CONTEXT:

- Government announced "a historic pro-farmer decision" by hiking fertiliser subsidy to Rs 1,200 per bag of DAP.

MORE ON THE NEWS:

- The price of fertilisers is undergoing an increase due to the rising prices of phosphoric acid, ammonia etc internationally.

- Hence, decision was taken to increase the subsidy for DAP fertiliser from Rs 500 per bag to Rs 1,200 per bag, which is an increase of 140%.

- Central government has decided to bear all the burden of price hike.

- Last year, the actual price of DAP was Rs 1,700 per bag. In which the Central Government was giving a subsidy of Rs 500 per bag. So, the companies were selling fertilizer to farmers for Rs 1,200 per bag.

- The actual price of a DAP bag is now Rs 2,400, which could be sold by fertiliser companies at Rs 1,900 after considering a subsidy of Rs 500. With the present decision, farmers will continue to get a DAP bag for Rs 1,200.

- The Central Government spends about Rs 80,000 crore on subsidies for chemical fertilisers every year.

- With the increase in subsidy in DAP, Government of India will spend an additional Rs 14,775 crore as subsidy in Kharif season.

WHAT IS DAP AND WHY IS IT IMPORTANT FOR FARMERS?

- DAP is the second most commonly used fertiliser in India, with its sales next only to that of urea.

- Farmers normally apply this fertiliser just before or at the time of sowing, as it is high in phosphorus (P) that stimulates root establishment and development – without which plants cannot grow to their normal size or will take too long to mature. DAP contains 46% P and 18% nitrogen (N).

WHAT IS FERTILISER SUBSIDY?

- Farmers buy fertilisers at MRPs (maximum retail price) below their normal supply-and-demand-based market rates or what it costs to produce/import them.

- The MRP of neem-coated urea, for instance, is fixed by the government at Rs ~6000 per tonne, whereas its average cost-plus price payable to domestic manufacturers and importers comes to around Rs 17,000 and Rs 23,000 per tonne, respectively. The difference, which varies according to plant-wise production cost and import price, is footed by the Centre as subsidy.

- This subsidy ensures cheap inputs to farmers, reasonable returns to manufacturer, stability in fertiliser prices, and availability of fertilisers to farmers

SUBSIDY SCHEME IN FERTILISERS:

- The maximum retail price (MRP) of urea is currently fixed at Rs 5,378 per tonne.

- Since companies have to sell at this controlled rate, the subsidy (the difference between the cost of manufacturing or import and the fixed MRP) is variable.

- The MRPs of all other fertilisers, by contrast, are decontrolled and decided by the companies themselves. The government only gives a fixed per-tonne subsidy. In other words, the subsidy is fixed, while the MRPs are variable.

- All non-urea fertilisers attract what is called nutrient-based subsidy or NBS, whose rates vary across nutrients.

- For 2020-21, the Centre fixed the NBS rates at Rs 18.789/kg for N, Rs 14.888/kg for P, Rs 10.116/kg for K and Rs 2.374/kg for S.

- Therefore, depending on the nutrient content in different fertilisers, the per-tonne subsidy varies.

HOW IS THE SUBSIDY PAID AND WHO GETS IT?

- The subsidy goes to fertiliser companies, although its ultimate beneficiary is the farmer who pays MRPs less than the market-determined rates.

- Companies, until recently, were paid after their bagged material had been dispatched and received at a district’s railhead point or approved godown.

- From 2018, direct benefit transfer system was introduced, wherein subsidy payment to the companies would happen only after actual sales to farmers by retailers.

- Only upon the sale getting registered on the e-Urvarak platform can a company claim subsidy, with these being processed on a weekly basis and payments remitted electronically to its bank account.

- The main motive is to curb diversion.

- Being super-subsidised, urea is always prone to diversion for non-agricultural use — as a binder by plywood/particle board makers, cheap protein source by animal feed manufacturers or adulterant by milk vendors — apart from being smuggled to Nepal and Bangladesh.

WHAT IS THE NEXT STEP BEING PROPOSED?

- At present, the Centre is following a “no denial” policy. Anybody, non-farmers included, can purchase any quantity of fertilisers through the PoS machines.

- That obviously allows for bulk buying by unintended beneficiaries, who are not genuine or deserving farmers. While there is a limit of 100 bags that an individual can purchase at one time, it does not stop anyone from buying any number of times.

- One plan under discussion is to cap the total number of subsidised fertiliser bags that any person can buy during an entire kharif or rabi cropping season. This, it is expected, would end even retail-level diversion and purchases by large buyers masquerading as farmers.

WHAT ARE SUBSIDIES?

- Derived from the Latin word ‘subsidium’, a subsidy literally implies coming to assistance from behind.

- A subsidy, often viewed as the converse of a tax, is an instrument of fiscal policy.

- The economic rationale of subsidies lies in incentivising the producers to invest in productive activities and increase production leading to high growth in national income and obtaining desirable structure of production.

- Similarly, the social justification of subsidies lies in reducing inter-personal income inequalities and inter- regional development imbalances.

- Subsidies help manipulate or balance growth rates of production and trade across various sectors and regions, and for equitable distribution of income for protecting the weaker sections of the society.

EXPENDITURE ON SUBSIDIES:

- In 2021-22, the total expenditure on subsidies is estimated to be Rs 3,69,899 crore, an annual increase of 19% over 2019-20.

|

|

Actuals

2019-20

|

Budgeted

2020-21

|

Revised

2020-21

|

Budgeted

2021-22

|

Change (Annualised)

(Actuals 2019-20 to BE 2021-22)

|

|

Food subsidy

|

1,08,688

|

1,15,570

|

4,22,618

|

2,42,836

|

49%

|

|

Fertiliser subsidy

|

81,124

|

71,309

|

1,33,947

|

79,530

|

-1%

|

|

Petroleum subsidy

|

38,529

|

40,915

|

39,055

|

14,073

|

-40%

|

|

Other subsidies

|

33,963

|

34,315

|

53,116

|

33,460

|

-1%

|

|

Total

|

2,62,304

|

2,62,109

|

6,48,736

|

3,69,899

|

19%

|

Sources: Expenditure Profile, Union Budget 2020-21; PRS.

FOOD SUBSIDIES:

- It is a governmental financial support paid to farmers and agribusinesses to supplement their income, manage the supply of agricultural commodities, and influence the cost and supply of such commodities.

- Agriculture subsidies act as an incentive to promote agricultural development and as an instrument of stimulating agricultural production and attaining self-sufficiency.

- Input Subsidies: Subsidies can be granted through distribution of inputs at prices that are less than the standard market price for these inputs.

- Fertiliser Subsidy

- Irrigation Subsidy: is the difference between operating and maintenance cost of irrigation infrastructure in the state and irrigation charges recovered from farmers.

- Power Subsidy: The electricity subsidies imply that the government charges low rates for the electricity supplied to the farmers.

- Seed Subsidies

- Credit Subsidy: It is the difference between interest charged from farmers, and actual cost of providing credit, plus other costs such as write-offs bad loans.

- Price Subsidy: It is the difference between the price of food-grains at which FCI procures food-grains from farmers, and the price at which PCI sells either to traders or to the PDS.

- Infrastructural Subsidy: Good roads, storage facilities, power, information about the market, transportation to the ports, etc. are vital for carrying out production and sale operations. The government takes the responsibility of providing these and given the condition of Indian farmers a lower price can be charged from the poorer farmers.

- Export Subsidies: Subsides provided to encourage exports are referred as export subsidies.

- Types of Agriculture Subsidies on the basis of Mode of Payment:

- Direct Subsidies: money transfers by the government that reach the ultimate beneficiary through a formal predetermined route.

- Indirect Subsidies: provided through price reduction, welfare and other ways but do not include a direct cash payment.

ISSUES RELATED TO SUBSIDIES:

- Heavy Fiscal Burden: In 2021-22, the total expenditure on subsidies is estimated to be Rs 3,69,899 crore, an annual increase of 19% over 2019-20.

- Subsidies are designed and implemented in such a way that it is skewed towards the excessive use of subsidized resources. For instance, power subsidy has led to overuse of ground water.

- Irrational usage of fertilisers on account of subsidies leads to environmental degradation and decline in soil fertility.

- Fertilizer subsidies are generally cornered by the manufacturers and the rich farmers.

- Price subsidy has made Indian agriculture cereal centric, and neglectful towards pulses, oil seeds and coarse cereals.

- Subsidies are reducing the share of money that goes for capital investment.

WAY FORWARD:

FERTILISER SUBSIDIES:

- The time has come to seriously consider paying farmers a flat per-acre cash subsidy that they can use to purchase any fertiliser.

- The amount could vary, depending on the number of crops grown and whether the land is irrigated or not.

- This is, perhaps, the only sustainable solution to prevent diversion and also encourage judicious application of fertilisers, with the right nutrient (macro and micro) combination based on proper soil testing and crop-specific requirements.

FOOD SUBSIDIES IN GENERAL:

- Economic Survey points out that the food subsidy bill is becoming unmanageably large. While it is difficult to reduce the economic cost of food management in view of rising commitment towards food security, there is a need to consider the revision of CIP to reduce the bulging food subsidy bill.

- Completely stopping subsidies may not be possible now given its reach and popularity; but it can be rationalised. A better targeting of subsidies with the usage of JAM trinity can reduce the fiscal burden.

- Gradually, the government should withdraw subsidies and possibly convert them to capital investments in the sector.

- Alternatives to price interventions that have similar advantages of targeting beneficiaries must be explored and tried. For instance, Price deficiency payments are a substantial improvement on procurement-based price supports.

- There is the need for long-term policies on export trade, for the government departments to engage with exporters on a regular basis.

- Building of an agri-market intelligence system needs to be fast-tracked.

https://indianexpress.com/article/explained/explained-why-has-the-modi-government-increased-subsidy-on-dap-7323687/

https://www.business-standard.com/article/economy-policy/govt-raises-subsidy-on-dap-fertiliser-by-140-to-rs-1-200-per-bag-121051901162_1.html

https://indianexpress.com/article/explained/how-fertiliser-subsidy-works-6793395/

https://prsindia.org/budgets/parliament/union-budget-2021-22-analysis

https://indianexpress.com/article/india/economic-survey-suggests-revision-of-cip-to-reduce-food-subsidy-bill-7167202/

NEWS IN BRIEF: PRELIMS SPECIAL

India and Israel

- India and Israel signed a three-year work program for cooperation in agriculture.

- India and Israel are implementing the “Indo-Israel Agricultural Project Centres of Excellence” and “Indo-Israel Villages of Excellence”.

- Indo-Israel Agricultural Project Centres of Excellence are implementing Advanced-Intensive agriculture farms with Israeli Agro-Technology tailored to local conditions.

- Indo-Israel Villages of Excellence program is aimed at creating a model ecosystem in agriculture across eight states, alongside 13 Centers of Excellence within 75 villages.

http://newsonair.com/News?title=India-and-Israel-sign-three-year-work-program-for-cooperation-in-agriculture&id=417816

International Day of Biological Diversity

- International Day of Biological Diversity is observed on 22 May annually.

- The theme of the 2021 International Day for Biological Diversity is “We’re part of the solution”.

- It is a UN-sanctioned international day for the promotion of biodiversity issues.

http://newsonair.com/Main-News-Details.aspx?id=417627

National Mission on use of Biomass in Thermal Power Plants

- Ministry of Power decided to set up a National Mission on use of Biomass in coal based thermal power plants.

- The Ministry of Power took this decision to address the issue of air pollution due to farm stubble burning and to reduce carbon footprints of thermal power generation.

- Mission aims to increase the level of co-firing from present 5% to higher levels to have a larger share of carbon neutral power generation from the thermal power plants.

- It aims to take up R&D activity in boiler design to handle the higher amount of silica, alkalis in the biomass pellets and facilitate overcoming the constraints in supply chain of bio mass pellets and agro-residue and its transport up to the power plants.

http://newsonair.com/Main-News-Details.aspx?id=417890

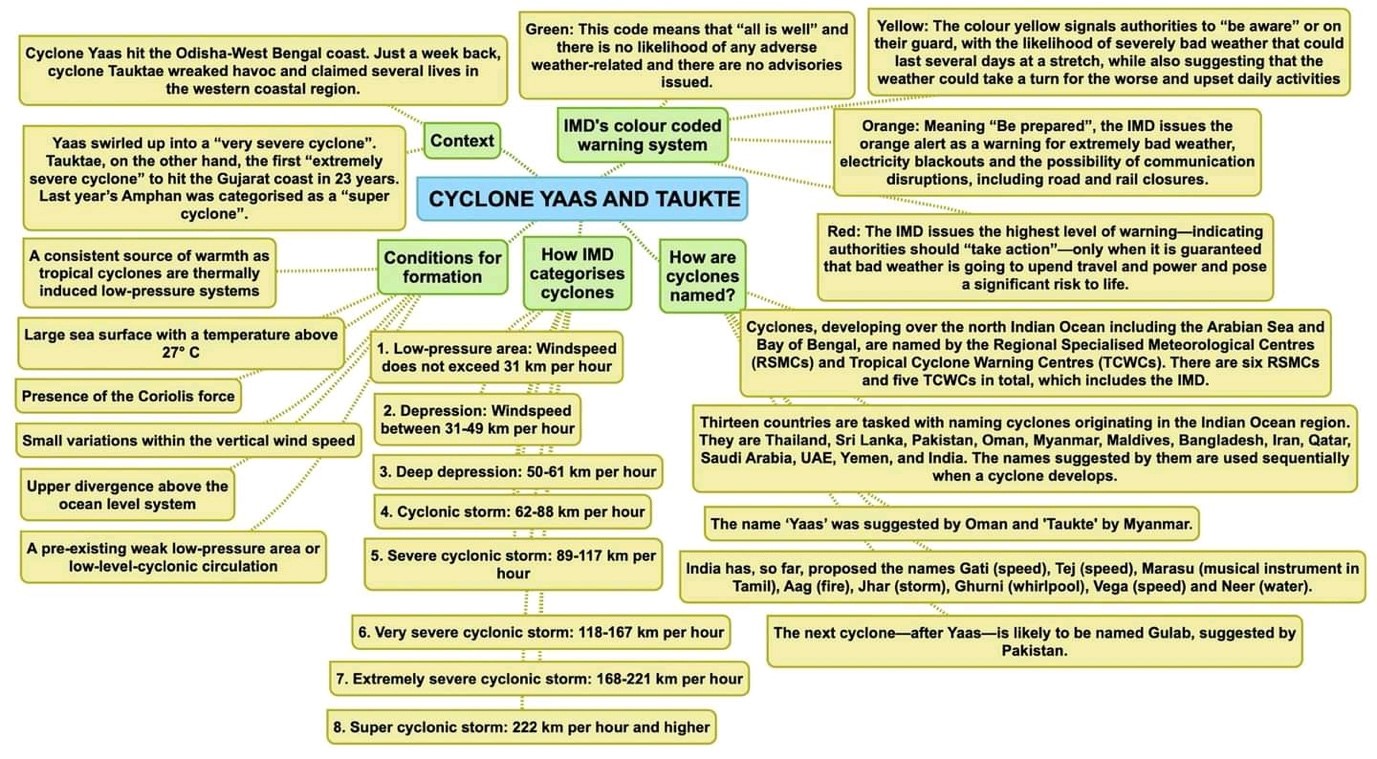

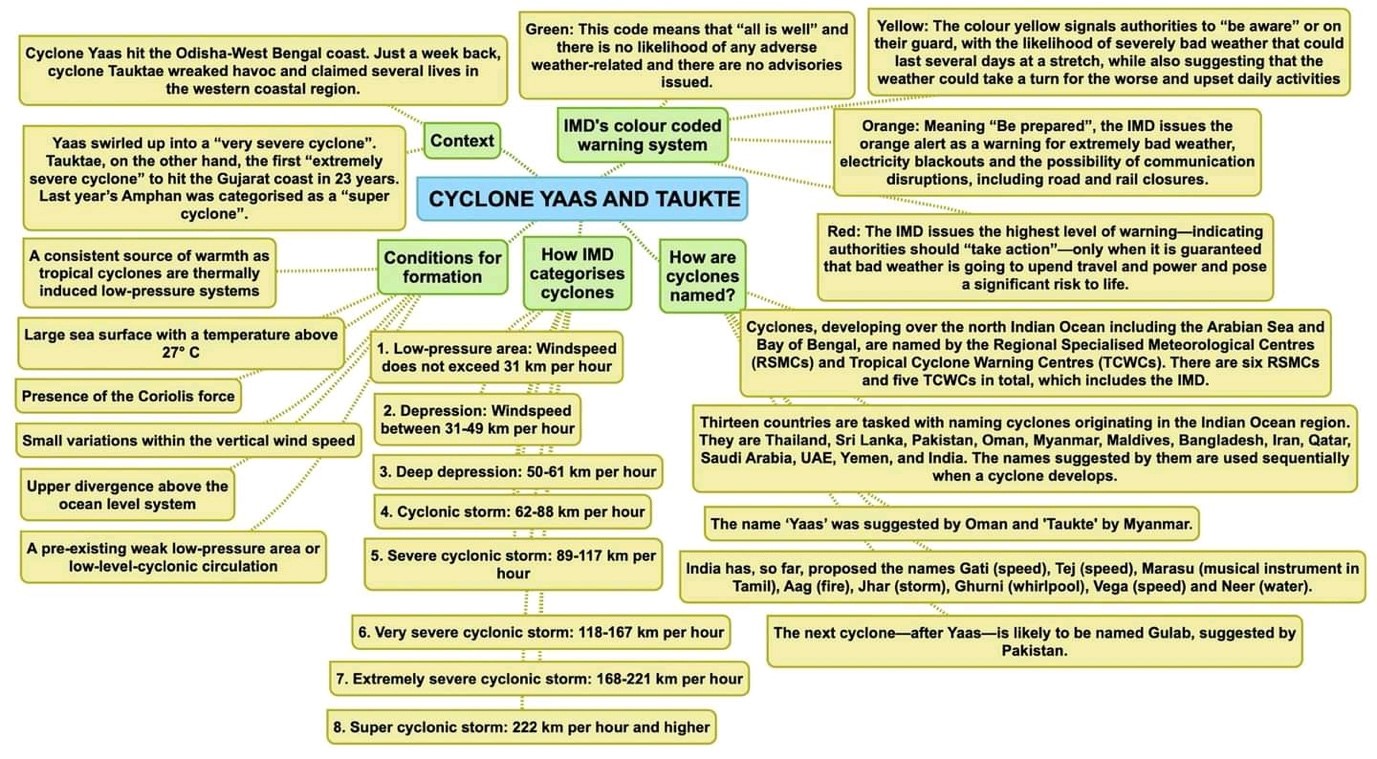

Cyclone Yaas and Taukte

http://www.newsonair.com/News?title=Very-severe-Cyclonic-storm-%E2%80%98Yass%E2%80%99-to-cross-North-Odisha-%26-West-Bengal-coasts-within-next-three-hours%3A-IMD&id=417929